Gold Price Soars Past US$3,500 to New High as Market Eyes September Rate Cut

The price of gold reached US$3,539.90 per ounce on September 2 as market watchers hotly anticipate an interest rate cut at this month's Fed meeting.

The gold price climbed to new record highs on Tuesday (September 2), reaching US$3,539.90 per ounce.

The yellow metal has had upward momentum since US Federal Reserve Chair Jerome Powell’s comments at the Jackson Hole Economic Policy Symposium on August 22 fueled speculation about a September interest rate cut.

He suggested risks in the market may be shifting as greater uncertainty bleeds into the American economy on the back of higher tariffs, tighter immigration and slowing growth in the labor market.

The latest inflation data was released last week, when the US Bureau of Economic Analysis (BEA) published personal consumption expenditures (PCE) price index data. The report indicates that core PCE, which excludes the volatile food and energy categories, rose 2.9 percent in July, up from the 2.8 percent recorded in June.

The PCE is the Fed's favored inflation metric when making rate policy decisions.

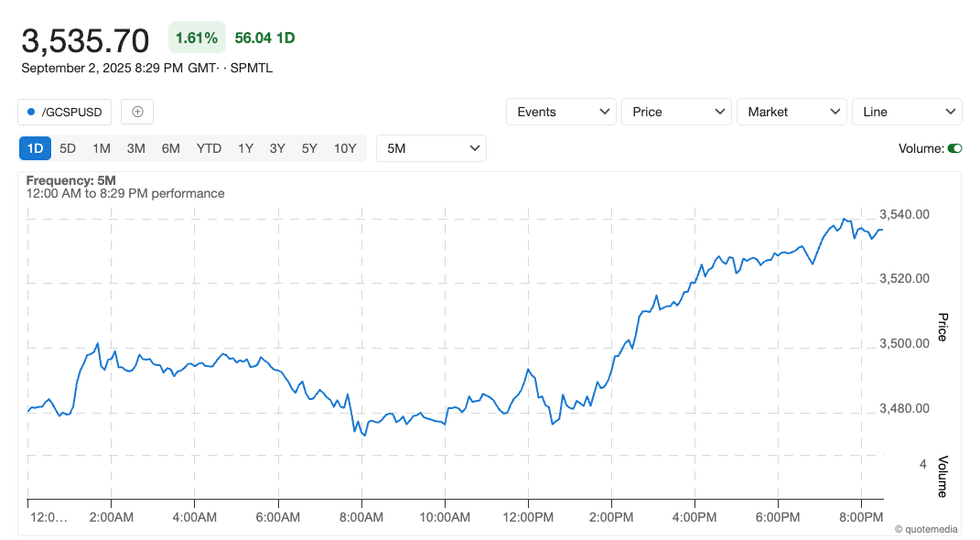

Gold price chart, September 2, 2025.

Chart via the Investing News Network.

The next inflation data in the calendar is the BEA’s consumer price index (CPI) report, set to be released on September 11. Early estimates from the Federal Reserve Bank of Cleveland suggest that core CPI continued to creep up in August and will come in at 3.05 percent, higher than the rise of 3.1 percent seen in July.

The Fed will also receive new labor market figures before its September 16 to 17 meeting. The Bureau of Labor Statistics is due to release its August nonfarm payroll report on Friday (September 5).

Analysts are predicting another weak report, with expectations of 73,000 additions to the US labor force; the unemployment rate is projected to tick up to 4.3 percent from the current 4.2 percent.

In July, the report indicated that just 73,000 jobs were added to the economy, but more significantly, it provided downward revisions for May and June, totaling 258,000 jobs combined.

Even though inflation is drifting further from the Fed's 2 percent goal, slowing growth in the labor market is likely to have greater weight ahead of the Fed meeting. There is currently a 90 percent chance of a 25 basis point cut.

Adding more fuel to the fire is an appeals court ruling on August 29 that struck down the majority of US President Donald Trump's reciprocal tariffs as unconstitutional, including those levied against Canada, Mexico and China.

However, tariffs on steel and aluminum were spared in the decision. The court said the tariffs will remain in place until October 14, providing sufficient time for the White House to launch an appeal to the Supreme Court.

Investors have turned to gold since the start of the year amid uncertainty caused by tariffs and as a debt crisis threatens the broader US economy. Additional momentum has come from the safe-haven status of precious metals as conflicts in Eastern Europe and the Middle East have continued unabated, threatening stability in both regions.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.