- WORLD EDITIONAustraliaNorth AmericaWorld

August 22, 2024

Golden Mile Resources (ASX:G88) is a project development and mineral exploration company focusing on multi asset and multi commodity strategy by advancing core projects, acquiring high-quality assets, and forging tactical alliances with joint venture partners. Golden Mile’s value proposition is driven by a highly experienced leadership team with proven expertise across the resources sector from exploration to development and production.

The company is advancing its newly acquired Pearl copper project in Arizona, and the Quicksilver nickel-cobalt project, located in Western Australia, which has an indicated and inferred resource of 26.3 Mt @ 0.64 percent nickel and 0.04 percent cobalt.

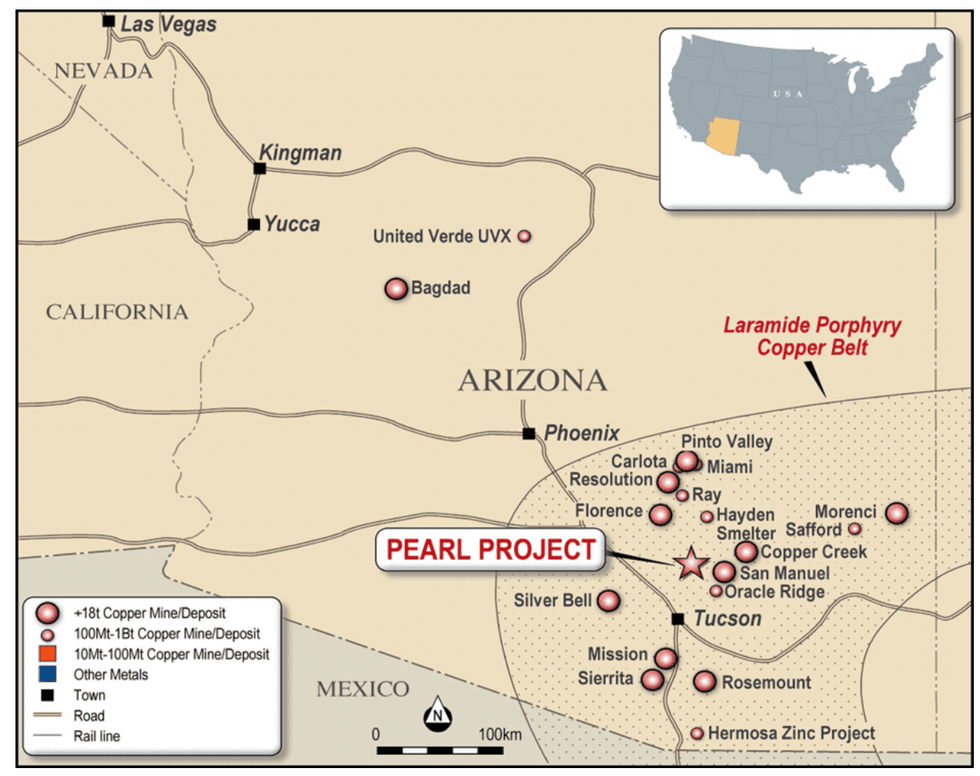

Golden Mile secured the Pearl copper project in August 2024. Located in Arizona, the asset hosts more than 50 artisanal copper workings and shares similar geological characteristics to the San Manuel-Kalamazoo and Pinto Valley porphyry copper mines. The project exhibits widespread surface alteration highlighted by rock chip samples of 7.3 percent copper, 0.43 percent molybdenum, 19.9 percent lead, 4.9 percent zinc and 360 g/t silver.

Company Highlights

- Golden Mile Resources has a diversified portfolio of both advanced projects and exploration assets in tier 1 jurisdictions of Australia and the US.

- The recently acquired Pearl copper project in Arizona is located in the renowned Laramide Porphyry Belt.

- The Quicksilver nickel-cobalt project near Perth has an indicated and inferred mineral resource of 26.3 Mt @ 0.64 percent nickel and 0.04 percent cobalt.

- Golden Mile is backed by a highly experienced management team with proven success in project engineering and development from exploration to production across multiple continents.

This Golden Mile Resources profile is part of a paid investor education campaign.*

Click here to connect with Golden Mile Resources (ASX:G88) to receive an Investor Presentation

G88:AU

The Conversation (0)

18 February

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

22 August

Private Placement to Raise $510.8K

Golden Mile Resources (G88:AU) has announced Private Placement to Raise $510.8KDownload the PDF here. Keep Reading...

20 August

Trading Halt

Golden Mile Resources (G88:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 July

June 2025 Quarterly Activities and Cashflow Reports

Golden Mile Resources (G88:AU) has announced June 2025 Quarterly Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

07 July

Aurora Prospect Delivers High-Grade Gold Assays

Golden Mile Resources (G88:AU) has announced Aurora Prospect Delivers High-Grade Gold AssaysDownload the PDF here. Keep Reading...

02 July

Maiden Drilling Campaign Intersects Copper and Lead

Golden Mile Resources (G88:AU) has announced Maiden Drilling Campaign Intersects Copper and LeadDownload the PDF here. Keep Reading...

10h

Mapping the Junior Mining Journey from Exploration to Production

Junior explorers play a vital role in the global gold pipeline, often discovering and advancing deposits that are later acquired or developed into producing mines. Yet the path from exploration to production is complex, capital intensive and full of risk. For investors, understanding this... Keep Reading...

12h

Lynette Zang: Gold, Silver Price Surge — "This is the End Game for Fiat"

Lynette Zang, CEO of Zang Enterprises, shares her thoughts on what the gold and silver price surge says about the world today, emphasizing that people are increasingly losing confidence in the monetary system at a global scale. Zang also shares how she's now considering not just a Plan B, but... Keep Reading...

13h

Gold, Silver in Focus, Investors Flocking to Safe Havens — Wheaton's Haytham Hodaly

Haytham Hodaly of Wheaton Precious Metals (TSX:WPM,NYSE:WPM) discusses what's driving gold and silver's record-setting price moves. He also weighs in on the company's bull market strategy, and the types of conversations Wheaton is having with investors, saying there's a growing appreciation of... Keep Reading...

13h

5 Best-performing Gold Stocks on the TSX in 2025

The gold price rose to repeated record highs during the third quarter of the year, breaking through significant milestones of US$3,700 and US$3,800 per ounce.The price rises were fueled by several factors, including safe haven demand led by economic uncertainty as US tariffs continued to impact... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00