- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

April 30, 2023

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to announce a further consolidating increase in its JORC (2012) reported Mineral Resource estimate for the Hombre Muerto West Project (HMW Project) located in Catamarca Province, Argentina. The revised Mineral Resource estimate was completed by the Australian based team of leading independent geological consultants, SRK Consulting (Australasia) (SRK).

Highlights:

- HMW Total Mineral Resource increases to 6.6Mt contained lithium carbonate equivalent (LCE) @ 880mg/l Li

- No cut-off grade applied to the Resource estimate

- Third significant resource upgrade since March 2020

- Consistent high grade with low impurities

- Measured Resource of 4.7Mt @ 873mg/L Li (72% of Resource)

- Impressive total Resources (including Candelas) of 7.3Mt @ 852 mg/l Li; one of the highest-grade Li resources in Argentina

- Solid resource foundation for Galan’s four stage long term production target

The maiden HMW Project Mineral Resource Estimate (refer Galan ASX release dated 12 March 2020) was prepared by SRK and was further updated on 17 November 2020 and again on 24 October 2022. Each upgrade has not only significantly increased the global JORC Resource inventory but also elevated the JORC Resource category and hence confidence in the HMW Resource inventory. This latest resource upgrade enhances Galan’s objective to achieve the conditions necessary to commence construction and commercial production at HMW in the shortest practical timeframe.

Galan’s Managing Director, Juan Pablo (JP) Vargas de la Vega, said:

“This latest increase in the high grade, low impurity HMW Resource highlights the potential enormity of the brine resource that sits within Galan’s 100% owned tenements in Argentina. We have continued to acquire tenements and continued to drill holes since our maiden resource was announced at HMW. The initial HMW resource in March 2020 was 1.08Mt LCE @ 946Mg/L Li. This now sits at a world class size of 6.6Mt contained LCE at 880mg/l Li. Coupled with our Candelas resource, Galan has a very solid foundation, and more importantly confidence, that its Hombre Muerto Salar resources fully support its four-stage lithium production target of up to 60ktpa LCE.”

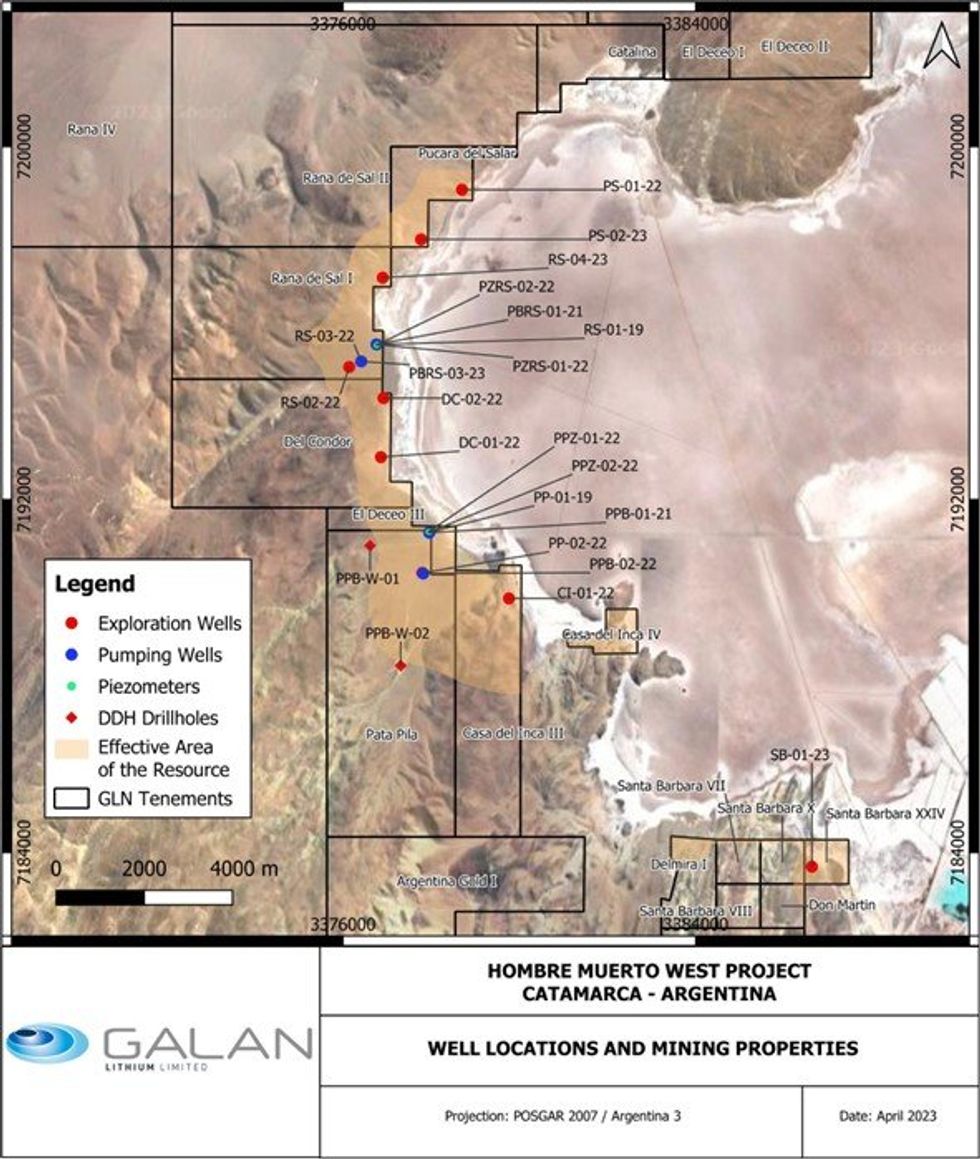

This latest revised Mineral Resource estimate incorporates geological and geochemical information obtained from nineteen (19) drillholes totalling 5,918 metres within the Pata Pila, Rana de Sal, Casa del Inca, Del Condor, Pucara del Salar, Delmira, Don Martin and Santa Barbara tenements (see figure 1). A total of 610 brine assays were used as a foundation of the estimation, all of which were analysed at Alex Stewart International laboratory (Jujuy). The QA/QC program includes duplicates, triplicates, and standards. In total, 325 QA/QC samples were considered using Alex Stewart (duplicates) and SGS in Argentina (triplicates) as the umpired laboratory.

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

23h

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00