- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

August 22, 2024

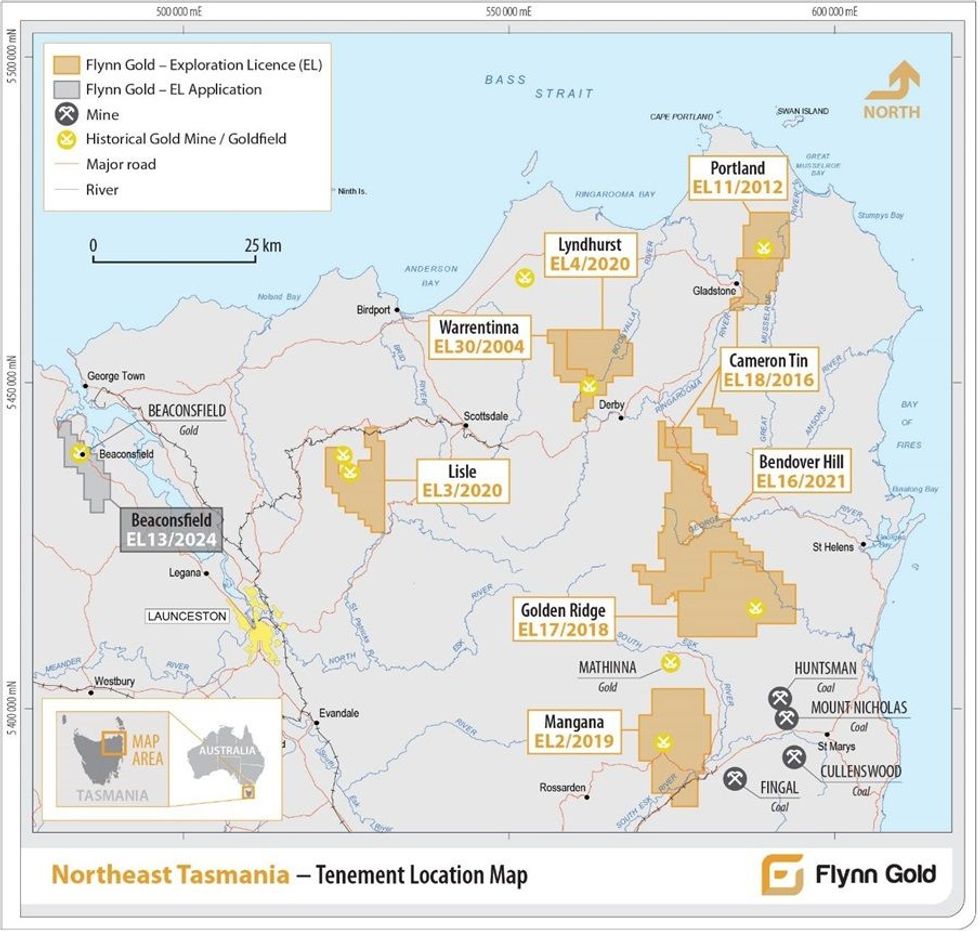

Flynn Gold Limited (ASX: FG1, “Flynn” or “the Company”) is pleased to advise that it has submitted an Exploration Licence Application (EL13/2024) strategically located surrounding the historical Beaconsfield Gold Mine, located approximately 35km north- west of Launceston in North-East Tasmania (see Figure 1).

Highlights

- New FG1 Exploration Licence Application (EL13/2024) submitted over 40km2 of highly prospective exploration tenure surrounding the Beaconsfield Gold Mine lease in NE Tasmania

- Beaconsfield is the largest gold mine in NE Tasmania with historical production of 3.79Mt @ 14.5g/t Au for 1.77Moz Au1

- EL13/2024 covers brownfields targets with several known gold occurrences outside of the Mining Lease offering excellent discovery potential using modern exploration techniques

- Securing EL13/2024 aligns with Flynn’s strategy of targeting orogenic gold in NE Tasmania which is recognised as an extension of the prolific Victorian gold belts

