February 15, 2023

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to provide results from the Company’s maiden drilling at the Meseta Gold prospect (Meseta), at the Linderos Project in southern Ecuador.

Key Highlights include:

- Recent drilling at Meseta proves that a shallow intermediate-sulphidation epithermal gold system exists adjacent to the recently discovered Copper Ridge Porphyry system.

- Several high-grade gold, silver and base metal epithermal veins intersected from shallow depths, with significant results including:

1. MGDD22-010:

- 7.22m grading 13.77g/t Au, 12.90g/t Ag, 0.15% Cu, 0.38% Zn from 66.28m, including higher grade intercepts of:

- 0.92m grading 31.50g/t Au, 24.30g/t Ag, 0.25% Cu from 68.28m: and

- 0.58m grading 99.80g/t Au, 89.90g/t Ag, 0.98% Cu, 0.31% Zn

- All within a broader intersection of 76.5m grading 1.41g/t Au. 5.63g/t Ag, 0.27% Zn from surface

2. MGDD22-012:

- 4.88m grading 12.87g/t Au, 6.04g/t Ag, 0.11 % Cu, 0.41% Zn from 41.0m, including a higher grade intercept of:

- 1.64m grading 33.35g/t Au, 11.28 g/t Ag, 0.23% Cu, 0.72% Zn from 44.24m

- All within a broader intersection of 45.82m grading 1.40g/t Au. 2.13g/t Ag, 0.25% Zn from 4.35m

3. MGDD22-001:

- 4.64m grading 5.00g/t Au, 10.33g/t Ag, 0.39% Zn, 0.19% Pb from 51.7m

4. MGDD22-003

- 5.76m grading 3.72g/t Au, 48.69g/t Ag, 0.25% Zn, 0.28% Pb from 36.54m, including a higher grade intercept of:

- 0.73m grading 11.35g/t Au, 73.30 g/t Ag, 0.84% Zn, 1.24% Pb from 37.35m

- Meseta is the first of several epithermal gold targets defined by Titan’s reconnaissance works within the Linderos Project to be drill tested, with high priority prospects proximal to porphyry copper-gold sources driving epithermal gold mineralisation.

Titan’s CEO Melanie Leighton commented:

“These are exciting results for Titan which confirm the potential for significant high-grade gold, silver and base metals at the Linderos Project. The results demonstrate that the causal intrusion responsible for the recently discovered Copper Ridge porphyry system, is also the plumbing to the Meseta intermediate sulphidation epithermal system.”

“In many cases these high-grade epithermal vein systems have been eroded, and all that remains is the porphyry source. So, we’re excited that the Meseta epithermal mineralisation remains preserved, adjacent to its source, the Copper Ridge porphyry system, where recent drilling has demonstrated the potential for significant copper-gold porphyry mineralisation from shallow depths.”

“We feel that we’re onto something big here, with our maiden drilling campaigns at both Meseta and Copper Ridge delivering promising results, and plenty of scope for extending mineralisation with strong vectors towards higher grade gold, silver and copper mineralisation.”

“We now have a pipeline of high conviction targets to feature in forthcoming exploration work programs in 2023.”

Linderos Project Drilling Results

The Company is pleased to provide results from its maiden drilling campaign completed in late 2022 at the Meseta Gold prospect (Meseta), at the company’s 100% held Linderos Project in southern Ecuador.

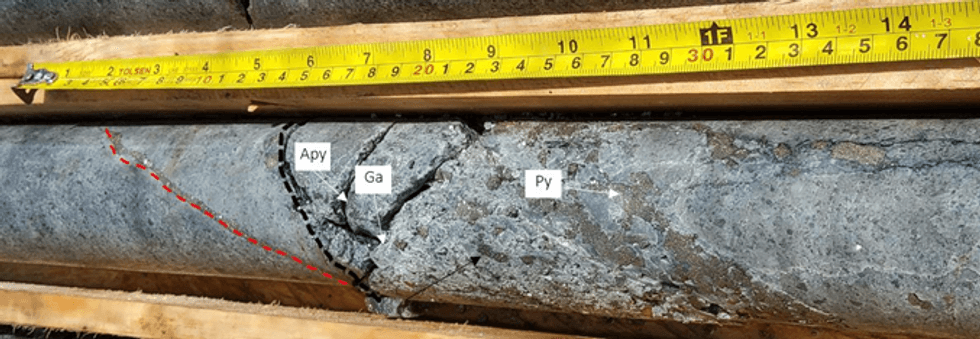

Drilling was successful in intersecting multiple pyrite-sphalerite-arsenopyrite±galena massive sulphide veins, with several significant intersections of high grade gold and silver returned, along with significant intersections of silver-zinc-±lead±gold±copper. Significant intersections are included in table 1, and illustrated in figures 1, 2, and 3.

The Meseta Gold prospect displays metal zonation and alteration assemblages typical of intermediate sulphidation systems related to proximal porphyry systems, with outcropping porphyry mineralisation identified and drill tested at the Copper Ridge Porphyry prospect (Copper Ridge) less than 500 metres to the south of Meseta (refer to Figures 1, 2 and 3).

Table 1 details significant intersections for gold, silver, copper, zinc, and lead returned from the Company’s maiden drilling at Meseta, where pleasingly 12 out of 14 holes intersected polymetallic massive sulphide mineralisation.

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00