July 14, 2022

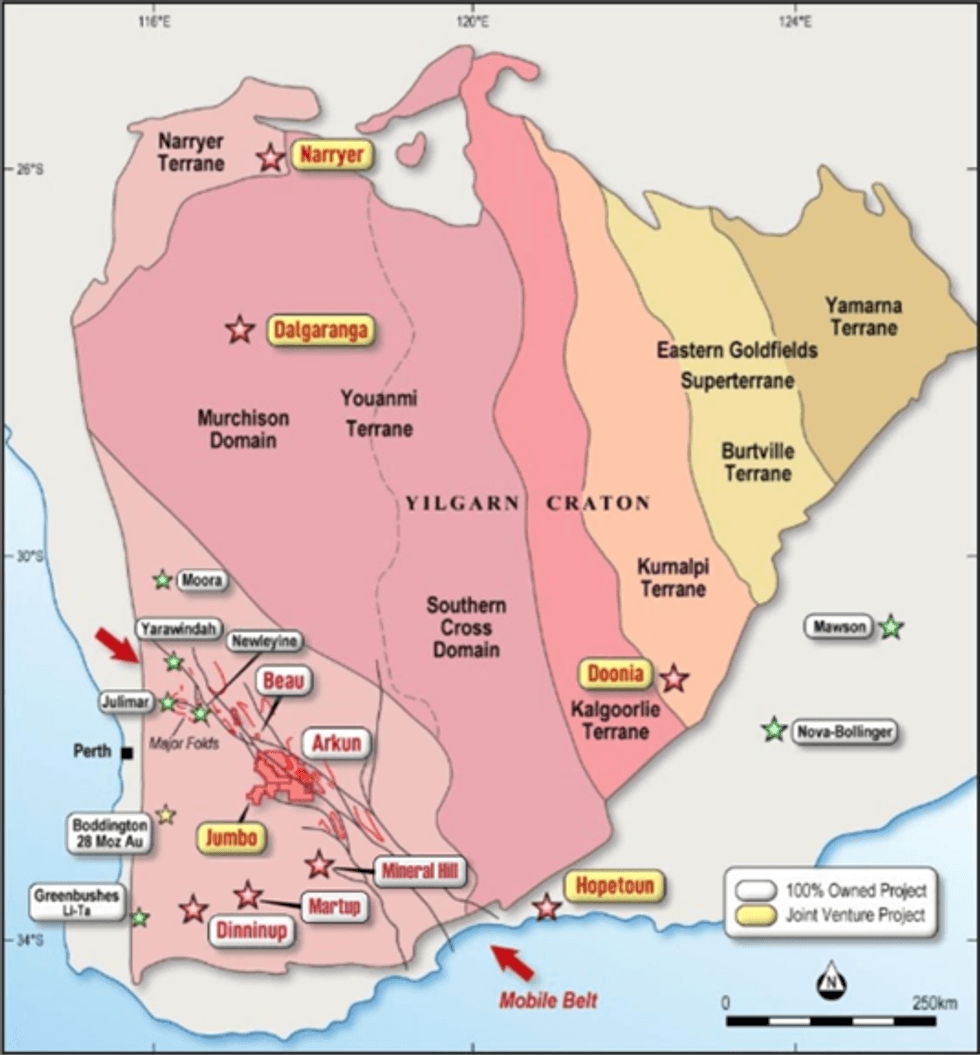

Significant progress has been made over the past months across a number of Impact Minerals Limited’s (ASX:IPT) portfolio of early-stage exploration projects for a range of critical and battery metals in the emerging mineral province of south west Western Australia (Figure 1).

- Airborne EM survey, soil geochemistry surveys, field checking and rock chip sampling completed at priority targets for Ni-Cu-PGE.

- Extensive time spent completing Land Access Negotiations across the project area.

- Assay results for Doonia and Hopetoun due by the end of July.

- Ongoing compilation of previous exploration work on other projects.

The portfolio has been assembled by Impact over the past 18 months as part of a strategic change in focus of the company following the discovery of the world class Julimar deposit just north of Perth by Chalice Mining Limited (ASX:CHN) (Figure 1). This has been done in tandem with the ongoing rationalisation of the Company’s projects in Eastern Australia, including a major joint venture on part of the Broken Hill Project with IGO Limited (ASX:IGO) (ASX Announcement 9th November 2021).

On-ground exploration programmes in Western Australia have been focussed on the Arkun-Beau-Jumbo Projects centred about 150 km south east of Perth and which has included a significant amount of time completing initial land access negotiations. In addition, synthesis and interpretation of previous exploration work is underway on other projects including Narryer, Dalgaranga and other projects (Figure 1).

Assay results from various rock chip and soil geochemistry programmes are starting to be received and interpreted. Assay results from two drill holes at Doonia have been received and are being interpreted, with the assays from the remaining four other holes at Doonia, as well as the final assays from the diamond drill programme at Hopetoun, due shortly.

BEAU-ARKUN-JUMBO

Previous reconnaissance geophysical and soil geochemistry surveys by Impact across the Arkun-Beau- Jumbo Project areas, which collectively cover about 2,380 km2, identified a significant number of areas for follow up work for a wide range of commodity metals including nickel-copper-PGE; Lithium pegmatites, Rare Earth Elements and Rubidium (ASX announcements 8th March 2022, 27th October 2021, 21st September 2021).

Figure 1. Location of Impact’s projects in Western Australia.

The following work has recently been completed across the Arkun-Beau-Jumbo Project areas:

- An extensive airborne HELITEM electromagnetic and magnetic survey comprising 920 line kilometres was completed in 7 blocks covering the priority soil geochemistry targets identified at Beau and Arkun (Figures 2 and 3). Final survey data has now been received and further processing and interpretation of the data is underway with results expected later this Quarter.

- Extensive time has been spent completing Land Access Agreements with landowners through the Beau and Arkun areas. A total of 22 agreements have been signed which cover the majority of the Ni-Cu-PGE targets in the northern part of the project area and negotiations are underway for the remaining targets in the southern part of the area. In general there has been a very good response from landowners in allowing exploration to commence.

- As a result of the Land Access Agreements, Impact has been able to complete several campaigns of field checking, soil geochemistry and rock chip sampling across some of the priority targets for Ni-Cu-PGE. A total of 949 soil samples and 171 rock chip samples have been collected and submitted for assay. First results are due by the end of July.

- Reconnaissance field checking and rock chip sampling has been completed along the main access road at Jumbo to follow up first pass soil geochemistry results. These samples have also been submitted for assay.

This work will allow further refinement of areas of interest for follow up work which will include drilling. Access is limited in some places until later in the year when the harvest season is completed. There is still significant follow up work to be done on the other targets and this is a priority for Impact over the next two Quarters.

DOONIA AND HOPETOUN

Drill programmes at Doonia and Hopetoun were completed earlier this year. Drill assays have been considerably delayed but results are due by the end of July.Soil geochemistry surveys have been completed at both projects to help define follow up drill targets. Assays results from these surveys are also due by the end of July.

OTHER PROJECTS

Compilation, synthesis and interpretation of previous exploration data has been on-going for Impact’s other projects in Western Australia. This includes the joint venture projects at Narryer and Dalgaranga (ASX Announcement 8th December 2022) as well as the 100% owned Dinninup, Mineral Hill and Martup Projects that were recent additions to the company’s portfolio (ASX Announcement 22nd April 2022).

Click here for the full ASX Release

This article includes content from Impact Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

7h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

8h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

8h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

13h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00