July 24, 2022

GTI Energy Ltd (GTI or the Company) (formerly GTI Resources Ltd) is pleased to report on its activities for the June 2022 quarter.

Highlights:

- Completion of acquisition of additional ~13,800 acres of contiguous ISR uranium exploration claims abutting Rio Tinto’s claims at Green Mountain WY, increases GTI holding to ~35,000 acres

- $5m Placement to fund acquisition & accelerate Wyoming ISR strategy

- Recent drill program success & understanding of the conditions for successful ISR recovery in the GDB positions GTI to capitalise on the burgeoning uranium market

- GTI shares start trading on North America’s OTCQB market under the code GTRIF

- Sale of Niagara Gold Project completed with $4.5m ASX IPO of Regener8 Resources NL (ASX:R8R)

- Appointment of US based, James (Jim) Baughman as Executive Director

GREAT DIVIDE BASIN (GDB) ISR URANIUM, WYOMING, USA

GREEN MOUNTAIN ISR PROJECT ACQUISITION AND $5M PLACEMENT

On 6 April 2022, GTI announced it had entered into a binding term sheet agreement (Term Sheet) for the strategic acquisition of 100% of Logray Minerals Pty Ltd (Logray) (Acquisition), holder of ~13,800 acres (~5,600 hectares) of underexplored mineral lode claims (Claims), abutting Rio Tinto’s properties & adjacent to GTI’s existing GDB projects, at Green Mountain in Wyoming, USA (the Properties).

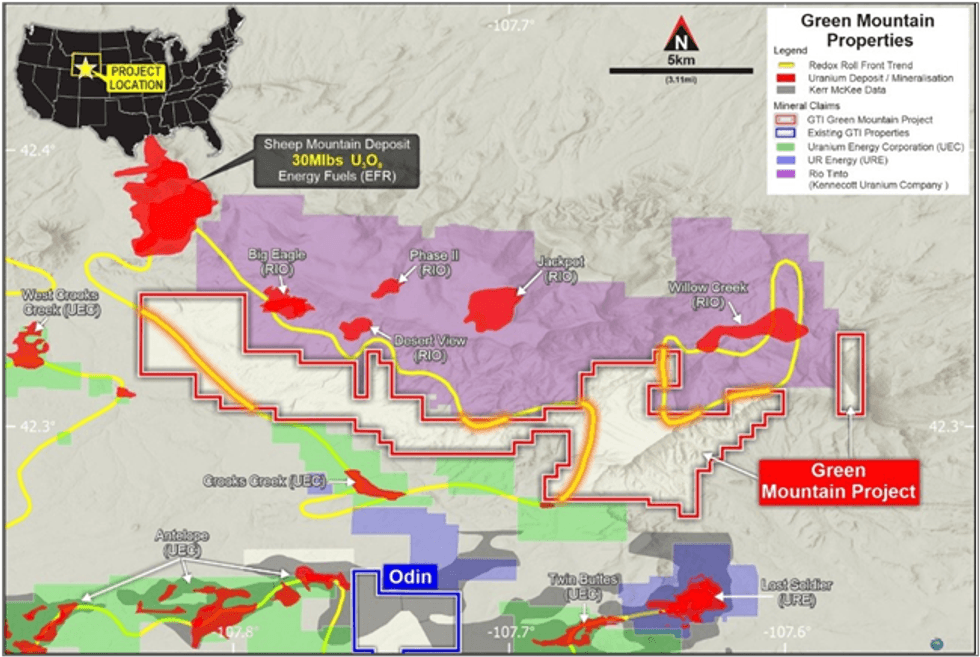

Figure 1. Location of The Green Mountain Project

Completion of the Acquisition was subject to several conditions that were satisfied within 90 days of the date of the Agreement (or such other date as agreed) including the Company completing technical, legal & commercial due diligence on Logray & the Properties within 30 days. The Company advised the successful completion of due diligence on 24 May 2022. Following shareholder approval, the Company completed the Acquisition on 14 June 2022.

