February 26, 2023

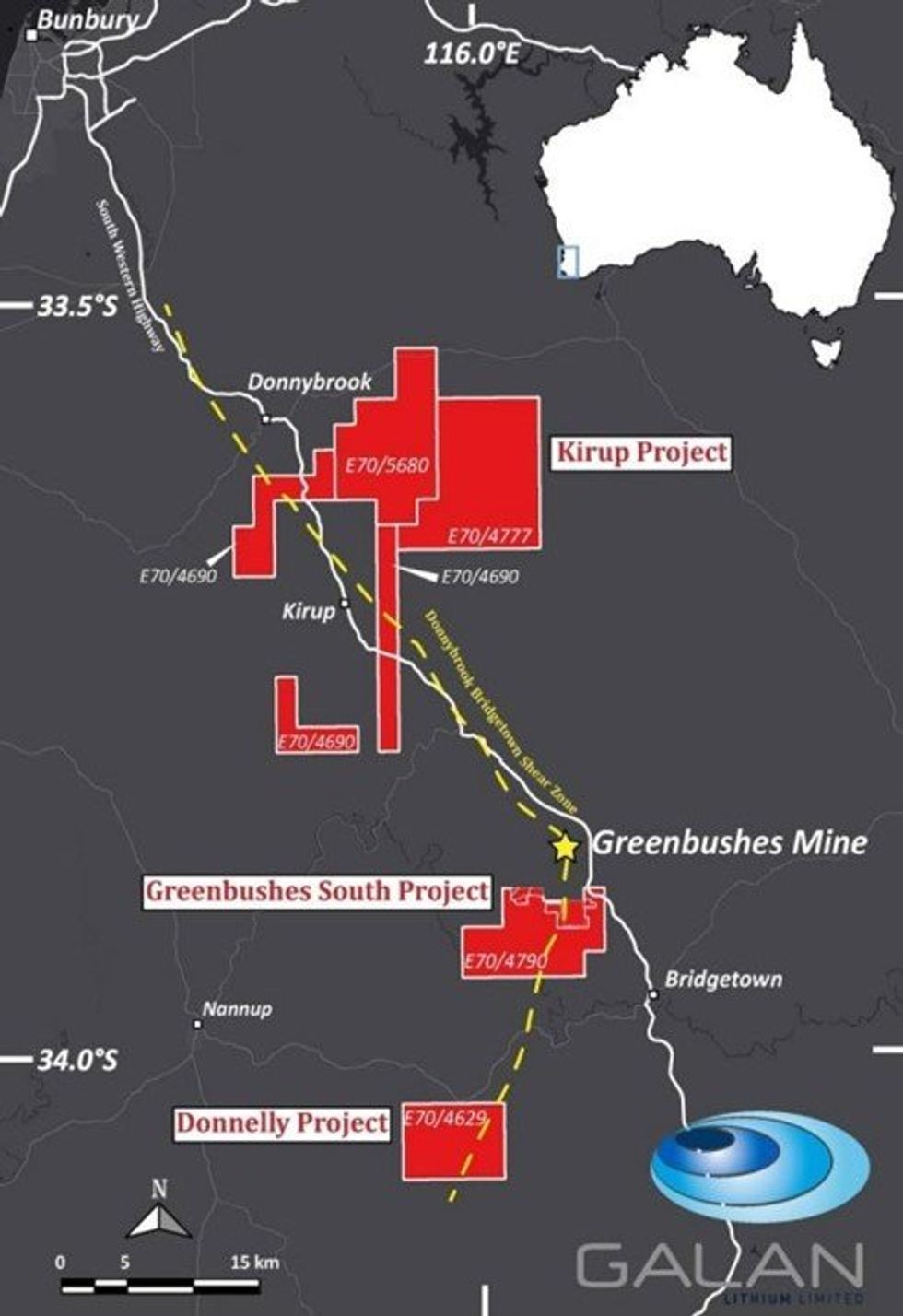

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to advise that the Program of Works (PoW) has been approved by the Department of Mines, Industry, Regulation and Safety (DMIRS) for the initial planned drilling activities at its 100%-owned Greenbushes South Lithium Project in Western Australia. Key Greenbushes South Project tenement, E70/4790, is located approximately 3 km south of the Greenbushes Lithium Mine (Figure 1).

Highlights:

- Program of Works (PoW) approved for maiden diamond drilling campaign at Greenbushes South Lithium Project in Western Australia.

- Drill pads built and ready, with drilling scheduled to commence this week.

- Key targets located only 4.5 km south of Greenbushes Mine open pit.

- Initial campaign of 2,500 metres set to test the first of several key targets identified within the project area.

- Further 550+ soil samples submitted to delineate new pegmatite targets within the project area.

- New ground geophysics underway over high trace element soil anomalies.

- Four large target areas identified over the Kirup Project to the north.

The initial campaign (approximately 2,500 metres drilling planned) is set to test the first of several key targets identified within the highly prospective Greenbushes South. Construction of requisite drill pads is complete and drilling is scheduled to commence on 1 March 2023.

Ground geophysics also commenced earlier this month on previously identified targets within E70/4790. These targets were defined by high concentrations of lithium and other trace elements in soil samples. The new ground geophysical results are expected later this quarter.

Additionally, a further approximately 550 soil samples have been collected and submitted for analysis. These soil samples were collected around the multiple new pegmatite outcrops identified across recent months and are expected to assist in targeting and delineating mineralisation beneath the subsurface.

The Kirup Project (E70/4777, E70/5680, and E70/4690) (Figure 2), located to the north of Greenbushes South, has undergone extensive target generation based on the processing of Galan’s aerial geophysics. Four (4) large target areas demonstrate strong prospectivity for blind lithium pegmatites. Field mapping and soil sampling are planned within these target areas.

Galan Managing Director, JP Vargas de la Vega, commented:

“Well done to the Galan team in advancing us to this exciting point. We look forward to testing our hypothesis, via this maiden drilling campaign, that significant lithium mineralisation exists south of the Greenbushes Mine. We are extremely encouraged by all data collected to date that demonstrates the strong potential for this to be the case. This includes having multiple observations of minerals associated with pegmatites only one metre below the sub-surface in the area we are about to drill.”

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00