FPX Nickel Corp. (TSX-V: FPX) (OTCQB: FPOCF) (" FPX " or the " Company ") is pleased to present key results from Phase 2 and initial results from Phase 3 of an ongoing three-phase metallurgical test program to support the continued development of the Company's Baptiste Nickel Project ("Baptiste" or the "Project") at the Decar Nickel District in central British Columbia . This release builds on results of Phase 1 metallurgical testing as released on December 8, 2021 . The overall metallurgical test program is aimed at validating and optimizing the flowsheet parameters outlined in the Project's 2020 Preliminary Economic Assessment (" PEA "), and to support the development of the next phase of study.

Highlights

- Mineralogy: Extensive mineralogy work confirms the benefit in using Davis Tube Recoverable (" DTR ") assay method as both a resource basis and geometallurgical tool, thereby increasing confidence in the life-of-mine nickel grade profile and recovery projections for Baptiste

- Flotation: Bench-scale flotation testwork significantly improves the Company's understanding of awaruite flotation, including:

- Confirming the ability to consistently produce very high-grade flotation concentrates of greater than 60% nickel

- Indicating the potential for an alternative flotation regime which can produce excellent metallurgical performance while reducing flotation operating costs and complexity

- Overall Recovery: Bench-scale and pilot-scale testing confirms overall metallurgical performance aligned with the 85% DTR nickel recovery assumed in the 2020 PEA, driven by:

- Achieving bench-scale flotation stage nickel recoveries of up to 91% in batch testing and 87% in locked cycle testing

- Confirming pilot-scale grinding results in preferential grinding of dense awaruite particles, leading to primary magnetic separation recovery improvements of approximately 5%

"The strong results of our ongoing three-phase metallurgical testwork program continue to demonstrate the technical viability of the Baptiste Nickel Project," commented Andrew Osterloh , FPX Nickel's Vice-President, Projects. "Our team continues to build a robust database that not only validates key PEA criteria, but also demonstrates that Baptiste's DTR-based resource provides heightened confidence in the Project's life-of-mine grade and recovery projections. Testwork is demonstrating that the advantages of Baptiste's minerology are not only centred on the production of very high-grade concentrates, but also on the potential to use a simple flowsheet with conventional unit operations, underpinned with improved production confidence."

Phase 2 Metallurgical Testwork Campaign

The Company has completed approximately 70% of a three-phase metallurgical test program aimed at validating and optimizing the flowsheet parameters outlined in the PEA and to support continued development of the Project. Phase 2 of the program had the following key objectives:

- Confirm the mineralogy and speciation of nickel for the Baptiste resource

- Confirm the ability to produce a high-grade nickel concentrate by froth flotation

- Confirm flotation stage recovery criteria

- Evaluate an alternative flotation regime to reduce acid requirements

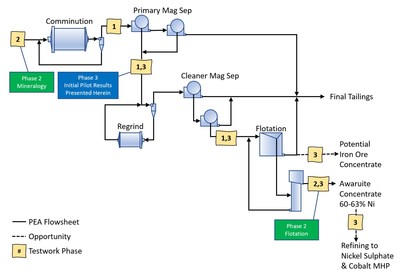

Figure 1 shows the Baptiste nickel recovery flowsheet as presented in the PEA. Highlighted within this figure are the unit operations which are the focus of each respective testwork phase.

Phase 2 of the metallurgical testwork campaign was overseen by Jeffrey B. Austin , P.Eng., President of International Metallurgical and Environmental Inc. Table 1 presents a summary of the Phase 2 testwork program, including general scope assignment by laboratory.

Table 1 – Phase 2 Metallurgical Test Program Scope Assignments

| Lab | Scope |

| ALS Metallurgy Kamloops, BC | Mineralogy variability testwork |

| SGS Mineral Services Burnaby, BC | Bench-scale flotation testwork |

Mineralogy Variability Testwork

The objective of the mineralogy variability testwork was to improve the understanding of nickel speciation at Baptiste and to provide insight into the relationship between awaruite grain size and DTR nickel. Detailed mineralogy was conducted on six mine phase composites samples representing the 35-year mine life envisioned in the PEA, as well as other composites from key historical testwork campaigns.

A key outcome of the testwork was finding that nickel mineralization at Baptiste is present only as awaruite (Ni 3 Fe) or nickel sulphide minerals. This supersedes a historic understanding that indicated approximately 10% of nickel was present as solid solution within silicates. The more detailed mineralogical work involved more exhaustive scanning microprobe analysis using QEMSCAN tools and longer scanning durations, confirming that previously reported solid solution nickel is actually very fine awaruite contained within a silicate matrix.

