April 28, 2025

Empire Metals Limited (LON:EEE)(OTCQB:EPMLF),the AIM-listed and OTCQB-traded resource exploration and development company,is pleased to announce highly successful results from its recently completed Air Core ('AC') drilling programme at the Pitfield Project in Western Australia ('Pitfield').

This latest phase of drilling has further defined widespread and continuous, high-grade titanium dioxide ('TiO₂') mineralisation within the in-situ weathered cap, extending from surface to depths of over 50 metres. These results represent the next step in developing a globally significant titanium resource at Pitfield whilst also delivering significant bulk sample material for further processing testwork.

Highlights

- 85 AC holes drilled over 4,437m, with 43 holes at Thomas and 42 holes at Cosgrove Prospects.

- Broad, continuous, high-grade zones identified in every hole, with an average weathered interval grade of 5.77% TiO₂.

- Standout intercepts include:

- 60m @ 6.30% TiO₂ from surface (AC25COS001)

- 56m @ 7.15% TiO₂ from surface (AC25COS042)

- 51m @ 7.88% TiO₂ from surface (AC25TOM039)

- 57m @ 7.48% TiO₂ from surface (AC25TOM040)

- 52m @ 7.43% TiO₂ from surface (AC25TOM042)

- Cosgrove Prospect revealed multiple zones exceeding 10% TiO₂, including 14m @ 11.66% TiO₂ from 2m depth.

- Thomas Prospect continues to impress with intercepts including 49m @ 7.49% TiO₂ and rich internal zones up to 11.67% TiO₂.

This campaign not only delivered over 70 tonnes of metallurgical bulk samples but also produced analytical data that will directly inform the planning of a maiden JORC-compliant Mineral Resource Estimate, targeted for Q3 2025.

Total drilling at Pitfield has surpassed 22,000m across 202 holes, providing a robust geological foundation ahead of resource definition.

Shaun Bunn, Managing Director, said:"These exceptional results demonstrate the sheer scale and quality of titanium mineralisation at Pitfield. The consistency of high-grade intervals from near-surface, along with the depth and continuity of weathering, has surpassed our expectations. The bulk samples will now feed directly into upscaled metallurgical testwork aimed at fast-tracking product development."

AC Drill Results Summary

The drilling campaign consisted of 85 AC drillholes for a total 4,437m drilled, that both tested the extent of, and bulk sampled, the high-grade zones of titanium mineralisation that were previously discovered within the strongly weathered cap covering this giant, titanium-rich mineral system.

The drilling focused on areas within the Thomas and Cosgrove Prospects. These areas contained thick, highly weathered in-situ zones of high-grade titanium mineralisation, previously identified from reverse circulation ('RC') and diamond drillholes ('DD'). The total combined drilling covered an area over 60 hectares, on a 100m by 100m grid, with the following key results:

Thomas Prospect:

- 43 AC drill holes for a total 2,326m, drilled

- Average hole depth of 54.1m

- Average grade of 6.20% TiO2 from 1,148 samples

Cosgrove Prospect:

- 42 AC drill holes for a total 2,111m drilled

- Average hole depth of 50.3m

- Average grade of 5.34% TiO2 from 1,060 samples

Two drill holes at each prospect were "twin holes", designed to validate the geological and assay data quality of the AC drill holes, focusing on the weathered portion of three existing RC drillholes and one diamond core drill hole located within the target areas.