Historical Kerr McGee drill data and oil-well exploration drill logs confirm the presence of roll fronts & the Battle Springs formation which hosts neighbouring major uranium deposits. The Properties are located in close proximity to Energy Fuel’s (EFR) 30Mlb1 Sheep Mountain deposit (Indicated), Ur- Energy’s (URE) Lost Soldier ISR deposit, UEC’s (UEC) Antelope deposit and they abut Rio Tinto’s (RIO) which hold the Big Eagle (past producing), Jackpot2, Desert View, Phase II, & Willow Creek deposits (Figure 4). The Claims lie south of Green Mountain, ~5kms from GTI’s existing Odin claim group and within 15km of GTI’s Thor project where a successful maiden drill program was completed during May 2022.

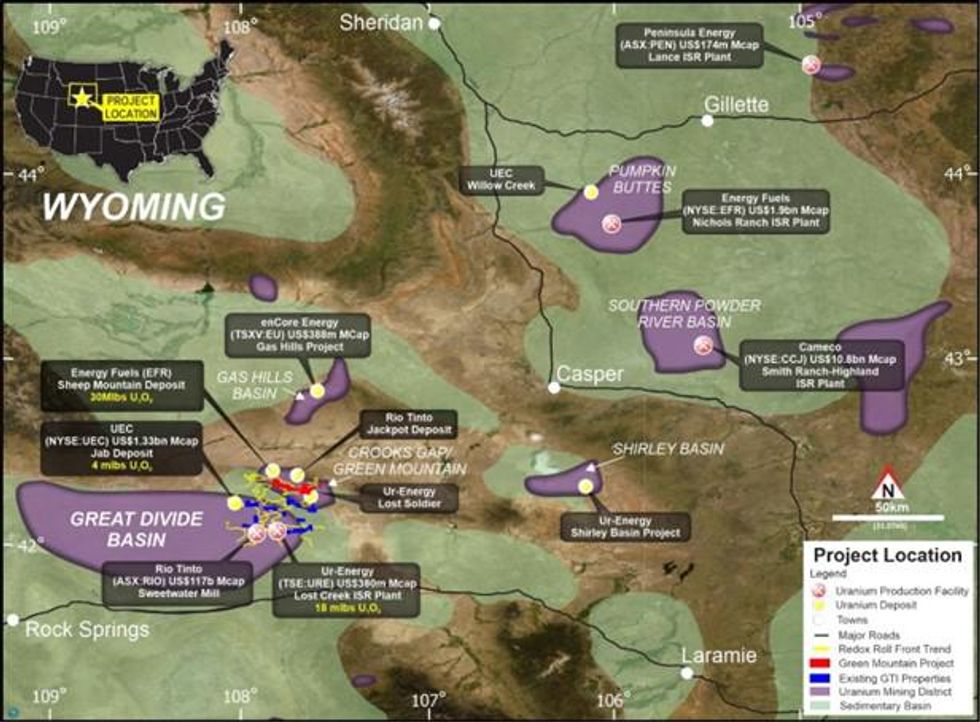

Figure 2. Regional Location of The Green Mountain Project

The GDB, which joins the southern slopes of Green Mountain, is one of several major basins within the Wyoming Basin Physiographic Province (Figure 2). All of these areas including Green Mountain/Crooks Gap are known to host economic, sandstone-type roll front hosted uranium deposits.

- The Properties are located within economically viable transportation distance from both GTI’s existing land holdings and several significant uranium deposits and or processing facilities held by the neighbouring Rio Tinto, Energy Fuels, UEC and Ur-Energy (Figures 2 & 3).