The mineralogical analysis indicated that awaruite accounts for 85-92% of total nickel content across the six mine phase composite samples. The balance of the nickel mineralization (8-15%) occurs as nickel sulphide minerals, most notably heazlewoodite and pentlandite. This confirms that awaruite is the dominant nickel mineralization across the Baptiste deposit, and that this mineral occurrence is relatively homogenous across all mine phases. The high content of awaruite, and the processing advantages associated with this style of mineralization, is the result of the virtual lack of sulphur in the host rock at the time of alteration.

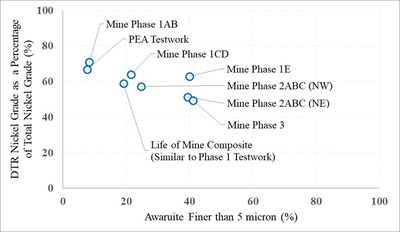

Assay analysis of the composites indicated a range of 0.20-0.25% total nickel, with 50-70% of the total nickel reporting as DTR nickel. Comparing these assay results with the mineralogical results indicated the difference between DTR nickel (50-70% of total nickel) and awaruite speciation (85-92% of total nickel) correlates strongly with the percentage of very fine awaruite (less than 5 microns). This result was expected as the DTR test is essentially a metallurgical test to identify the proportion of awaruite of sufficient grain-size to be collected by magnetic separation.

The strong correlation between DTR nickel and awaruite grain size is shown in Figure 2. It is noteworthy that the PEA's starter pit ("PEA Testwork" and "Mine Phase 1AB" datapoints) has the lowest proportion of fine awaruite within the resource, which aligns with the higher DTR nickel grades during the early years of operation. This provides confidence in the selection of the Baptiste starter pit location, which provides increased nickel production in the early years of operation due to the generally coarser, more readily recoverable awaruite.

In addition to improving the understanding of the Baptiste mineralogy, these results also demonstrate the value of using the DTR assay method as a geometallurgical tool. Very fine awaruite and nickel sulphides are not captured in the DTR test, nor are they currently targeted for recovery in the PEA flowsheet (though both represent future recovery opportunities). This finding helps validate that the DTR nickel grade filters a significant portion of metallurgical variability from the Baptiste resource. As such, projected metallurgical recoveries on a DTR nickel basis will be significantly less variable than recoveries on a total nickel basis, thereby increasing the confidence in the basis of the Baptiste resource and the associated recovery projections.

Bench-Scale Flotation Testwork

As reported in the summary of the Phase 1 metallurgy testwork campaign (see the Company's December 8, 2021 news release), magnetic concentrate (principally containing awaruite and magnetite) was produced from pilot testing material approximately representative of the Baptiste resource. This pilot plant utilized closed circuit grinding with cyclone classification which, as planned, resulted in preferential grinding of the dense awaruite particles. While this preferential grinding tangibly lowered magnetic separation tailings grades, it also resulted in the significant hold-up of awaruite within the grinding circuit, resulting in a lower-than-expected flotation feed grade (2.2% observed versus 2.6-2.7% expected).

Batch and locked-cycle flotation testwork has demonstrated the ability to produce high-grade flotation concentrates, routinely exceeding 60% nickel, with select tests achieving grades of up to 68% nickel, despite the lower flotation feed grade. These high-grade concentrates are possible due to high nickel tenor in awaruite (Ni 3 Fe).

Metallurgical recoveries in optimized open circuit roughing tests yielded nickel recoveries of up to 91%, while locked cycle testing yielded nickel recoveries of 87% to the cleaner concentrate with nickel concentrate grades ranging from 60 to 66%. Flotation conditions were largely comparable to historic metallurgical testwork, validating the PEA flotation conditions.

While recovery values are less than the PEA flotation stage recovery criteria of 94%, the current SGS flotation results were impacted by the lower feed grade owing to the hold-up of nickel in the pilot plant grinding circuit. As comparable flotation tailings grades were observed across the current and historic flotation programs, and previous testwork indicated that coarse, liberated awaruite is readily recoverable in flotation, it is anticipated recovery estimates would increase if the flotation feed material was more representative.

In addition to affirming the PEA flotation reagent regime, Phase 2 testing included an alternative flotation regime targeting higher flotation slurry pH conditions, therefore requiring reduced acid addition rates. Optimized bench tests under the alternative flotation regime showed positive results with near identical recoveries and concentrate grades, but with a 25% decrease in acid consumption, thereby indicating a potential for reducing flotation operating costs versus the 2020 PEA.

Given the results described above, the scope and duration of Phase 2 testwork has been extended to pursue opportunities to further improve the flotation regime and overall results; results of this expanded portion of the Phase 2 testwork program are anticipated in the fourth quarter of 2022.