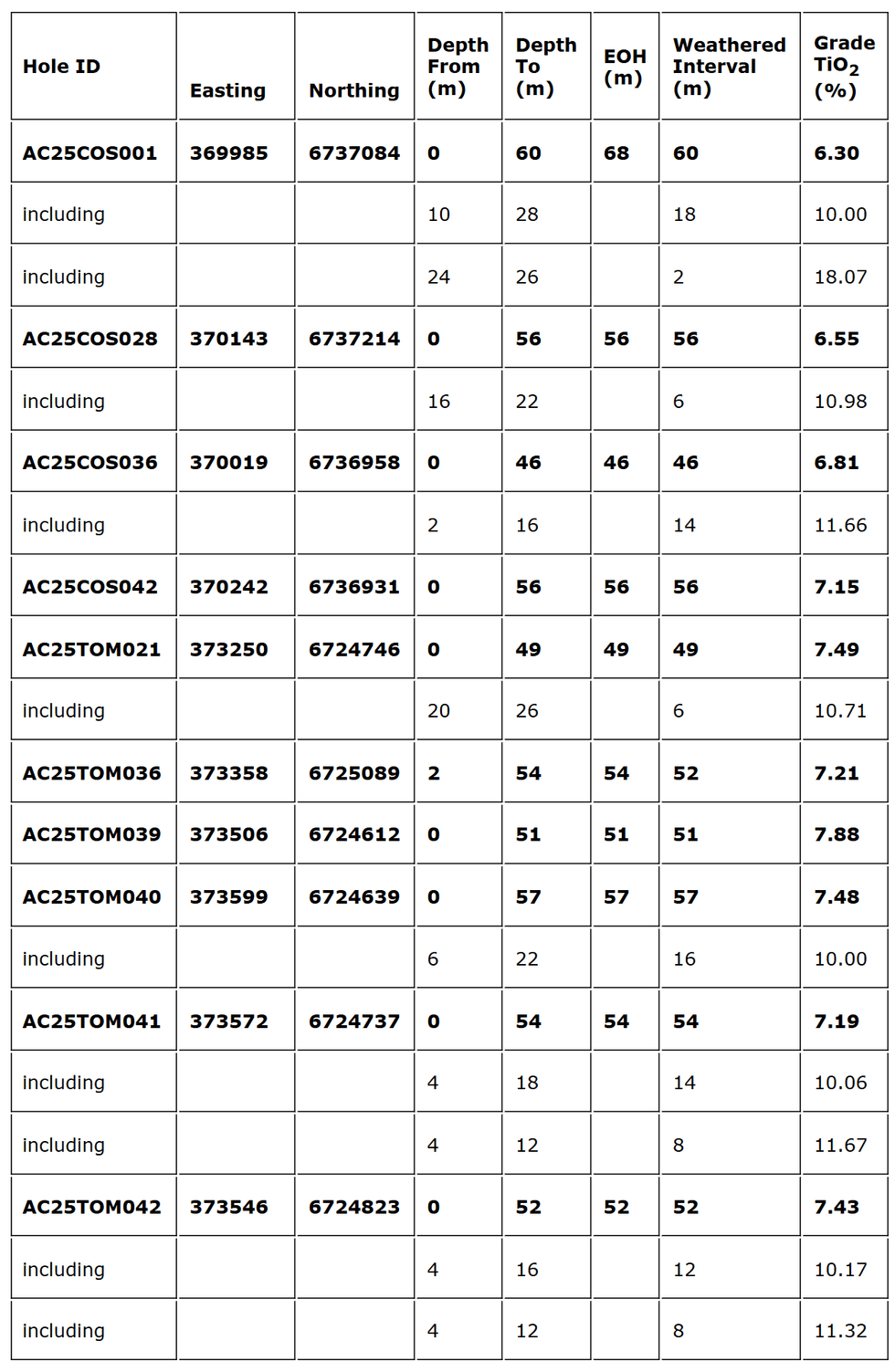

The drill programme confirmed thick, strongly weathered zones of high-grade titanium mineralisation of between 7% and 10% TiO2 at both the Thomas and Cosgrove Prospects, with assays peaking up to 18% (refer Table 1). Importantly, all drill holes confirmed continuous mineralisation, with an average grade of 5.79% TiO2 from 2,208 samples.

