July 15, 2021

Galan Lithium Limited (ASX:GLN) (Galan or the Company) is pleased to announce that it has executed a binding Option Agreement (Agreement) with a private Argentinian individual for the purchase of the right to earn a 100% interest in the Casa Del Inca III lithium brine tenement. The acquisition increases and consolidates our Hombre Muerto West (HMW) project footprint located in the South American Lithium Triangle in Catamarca, Argentina (Figure 1).

- Option to purchase strategic new tenement executed

- Right to acquisition increases flexibility and more area for pond location and infrastructure such as camp and processing plant for HMW

- Potential to increase lithium resource to be assessed with geophysics work to follow

Galan has agreed to initially acquire 300ha for a total of US$150,000 with the initial deposit of US$80,000 being paid.

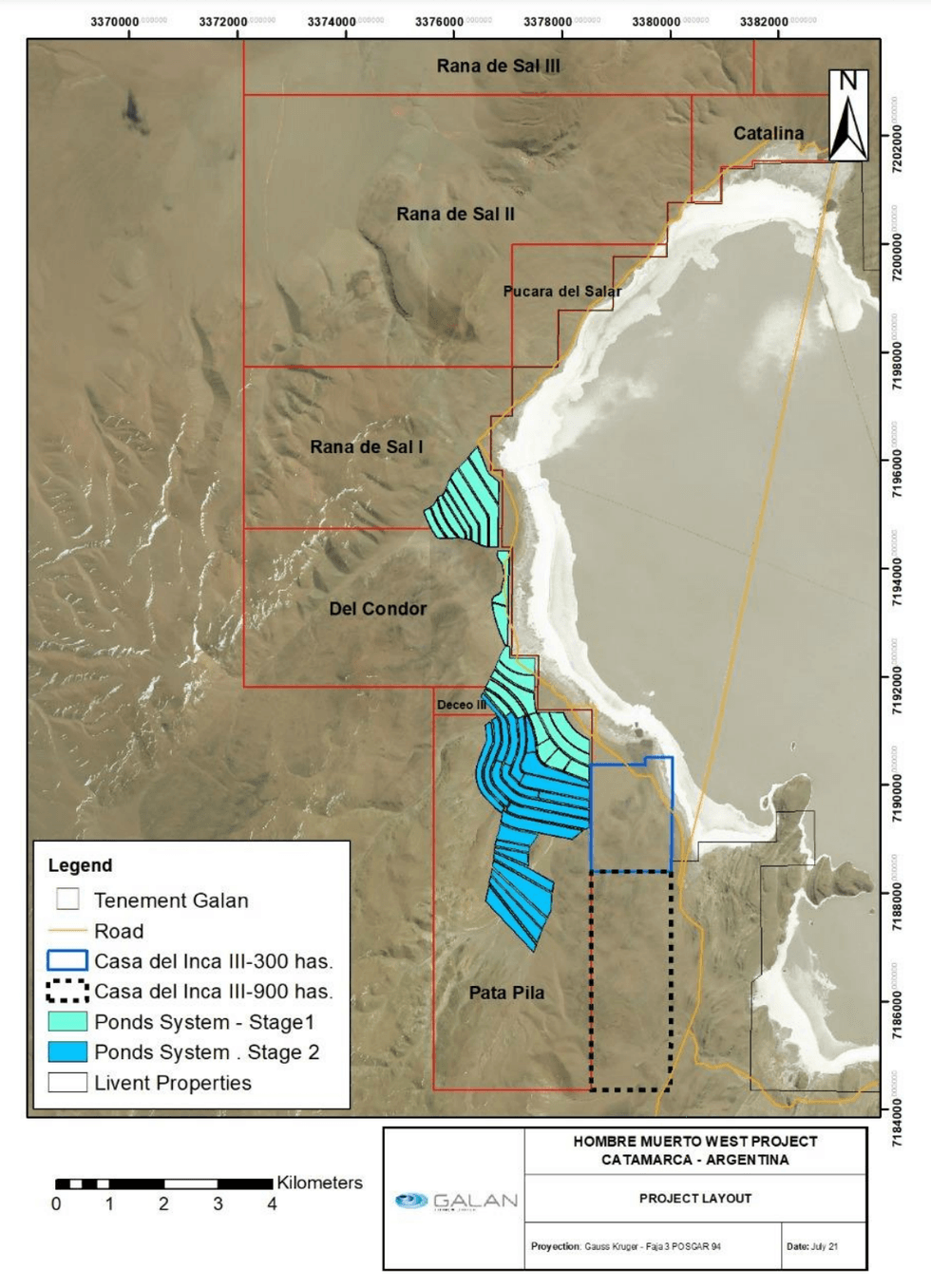

Figure 1 shows that the project abuts the east side of the Pata Pila tenement and highlights the initial 300ha to be purchased under the Agreement plus the total 900ha, if required.

Casa del Inca III is located within the world-class, Salar del Hombre Muerto, where Livent Corporation (NYSE:LTHM) is currently producing lithium carbonate and Galaxy Resources Limited (ASX:GXY) is developing its Sal de Vida project. More importantly, it abuts Galan's Pata Pila interest, which shares the same geology setting forming part of the suite of tenements that comprise the HMW project. The HMW project currently houses a high-grade, low impurity lithium brine resource of ~2.3Mt LCE @ 946mg/l Li.

JP Vargas de la Vega, the Galan Managing Director said, 'This strategic project acquisition by Galan consolidates its Hombre Muerto West project with an extension of the concessions from Catalina to Pata Pila and onwards to Casa del Inca III. This provides Galan with the opportunity to quickly build additional scale to its already significant brine resource and tenure in the region.

Figure 1: Location of Casa del Inca III concession (300ha in blue; 900ha dotted) and GLN's concessions (in red)

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00