- Once EL13/2024 is granted, data compilation and reconnaissance exploration programs will commence to identify priority targets

- Concurrently, Flynn has reduced by 30% (457km2) its existing land-holdings in NE Tasmania as its exploration activities focus on higher priority areas based on recent results

- For further information or to post questions go to the Flynn Gold Investor Hub at https://investorhub.flynngold.com.au/link/8r6A0e

The 40km2 Exploration Licence Application surrounds the privately held Mining Lease over the high-grade Beaconsfield Gold Mine and covers a prospective 12km corridor along the Cabbage Tree thrust block that contains numerous historic gold workings and prospects.

Flynn Gold Managing Director & CEO Neil Marston said:

“This is an important strategic addition to our extensive portfolio of high-quality gold exploration tenure in North-East Tasmania. The new Exploration Licence Application encompasses highly prospective ground covering the strike extensions to the Beaconsfield Gold Mine host sequence. This was the largest gold mine in North-East Tasmania with historical production of about 1.8 million ounces of gold when underground mining operations ceased at Beaconsfield in 2012.

“The acquisition complements our strategic focus on exploring for high-grade gold in North-East Tasmania, a recognized extension of the prolific Victorian goldfields.

“While the Mining Lease is excluded from our application, we believe there is significant potential for fresh gold discoveries to be made within the licence application area. Once the Exploration Licence is granted, we’ll compile and evaluate the historical information to generate targets before commencing field activities.”

About the Beaconsfield-Salisbury Goldfield

Alluvial gold was first discovered in the Beaconsfield-Salisbury area in 1869 and, in 1877, the cap of the Tasmania Reef (now known as the Beaconsfield Gold Mine) was discovered outcropping on Cabbage Tree Hill.

Gold production commenced almost immediately, and the mine operated continuously until 1914. The mine was reopened in more recent times, operating between 1999 and 2012, with the gold processing plant still largely intact within the Mining Lease. The historical production of 3.785Mt @ 14.51g/t Au (1,774koz Au) makes Beaconsfield the largest gold mine in NE Tasmania.

Figure 2 – Beaconsfield Tenement Location Map

The Tasmania Reef at the Beaconsfield Gold Mine is a Devonian aged structurally- controlled orogenic gold style quartz reef similar in type to gold deposits hosted in the Victorian orogenic belts. The reef is hosted by sediments located in the Cabbage Tree thrust block which is bound by the underlying and overlying Cabbage Tree and Cobblestone Creek Thrusts respectively (see Figure 2).

Concurrent with the early development of the Beaconsfield Gold Mine, several other small-scale mining and prospecting activities were undertaken throughout the wider goldfield, many of which are within Flynn’s licence application area, with upwards of 70 historical small-scale mines and prospects recorded over a 10km strike length. Most of these prospects are located within the same geological host rocks as the Beaconsfield deposit. Previous exploration outside of the Beaconsfield Gold Mine area was limited and many targets within Flynn’s Exploration Licence area remain poorly tested using modern techniques.

Click here for the full ASX Release

This article includes content from Flynn Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FG1:AU

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

20 February 2025

Exploration Update - Golden Ridge Project, NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Update - Golden Ridge Project, NE TasmaniaDownload the PDF here. Keep Reading...

18 February 2025

High-Grade Silver-Lead at Henty Project, Western Tasmania

Flynn Gold (FG1:AU) has announced High-Grade Silver-Lead at Henty Project, Western TasmaniaDownload the PDF here. Keep Reading...

30 January 2025

December 2024 Quarterly Activities Report and Appendix 5B

Flynn Gold (FG1:AU) has announced December 2024 Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

12 January 2025

Flynn Expands Key Gold Targets at Golden Ridge, NE Tasmania

Flynn Gold (FG1:AU) has announced Flynn Expands Key Gold Targets at Golden Ridge, NE TasmaniaDownload the PDF here. Keep Reading...

08 December 2024

Exploration Licence Granted at Beaconsfield in NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Licence Granted at Beaconsfield in NE TasmaniaDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00