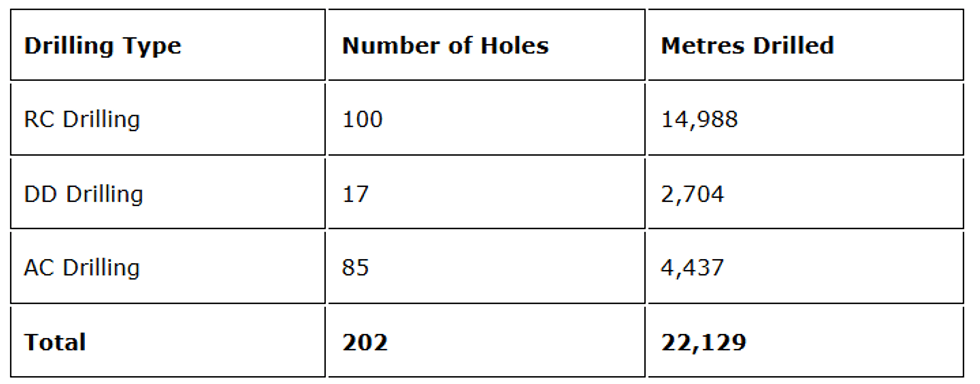

Pitfield Project Combined Drilling Summary 2023-2025

The Company completed its maiden reconnaissance drilling programme at the Pitfield Project in early 2023 (announced 24 April 2023), which consisted of 21 RC drill holes focused mainly to the north of the giant mineral system, near Mt Scratch. The Company executed two further drill campaigns in late 2023, a three-hole DD drill programme, which confirmed the mineralisation to a depth of over 350m below surface (announced 20 November 2023) and a 40-hole RC drill programme which confirmed the high-grade, near surface mineralisation at what is now referred to as the Thomas and Cosgrove Prospects (announced 22 January 2024).

Further RC and DD campaigns were carried out in early 2024, which identified the much higher grade, in-situ weathered cap and confirmed the presence of clean, titanium dioxide minerals (anatase and rutile) which occur as a result of the natural weathering of the interbedded in-situ sediments near surface (announced 5 June 2024). A subsequent DD drilling campaign (announced 24 October 2024) encountered extensive weathered zones from very near surface to depths of around 60 metres, nearly double that previous encountered at the Cosgrove and Thomas prospects, confirming the extremely soft and friable nature of the bedded sandstones in this weathered zone.

With the successful completion of the recent 85-hole AC drilling campaign the total exploration drilling completed at the Pitfield Project now stands at:

