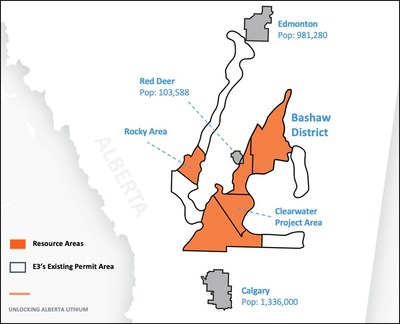

E3 Lithium (TSXV: ETL) (FSE: OU7A) (OTCQX: EEMMF) (the "Company" or "E3 Lithium" or "E3"), Alberta's leading lithium developer and Direct Lithium Extraction (DLE) technology innovator today announced the increase in its inferred mineral resource to 23.4 million tonnes of lithium carbonate equivalent (LCE) contained within the newly-named Bashaw District (the "Resource"). The Bashaw District combines and expands the Clearwater Resource and Exshaw Resource areas into a consolidated resource that contains an estimated total of 59 billion m 3 (59 km 3 ) of brine formation water at an average grade of 74.5 milligramLitre (mgL) lithium (Figure 1).

"This increase clearly establishes E3 Lithium, and the Leduc Aquifer in this region, as being a globally-significant source of lithium," commented Chris Doornbos , E3's CEO. "With the combination of the Resource, and the Company's ion-exchange direct extraction technology, E3 continues to lead Alberta on the path to becoming a major lithium producing jurisdiction. With E3's significant resource, established social licence to operate, supportive government policy, low-risk and transparent regulatory processes, and stable tax and royalty systems, E3 is well-situated to realize commercial production of battery-grade lithium."

The increase in the Resource is a result of the significant work completed by the E3 Lithium geology and subsurface team to improve and increase E3's understanding of the highly saline Leduc Aquifer within the Bashaw District. The work incorporated the thorough reviews and analyses of available core samples, the addition of hundreds of digital wireline logs, 2D seismic data, additional brine sampling results, and an updated interpretation of the Leduc facies, brine and reservoir properties. This work advanced E3's understanding of the reservoir and improved the Company's confidence in the resource volumes. Based on this analysis, the resource area has now been defined as:

- the combination of the previously published Clearwater and Exshaw Resource Areas;

- the expansion of resource area to include additional area of the Bashaw reef trend (3,033 km 2 of additional aquifer) for a new total of 5,931 km 2 .

Additionally, E3 has removed the production factor included in previous reports. The production factor cut-off methodology applied in previous resource estimates is considered a "modifying factor" and was removed from the updated resource estimate in accordance with NI 43-101. The modifying factors will be addressed as part of future reserves estimation 2 .

In estimating the current Resource, a 2% porosity cut-off was utilized, so that areas of the aquifer at or below 2% porosity were not included in the total volume used in the calculation of the Resource. Effective porosity for the intervals above the cut-off were estimated by applying the average net to gross ratio to measurements of total porosity available from petrophysical logs and core. It was also independently estimated through a petrophysical analysis using shale volume with consistent results. Consistent with E3 Lithium's prior resource estimates, the NI 43-101 Technical Report for the Bashaw District is being prepared and will be filed on SEDAR and the Company's website within 45 days.

The data being collected from E3's ongoing, and previously announced, drill program will be incorporated into a potential upgrade of a portion of the Bashaw District Resource from "Inferred" to "Measured and Indicated", as defined by the NI 43-101 2 . This upgrade will largely focus in the Clearwater Project Area, which is the target location of E3 Lithium's initial commercial production facility.

Mineral Resource Estimate

The Resource estimate was completed by E3's multi-disciplinary team and overseen by Daron Abbey , P. Geo and Alex Haluszka , P. Geo of Matrix Solutions Inc. acting as the Qualified Person (QP) required by National Instrument 43-101 (NI 43-101) standards 2 . The estimate was completed using volumetric analytics based on the geological parameters: aquifer geometry, porosity, permeability, pressure, and lithium concentrations. The mineral resource estimate benefited from a considerable amount of data compiled by the oil and gas industry and made public by the Government of Alberta.

Key data sets used to determine aquifer brine parameters in the resource area include drill stem tests (pressure, water quality, and permeability), core plug analyses (porosity and permeability), core logging and facies description (geometry of the aquifer), downhole wireline logs (lithology, total porosity, effective porosity, and permeability), sampling compositional analysis (lithium concentration), and historical production volumes of hydrocarbons and water (context for aquifer pressure and continuity).