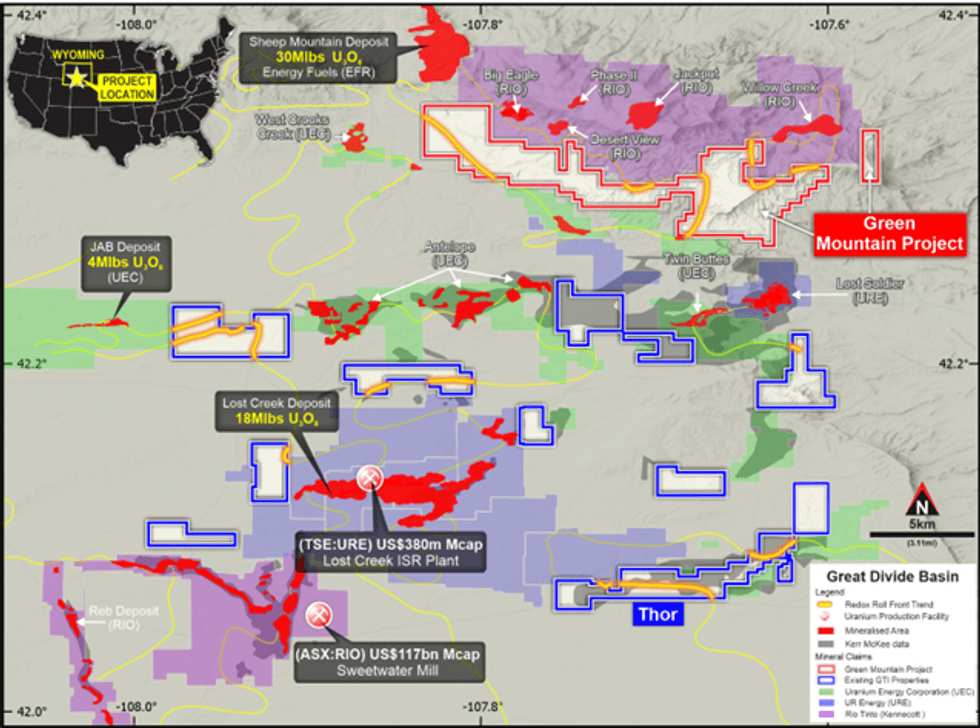

- Notable nearby deposits include Energy Fuel’s (EFR) 30Mlb Sheep Mountain deposit, Ur- Energy’s (URE) Lost Soldier ISR deposit, UEC’s (UEC) Antelope deposit & Rio Tinto’s (RIO) Big Eagle (past producing), Jackpot, Desert View, Phase II & Willow Creek deposits (Figure 3).

- The GDB/Green Mountain area was extensively explored by drilling in the 1970’s and early 1980’s by major US companies including Kerr McGee Uranium, Conoco Minerals, Phillips, World Nuclear, Union Carbide, Occidental Petroleum, Western Nuclear and Pathfinder Mines.

- A review of historical Kerr McGee drill data and oil-well exploration drill logs confirms the presence of roll fronts & the Battle Springs formation which hosts neighbouring major uranium deposits.

Figure 3. Great Divide Basin/Green Mountain Location of The Green Mountain Project

The Company has, with the help of historical Kerr McGee drilling information & oil well drill logs, identified mineralised roll front exploration target areas which will be further evaluated & progressed towards permitting & drilling as soon as practicable leading up to and after settlement of the Acquisition.

In connection with the Acquisition, GTI advised it had received commitments for a placement to raise$5,040,000 (before costs) (Capital Raising). The funds raised from the Capital Raisings will be used to fund the Acquisition, exploration of the Properties, pay costs of the Capital Raising and for working capital. In particular, new funds will enable increased drilling on roll fronts in proximity to major U3O8 deposits.

Click here for the full ASX Release

This article includes content from GTI Energy Ltd , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

12h

Uranium Market Facing Supply Crunch as Nuclear Fleet Grows

The global uranium market is entering what industry leaders describe as a pivotal phase, with strengthening nuclear demand colliding with tightening supply and rising geopolitical competition for fuel.At the Prospectors & Developers Association of Canada (PDAC) convention in Toronto, an... Keep Reading...

12h

Uranium Supply Behind, Demand Evolving — What's Next? Denison Mines' David Cates

David Cates, president and CEO of Denison Mines (TSX:DML,NYSEAMERICAN:DNN), discusses uranium market dynamics, as well as the company's path forward after its recent final investment decision for the Phoenix ISR uranium project in Saskatchewan's Athabasca Basin. Construction at the asset has... Keep Reading...

13h

Generation Uranium CEO: Underexplored Thelon Basin Offers Major Discovery Upside

Generation Uranium (TSXV:GEN,OTCQB:GENRF,FWB:W85) CEO and Director Michael Collins highlighted the potential of the underexplored Thelon Basin in Nunavut, Canada, where the company’s 100 percent owned Yath project is located. The Thelon Basin is an unconformity basin recognized as similar to the... Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00