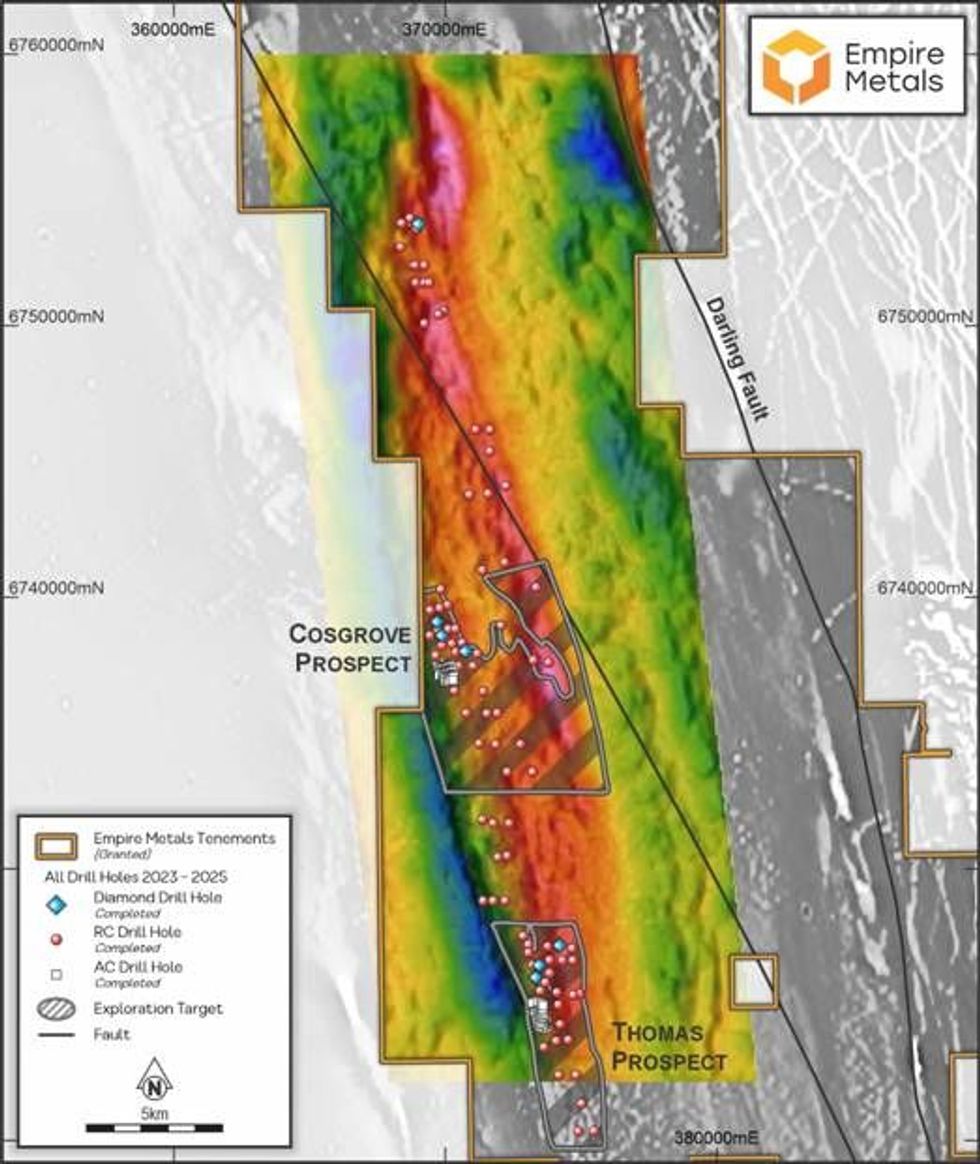

Figure 1 below shows all the prior drill holes across the mineralised system and the recent AC drilling at the high-grade target areas within the Cosgrove and Thomas Prospects.

February 2025 AC Drilling Programme

Cosgrove Prospect

Drilling at Cosgrove was focused on a priority area off approximately 500m by 600m (refer Figure 2).

The weathered zone interval width from this drill programme confirmed previous drilling in the area, however the average TiO2 grades for each drill hole were higher than any prior programme.

There are broad zones of high-grade mineralisation over the weathered zone, for example 60m at 6.30% TiO2 from surface [AC25COS001] and 56m @ 7.15% TiO2 from surface [AC25COS042]. The depth of weathering of the Cosgrove drill area was shown to be on average 50.1m and contains very high-grade intervals of mineralisation of up to 18% TiO2.

There are broad zones of high-grade mineralisation close to surface, for example 14m at 11.66% TiO2 from 2m [AC25COS036] and 18m at 10.00% TiO2 from 10m [AC25COS036].

All 42 drill holes confirmed the continuity of high-grade TiO2 mineralisation, with total hole average grades ranging from 3.48% to 7.15% TiO2. The overall average grade from the 1,060 assayed samples is 5.34% TiO2.

Thomas Prospect

Drilling at Thomas was focused on a priority area of approximately 300m by 1,000m (refer Figure 3).

The depth of weathering at Thomas was consistently deeper than that encountered at Cosgrove, with the deepest AC drill hole reaching 66m from surface.

There are broad zones of high-grade mineralisation over the weathered zone, for example 57m @ 7.48% TiO2 from surface [AC25TOM040] and 49m @ 7.49% TiO2 from surface [AC25TOM021]. There are broad zones of high-grade mineralisation close to surface, for example 16m at 10.00% TiO2 from 6m [AC25TOM040] and 14m at 10.06% TiO2 from 4m [AC25TOM041].

All 43 drill holes confirmed the continuity of high-grade TiO2 mineralisation, with total hole average grades ranging from 4.41% to 7.88% TiO2. The overall average grade from the 1,148 assayed samples is 6.20% TiO2.