Phase 3 – Initial Results from Large-Scale Pilot-Scale Testwork

Building on the results of Phase 1 piloting, Phase 3 of the metallurgical testwork campaign includes larger-scale pilot processing, with the intent to both optimize the PEA flowsheet and to produce a significant quantity of high-grade awaruite concentrate for hydrometallurgical testwork. The pilot testwork is being conducted at Corem in Quebec City . Progress to date includes bench- and pilot-scale testing of the primary grind/magnetic separation and regrind/magnetic separation unit operations. Key initial findings of Phase 3 pilot testing are presented below, and the full results are expected to be released in the fourth quarter of 2022.

As noted above and previously released by the Company, the initial pilot-scale testing in Phase 1 indicated potential DTR nickel recoveries up to 5% higher than those observed in previous bench-scale testing, owing to the preferential grinding of the deposit's dense awaruite nickel mineralization using cyclone classification. However, due to the feed rate and duration of this Phase 1 initial piloting, substantial hold-up of nickel (estimated 20-40%) was witnessed within the grinding circuit. As such, this led the Company to undertake larger-scale piloting, utilizing higher feed rates and longer operating duration in order to reach steady state operation.

The Phase 3 primary grind and magnetic separation campaign processed a total of 16 tonnes of feed material over a cumulative duration of 80 hours (as compared to Phase 1 piloting which processed 3.6 tonnes over a cumulative duration of 23 hours). Similar to Phase 1 piloting, Phase 3 piloting saw significant hold-up of dense awaruite, and it took an estimated 11 tonnes of material over a cumulative period of 54 hours to reach steady state operation, indicated by equivalent DTR nickel grades in the fresh mill feed and the cyclone overflow.

At steady state, the DTR nickel recirculating load was approximately 700%, compared to the overall mill recirculating load of 300%. Once steady-state conditions were reached, a clear preferential grinding benefit of dense awaruite particles in closed circuit grinding was observed with a 5% DTR nickel recovery increase relative to open circuit grinding on the same sample. Consistent with the results of the Phase 1 program, these new results continue to indicate the potential to achieve nickel recoveries up to 5% higher than the 90% DTR nickel primary magnetic separation stage recovery assumed in the 2020 PEA. Better liberation seen in the pilot plant work, due to cyclone classification, is also contributing to a reduction in the mass recovery during magnetic separation at comparable or better nickel recoveries.

As a further optimization opportunity, additional pilot plant trials with modestly increased magnetic separation field strength demonstrated that a further 1-4% nickel recovery could be realized with a relatively low increase in mass recovery. Further testing and evaluation of varying magnetic intensities is planned during the remainder of the Phase 3 program. Complete results will be presented when the pilot campaign is complete.

In addition to the results described above, remaining aspects of the Phase 3 testwork program include the following:

- Completing pilot testing, from primary grind and magnetic separation through to flotation

- Conducting suitable variability testwork, to confirm the homogeneity of the Baptiste resource and further validate the process design criteria and design factors

- Demonstrating a robust and efficient integration into the battery material supply chain by optimizing previous leach testwork and conducting solvent extraction and nickel sulphate (NiSO 4 ) crystallization testwork

- Evaluating the potential for producing a saleable iron ore product, which represents a potential new product stream which was not included in the 2020 PEA

Qualified Person

The metallurgical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosures for Minerals Projects of the Canadian Securities Administrators ("NI 43-101") and supervised, reviewed, and verified by Jeffrey B. Austin , P.Eng., President of International Metallurgical and Environmental Inc., a "Qualified Person" as defined by NI 43-101 and the person who oversees metallurgical developments for FPX Nickel.

About the Decar Nickel District

The Company's Decar Nickel District claims cover 245 km 2 of the Mount Sidney Williams ultramafic/ophiolite complex, 90 km northwest of Fort St. James in central British Columbia . The district is a two-hour drive from Fort St. James on a high-speed logging road.

Decar hosts a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite (Ni 3 Fe), which is amenable to bulk-tonnage, open-pit mining. Awaruite mineralization has been identified in four target areas within this ophiolite complex, being the Baptiste Deposit, and the B, Sid and Van targets, as confirmed by drilling, petrographic examination, electron probe analyses and outcrop sampling on all four targets. Since 2010, approximately US $28 million has been spent on the exploration and development of Decar.

Of the four targets in the Decar Nickel District, the Baptiste Deposit, which was initially the most accessible and had the biggest known surface footprint, has been the focus of diamond drilling since 2010, with a total of 99 holes and 33,700 m of drilling completed. The Sid target was tested with two holes in 2010 and the B target had a single hole drilled in 2011; all three holes intersected nickel-iron alloy mineralization over wide intervals with DTR nickel grades comparable to the Baptiste Deposit. In 2021, the Company executed a maiden drilling program at Van, which has returned promising results comparable with the strongest results at Baptiste.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite. For more information, please view the Company's website at www.fpxnickel.com or contact Martin Turenne , President and CEO, at (604) 681-8600 or ceo@fpxnickel.com .

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2022/27/c4374.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2022/27/c4374.html