February 15, 2023

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to provide results from the Company’s maiden drilling at the Meseta Gold prospect (Meseta), at the Linderos Project in southern Ecuador.

Key Highlights include:

- Recent drilling at Meseta proves that a shallow intermediate-sulphidation epithermal gold system exists adjacent to the recently discovered Copper Ridge Porphyry system.

- Several high-grade gold, silver and base metal epithermal veins intersected from shallow depths, with significant results including:

1. MGDD22-010:

- 7.22m grading 13.77g/t Au, 12.90g/t Ag, 0.15% Cu, 0.38% Zn from 66.28m, including higher grade intercepts of:

- 0.92m grading 31.50g/t Au, 24.30g/t Ag, 0.25% Cu from 68.28m: and

- 0.58m grading 99.80g/t Au, 89.90g/t Ag, 0.98% Cu, 0.31% Zn

- All within a broader intersection of 76.5m grading 1.41g/t Au. 5.63g/t Ag, 0.27% Zn from surface

2. MGDD22-012:

- 4.88m grading 12.87g/t Au, 6.04g/t Ag, 0.11 % Cu, 0.41% Zn from 41.0m, including a higher grade intercept of:

- 1.64m grading 33.35g/t Au, 11.28 g/t Ag, 0.23% Cu, 0.72% Zn from 44.24m

- All within a broader intersection of 45.82m grading 1.40g/t Au. 2.13g/t Ag, 0.25% Zn from 4.35m

3. MGDD22-001:

- 4.64m grading 5.00g/t Au, 10.33g/t Ag, 0.39% Zn, 0.19% Pb from 51.7m

4. MGDD22-003

- 5.76m grading 3.72g/t Au, 48.69g/t Ag, 0.25% Zn, 0.28% Pb from 36.54m, including a higher grade intercept of:

- 0.73m grading 11.35g/t Au, 73.30 g/t Ag, 0.84% Zn, 1.24% Pb from 37.35m

- Meseta is the first of several epithermal gold targets defined by Titan’s reconnaissance works within the Linderos Project to be drill tested, with high priority prospects proximal to porphyry copper-gold sources driving epithermal gold mineralisation.

Titan’s CEO Melanie Leighton commented:

“These are exciting results for Titan which confirm the potential for significant high-grade gold, silver and base metals at the Linderos Project. The results demonstrate that the causal intrusion responsible for the recently discovered Copper Ridge porphyry system, is also the plumbing to the Meseta intermediate sulphidation epithermal system.”

“In many cases these high-grade epithermal vein systems have been eroded, and all that remains is the porphyry source. So, we’re excited that the Meseta epithermal mineralisation remains preserved, adjacent to its source, the Copper Ridge porphyry system, where recent drilling has demonstrated the potential for significant copper-gold porphyry mineralisation from shallow depths.”

“We feel that we’re onto something big here, with our maiden drilling campaigns at both Meseta and Copper Ridge delivering promising results, and plenty of scope for extending mineralisation with strong vectors towards higher grade gold, silver and copper mineralisation.”

“We now have a pipeline of high conviction targets to feature in forthcoming exploration work programs in 2023.”

Linderos Project Drilling Results

The Company is pleased to provide results from its maiden drilling campaign completed in late 2022 at the Meseta Gold prospect (Meseta), at the company’s 100% held Linderos Project in southern Ecuador.

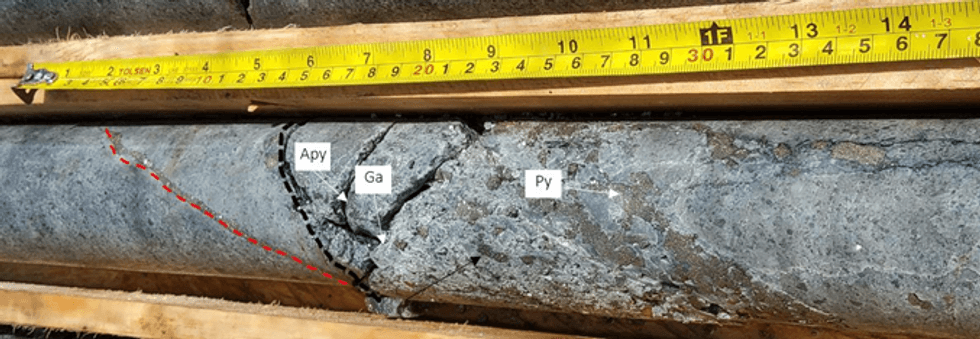

Drilling was successful in intersecting multiple pyrite-sphalerite-arsenopyrite±galena massive sulphide veins, with several significant intersections of high grade gold and silver returned, along with significant intersections of silver-zinc-±lead±gold±copper. Significant intersections are included in table 1, and illustrated in figures 1, 2, and 3.

The Meseta Gold prospect displays metal zonation and alteration assemblages typical of intermediate sulphidation systems related to proximal porphyry systems, with outcropping porphyry mineralisation identified and drill tested at the Copper Ridge Porphyry prospect (Copper Ridge) less than 500 metres to the south of Meseta (refer to Figures 1, 2 and 3).

Table 1 details significant intersections for gold, silver, copper, zinc, and lead returned from the Company’s maiden drilling at Meseta, where pleasingly 12 out of 14 holes intersected polymetallic massive sulphide mineralisation.

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

2h

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

18h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

18h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

19h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00