May 25, 2022

Critical Resources Limited (ASX:CRR) (“Critical Resources” or the “Company”) is pleased to advise that it has received assay results from its 10th and 11th drill holes at its 100% owned Gibsons prospect. Diamond drill holes CRR21DD_04 (“Hole 04”) and CRR21DD_02 (“Hole 02”) have intersected further zinc, lead, copper, and silver bearing zones of sulphide mineralisation. Both Hole 04 and Hole 02 are step out holes that continue to demonstrate the potential of the mineralised extent of the Halls Peak system.

Highlights

Hole 04

- 6.91m @ 9.41% Zn, 2.45% Pb, 1.56% Cu, 34.6g/t Ag from 98.04-104.95m downhole

- Including 1.69m @ 13.82% Zn, 2.08% Pb, 4.26% Cu, 64.37g/t Ag from 103.26 – 104.95m downhole

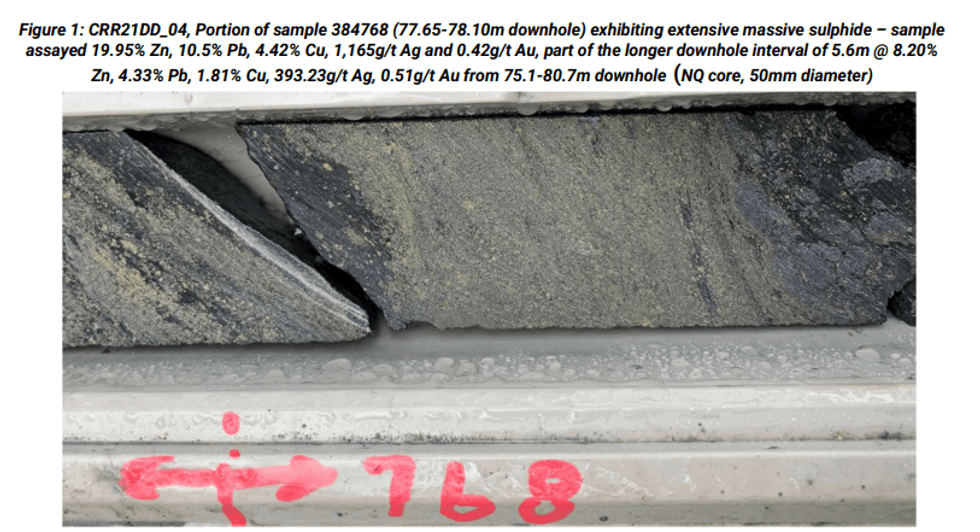

- 5.6m @ 8.20% Zn, 4.33% Pb, 1.81% Cu, 393.23g/t Ag, from 75.1-80.7m downhole

- Including 1.65m @ 14.79% Zn, 7.61% Pb, 3.17% Cu, 807.55g/t Ag from 77.05 – 78.7m downhole

- 4.9m @ 3.91% Zn, 1.24% Pb, 0.15% Cu, 8.55g/t Ag, from 58.60-63.5m downhole

Hole 02

- 17.75m @ 2.20% Zn, 1.28% Pb, 0.18% Cu, 19.34g/t Ag from 87.8-105.55m downhole

- Including 1.1m @ 7.45% Zn, 4.36% Pb, 0.67% Cu, 43g/t Ag from 90.3–91.4m downhole and

- Including 1.4m @ 10.4% Zn, 7.53% Pb, 0.48% Cu, 33.8g/t Ag from 99.6–101m downhole

- Previously untested areas continue to provide consistent mineralisation at depth

- Cores from completed holes 14, 15 and 16 are currently being assayed at the ALS laboratory in Brisbane with results expected progressively

The Company is pleased to receive further assays from Hole 02 and Hole 04 at its 100% owned Halls Peak project in New South Wales. Results continue to demonstrate the scale potential of the Halls Peak system, particularly at depth. Results continue to provide strong support for an expanded drill program.

Critical Resources Managing Director Alex Biggs said:

“We’re continuing to see some fantastic intersections at Gibsons that are demonstrating the potential of the Halls Peak system. Drilling is ongoing across multiple targets as we look to start to further define the potential scale at Halls Peak. The asset is shaping up as potentially transformational for the Company and we look forward to updating the market with more exciting results”.

Summary of Key Polymetallic Intersections

Hole 04

- 4.9m @ 3.91% Zn, 1.24% Pb, 0.15% Cu, 8.55g/t Ag, 0.04g/t Au, from 58.60-63.5m downhole

- 5.6m @ 8.20% Zn, 4.33% Pb, 1.81% Cu, 393.23g/t Ag, 0.51g/t Au from 75.1-80.7m downhole

- Including 1.65m @ 14.79% Zn, 7.61% Pb, 3.17% Cu, 807.55g/t Ag, 0.45g/t Au from 77.05 – 78.7m downhole

- 6.91m @ 9.41% Zn, 2.45% Pb, 1.56% Cu, 34.6g/t Ag, 0.23g/t Au from 98.04-104.95m downhole

- Including 1.69m @ 13.82% Zn, 2.08% Pb, 4.26% Cu, 64.37g/t Ag, 0.37g/t Au from 103.26 – 104.95m downhole

Hole 02

- 17.75m @ 2.20% Zn, 1.28% Pb, 0.18% Cu, 19.34g/t Ag, 0.09g/t Au from 87.8-105.55m downhole

- Including 1.1m @ 7.45% Zn, 4.36% Pb, 0.67% Cu, 43g/t Ag, 0.24g/t Au from 90.3– 91.4m downhole and

- 1.4m @ 10.4% Zn, 7.53% Pb, 0.48% Cu, 33.8g/t Ag, 0.14g/t Au from 99.6–101m downhole

Click here for the full ASX Release

This article includes content from Critical Resources (ASX:CRR), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRR:AU

The Conversation (0)

21 June 2022

Critical Resources

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00