December 02, 2021

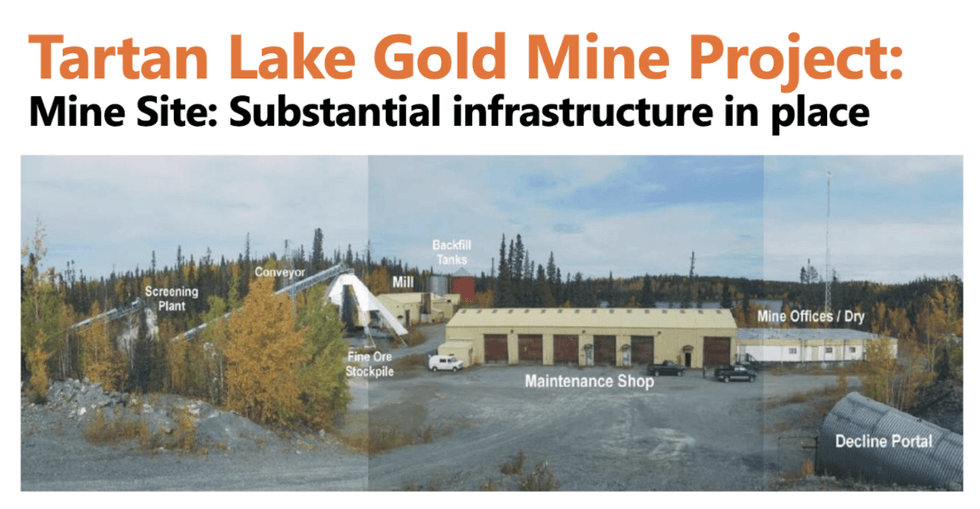

Satori Resources (TSXV:BUD) redevelops past-producing mines to have a quicker path to production by leveraging existing infrastructure, workforce and historical data. Its flagship project is the 100 percent owned Tartan Lake Gold project near Flin Flon, Manitoba. The past-producing Tartan Lake Gold Mine was operational from 1986 to 1989 but was shut down when the price of gold fell below $400 per ounce in 1989.

The Flin Flon Snow Lake Greenstone Belt, home of the Tartan Lake Gold project, is considered one of the largest and most prolific greenstone belts in the world. Greenstone belts are unique geologic features that can contain numerous minerals, such as copper, silver and zinc. More importantly, there is a strong presence of gold deposits in greenstone belts. The Tartan Lake Gold project contains 20 mineral claims across 2,670 hectares, and produced 47,000 oz of gold from 1987 to 1989.

Satori Resources' Company Highlights

- Satori's July 2021 drilling campaign extended the Main Zone over 200 metres down plunge, evidencing that mineralization remains open at depth, along plunge.

- The grade and thickness of the mineralization in certain holes drilled in the summer of 2021 are not only consistent with the historical drill results but are also comparable with results currently being reported at some of Canada's most exciting gold discoveries in Red Lake and Newfoundland.

- Satori drilled longest and highest grade interval at the South Zone, averaging 9.59 g/t Au over 11.75 metres, and Main Zone returned 9.73 g/t Au over 4.15 metres.

- For the first time in decades this project is benefitting from a new team applying modern day techniques in a robust gold environment. The entire project area has been overlooked for decades and is sparsely-drilled.

- During fall 2021 ground reconnaissance program investigating remote showings, the low water levels exposed significant outcrop along the shoreline of Batters Lake, exposing extensive zones of shearing with favourable quartz-carbonate-tourmaline veining and sulphide mineralization similar to what is observed at the Main and South Zones.

- Satori Resources holds a 100 percent interest in the Tartan Lake Gold project (subject to a 2% NSR interest with a buy-back right) which includes a 450 mt/day processing plant.

- The Tartan Lake Gold project sits upon one of the largest greenstone belts on the planet, a geologic feature that is known for containing gold

- The project has existing infrastructure that will reduce the time and resources required to become operational

- Previous operations in the Tartan Lake Gold Mine produced 47,000 ounces of gold between 1987 and 1989

- Satori Resources is operated by a strong management team

Click here to connect with Satori Resources (TSXV:BUD) to receive an Investor Presentation

BUD:CA

The Conversation (0)

04 October 2019

Canadian Gold

Developing the Past-Producing Tartan Lake Gold Mine Near Flin Flon, Manitoba

Developing the Past-Producing Tartan Lake Gold Mine Near Flin Flon, Manitoba Keep Reading...

20h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

22h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00