The concentration of lithium within the consolidated Bashaw District is reasonably consistent and evenly distributed across the aquifer ranging from 53.5 mg/L to 93 mg/L lithium, with a P50 value of 74.5 mg/L. Wells included in the sampling program are located throughout the Bashaw District, concentrated in the Clearwater and Exshaw Resource Areas (Figure 1). Since 2017, E3 has analyzed a total of 75 brine samples from the Bashaw District. This included samples from 42 individual wells, with 4 or more repeat samples collected different locations. All analytical results fall within acceptable limits as prescribed by the ISO certified 3 rd party laboratory and followed strict chain of custody throughout all sampling programs. The results indicate that lithium concentrations remain steady in a relatively narrow P90 (70.4 mg/L) to P10 (79.9 mg/L) distribution.

The methodology used to estimate the resource volumes is as follows:

- Step 1: Calculate rock volume (area x average net thickness) [5931 km 2 x 193m = 1,146x10 9 m 3 ]

- Step 2: Calculate total pore volume (net rock volume x estimated effective porosity) [(Step 1) x 6.63%]

- Step 3: Calculate brine resource volume ((total effective pore volume – hydrocarbon pore volume) x brine saturation [((Step 2) – (OOIP*+OGIP*)) x 99%]

- Step 4: Calculate the mass of lithium by multiplying the brine volume by the P50 concentration. E3 has termed this value the Original Lithium In Place (OLIP). [(Step 3) x 74.5 mg/L]

*OOIP: Original Oil In Place, *OGIP: Original Gas In Place

Based on the total calculated 59km 3 of brine volume at a 74.5 mg/L average grade, the mineral resource estimate for the Bashaw District is 4,398,000 tonnes of Li, which equates to 23,400,000 tonnes of lithium carbonate equivalent (LCE) 3 . This resource estimate is classified as inferred due to the geological evidence being sufficient to imply but not verify geological, grade or quality continuity. Inferred mineral resource estimates can be upgraded to indicated and measured mineral resource with continued exploration. E3 Lithium is currently drilling a number of wells, which will be cored and sampled. Cores will be analyzed for reservoir parameters like effective porosity. Lithium samples will be collected from various aquifer intervals and pressure testing in the aquifer will be conducted. It is believed that this additional data will be sufficient to increase portions of the resource to Indicated and Measured in the Bashaw District. At that time, additional analysis and modifying factors can be applied to indicated and measured mineral resources to categorize mineral reserves.

The Company would like to thank its staff and contractors for their diligent and safe work in achieving this significant corporate milestone, as well as the cooperation of producing oil and gas partners across its permit areas for the brine samples.

Daron Abbey , P. Geo and Alex Haluszka , P. Geo, of Matrix Solutions Inc., are QP's responsible for the preparation of the technical information relating to the Bashaw District resource that is contained in this news release and have reviewed and approved the use and disclosure of such information in this news release. Daron Abbey and Alex Haluszka are a "Qualified Person", as that term is defined in NI 43-101.

About E3 Lithium

E3 Lithium is a development company with total of 24.3 million tonnes of lithium carbonate equivalent (LCE) inferred mineral resources 1 in Alberta. As outlined in E3's Pre-liminary Assessment, the Clearwater Lithium Project has an NPV8% of USD 1.1 Billion with a 32% IRR pre-tax and USD 820 Million with a 27% IRR after-tax 1 . Through the successful scale up its DLE technology towards commercialization, E3 Lithium's goal is to produce high purity, battery grade lithium products. With a significant lithium resource and innovative technology solutions, E3 Lithium has the potential to deliver lithium to market from one of the best jurisdictions in the world.

ON BEHALF OF THE BOARD OF DIRECTORS

Chris Doornbos , President & CEO

E3 Lithium

| 1: The Preliminary Economic Assessment (PEA) of the Clearwater Lithium Project NI 43-101 technical report is effective Sept 17, 2021. The mineral resource NI 43-101 Technical Report over the North Rocky Resource Area (NRRA), effective October 27, 2017, identified 0.9Mt LCE (inferred). The Bashaw District resource estimate is outlined with the news release titled "E3 Lithium Outlines 23.4 Mt LCE Inferred Mineral Resource in Consolidated Bashaw District" dated July 11, 2022, the full technical report will be made available within 45 days of the news release date. All reports are available on the Company's website (e3lithium.ca/technical-reports) and SEDAR (www.sedar.com) |

| |

| 2: NI 43-101 Standards of Disclosure for Mineral Projects, Form 43-101F1 Technical Report and Related Consequential Amendments (cim.org) ; cim-definition-standards_2014.pdf |

| |

| 3: LCE tonnes = Li tonnes x 5.323 |

Forward-Looking and Cautionary Statements

This news release includes certain forward-looking statements as well as management's objectives, strategies, beliefs and intentions. Forward looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the effectiveness and feasibility of emerging lithium extraction technologies which have not yet been tested or proven on a commercial scale or on the Company's brine, competitive risks and the availability of financing, as described in more detail in our recent securities filings available at www.sedar.com . Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE E3 Lithium Ltd.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2022/11/c4575.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/July2022/11/c4575.html