September 11, 2024

GTI Energy Limited (ASX: GTR) (GTI or Company) is pleased to advise that a total of 66 mud rotary drill holes have now been completed at its 100% owned Lo Herma ISR Uranium Project (Lo Herma), located in Wyoming’s prolific Powder River Basin (Figures 1 & 2). GTI has now completed 13,405m (43,980 ft) of drilling at Lo Herma this summer representing ~87% of the planned 76-hole program.

HIGHLIGHTS

- GTI has now completed 66 resource estimate development drill holes of 76 planned at the Lo Herma ISR uranium project during the 2024 drill program

- Drilling to date confirms that uranium mineralisation continues north from the current mineral resource area with strong mineralised intercepts over good thicknesses encountered stretching at least 2km north along projected trends

- Best mineralised intercepts reported include 6.0ft at 0.123% (1,230ppm) eU308 in drill hole LH-24-028, and 11.0 ft at 0.054% (540ppm) eU308 in drill hole LH-24-063

This news release follows on from the Company’s 31 July 2024 news release which reported results from the first ten (10) drill holes of the 2024 drill program. The results from the next fifty- six (56) drill holes (Table 2) include several highlights:

- Drill hole LH-24-028 returned the highest-grade intercept at 6.0ft of 0.123% eU3O8, and a total hole grade thickness (GT) of 0.903*.

- 45 of 56 drill holes have intercepted on trend mineralisation.

- Mineralisation continues across multiple sandstone units as GTI expands the mineralised trends to the north, as demonstrated by drill hole LH-24-03 which encountered 11ft of 0.054% eU3O8 (0.594 GT) and 6.5ft of 0.043% eU3O8 (0.280 GT) from different sand units.

* Typical economically viable ISR grade and GT cut-offs are: 0.02% (200ppm) U3O8and 0.2GT i.e., 10 ft (3 m) @ .02% (200ppm) U3O8.

GTI Executive Director & CEO Bruce Lane commented “Drilling to date at Lo Herma has been very successful in demonstrating extensions of mineralisation, with strong GT numbers to the north of the project area and at depth in the sands of the lower Wasatch formation. Results so far give us great confidence that we can grow the global uranium resource estimate and upgrade a material portion to the indicated category. Drilling is currently running to schedule with operations now moved to the east of the project area to test for deeper mineralisation in the Fort Union formation. The sand units of the lower Wasatch formations are showing reliable continuity and mineralisation far along trend to the north so we are now excited to see what the deeper Fort Union formation sands may hold as we move to our final exploration area for this phase of drilling.”