Next Steps:

Acceleration of Mineral Resource Estimate ('MRE') Drill Programme

Based on the highly encouraging AC drill campaign results the Company is planning an enlarged programme of works at the Thomas and Cosgrove Prospects. Results from the AC, RC and DD drilling indicate the potential for a significant mineral resource at both prospects. The strategic importance of a resource for Empire Metals is significant for the company moving forward with the project. As such planning has begun on generating a MRE, which will include RC and AC drilling, with the drilling focused on a significantly expanded target area.

Interpretation of the drilling data highlights the Thomas Prospect as the best place to drill the initial resource due to the better consistency of geology and grade with thicker zones of weathering. A second phase of drilling will be planned in late 2025 to drill a resource at the Cosgrove prospect.

Metallurgical Test Programme

The broad zones of high-grade mineralisation encountered at or near surface within the in-situ weathered cap have been shown to hold the highest percentage of the most important titanium bearing minerals, anatase and rutile, and these will form the primary feedstock for the upscaled metallurgical test work programme.

The Pitfield Titanium Project

Located within the Mid-West region of Western Australia, near the northern wheatbelt town of Three Springs, the Pitfield titanium project lies 313km north of Perth and 156km southeast of Geraldton, the Mid West region's capital and major port. Western Australia is ranked as one of the top mining jurisdictions in the world according to the Fraser Institute's Investment Attractiveness Index published in 2023, and has mining-friendly policies, stable government, transparency, and advanced technology expertise. Pitfield has existing connections to port (both road & rail), HV power substations, and is nearby to natural gas pipelines as well as a green energy hydrogen fuel hub, which is under planning and development (refer Figure 4).

Competent Person Statement

The technical information in this report that relates to the Pitfield Project has been compiled by Mr Andrew Faragher, an employee of Empire Metals Australia Pty Ltd, a wholly owned subsidiary of Empire. Mr Faragher is a Member of the Australian Institute of Mining and Metallurgy. Mr Faragher has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Faragher consents to the inclusion in this release of the matters based on his information in the form and context in which it appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have been deemed inside information for the purposes of Article 7 of Regulation (EU) No 596/2014, as incorporated into UK law by the European Union (Withdrawal) Act 2018, until the release of this announcement.

**ENDS**

For further information please visit www.empiremetals.co.uk or contact:

About Empire Metals Limited

Empire Metals is an AIM-listed and OTCQB-traded exploration and resource development company (LON: EEE) with a primary focus on developing Pitfield, an emerging giant titanium project in Western Australia.

The high-grade titanium discovery at Pitfield is of unprecedented scale, with airborne surveys identifying a massive, coincident gravity and magnetics anomaly extending over 40km by 8km by 5km deep. Drill results have indicated excellent continuity in grades and consistency of the mineralised beds and confirm that the sandstone beds hold the higher-grade titanium dioxide (TiO₂) values within the interbedded succession of sandstones, siltstones and conglomerates. The Company is focused on two key prospects (Cosgrove and Thomas), which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

An Exploration Target* for Pitfield was declared in 2024, covering the Thomas and Cosgrove mineral prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Empire is now accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

The Company also has two further exploration projects in Australia; the Eclipse Project and the Walton Project in Western Australia, in addition to three precious metals projects located in a historically high-grade gold producing region of Austria.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

EPMLF

The Conversation (0)

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

17 February

Empire Metals Limited Announces Major Drilling Campaign to Commence at Pitfield

LONDON, UK / ACCESS Newswire / February 17, 2026 / Empire Metals Limited (LON:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce the commencement of a major drilling campaign at the Pitfield Project in Western Australia ('Pitfield' or... Keep Reading...

27 January

Empire Metals Limited Announces Pitfield Project Development Update

LONDON, UNITED KINGDOM / ACCESS Newswire / January 27, 2026 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded leading exploration and development company, is pleased to provide an update on the Pitfield titanium Project in Western Australia ('Pitfield' or the... Keep Reading...

30 December 2025

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

LONDON, UNITED KINGDOM / ACCESS Newswire / December 30, 2025 / Empire Metals Limited (AIM:EEE)(OTCQX:EPMLF), the AIM-quoted and OTCQX-traded exploration and development company, is pleased to announce that it has entered into a conditional sale and purchase agreement for its 75% interest in the... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00