LO HERMA URANIUM PROJECT – LOCATION & BACKGROUND

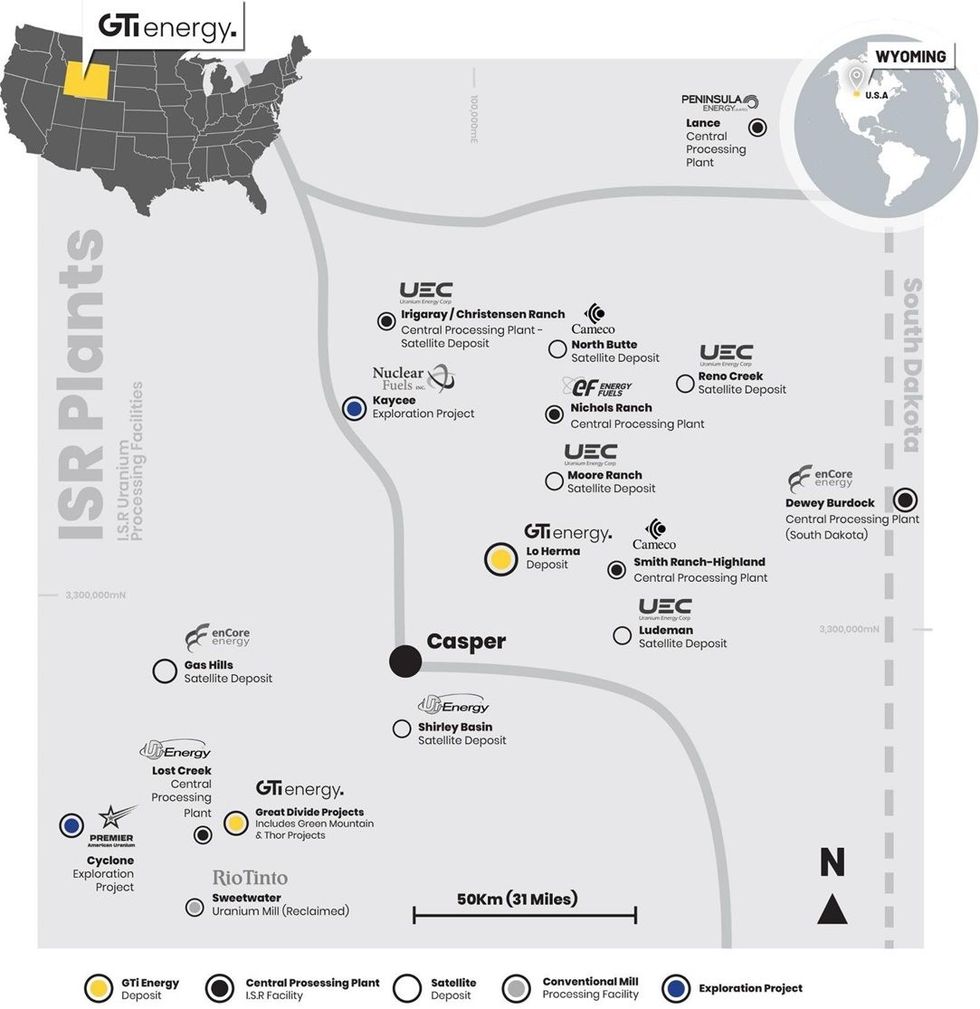

The Lo Herma ISR Uranium Project (Lo Herma) is located in Converse County, Powder River Basin (PRB), Wyoming (WY). The Project lies approximately 15 miles north of the town of Glenrock and close to seven (7) permitted ISR uranium production facilities. These facilities include UEC’s producing Willow Creek (Irigaray & Christensen Ranch) & idled Reno Creek ISR plants, Cameco’s idled Smith Ranch-Highland ISR facilities and Energy Fuels idled Nichols Ranch ISR plant (Figure 1).

The Powder River Basin has extensive ISR uranium production history with numerous defined ISR uranium resources, central processing plants (CPP) & satellite deposits (Figure 1). The Powder River Basin has been the backbone of Wyoming U3O8 production since the 1970s.

As reported to ASX on 14 March 2023, a comprehensive historical data package, with an estimated replacement value of ~$15m, was purchased for Lo Herma in March of 2023. The data package includes original drill data for roughly 1,771 drill holes, from the 1970’s and 1980’s, pertaining to the Lo Herma region. A total of 1,391 original drill hole logs were digitised for gamma count per second (CPS) data and converted to eU3O8% grades.

833 of these historical drill holes are located on GTI’s land position and were used to prepare the maiden MRE. 21 additional drill holes are located in an expanded area of additional claims that were subsequently staked across Section 4 of Township 36N, Range 75W. Along with the 26 drill holes completed in the initial 2023 drill program, GTI holds data from 880 drill holes within the current Lo Herma mineral holdings prior to the current 76 hole drill campaign.

An initial Exploration Target for the Lo Herma project was previously announced to the ASX on 4 April 2023. An additional data package, containing previously unavailable drill maps with geologically interpreted redox trends, was subsequently secured by GTI, as announced to the ASX on 27 June 2023 (refer to Table 1).

Whilst additional redox trends were interpolated based on the 2023 drilling and acquisition of the newly located mineral claims, the Exploration Target has not yet been updated. GTI plans to update the mineral resource and exploration target estimates following completion of the current 2024 drilling campaign.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00