May 24, 2022

Impact Minerals Limited (ASX:IPT) is pleased to provide an update on the company’s recent activities across its extensive portfolio of exploration projects in Western Australia.

- Diamond drill programme completed at Hopetoun: target shear zone intersected 60 metres up dip.

- First pass soil geochemistry surveys completed over priority targets at Hopetoun.

- Airborne EM survey completed over priority targets at the Arkun-Beau Ni-Cu-PGM Project.

- Soil geochemistry surveys completed at Beau and in progress at four other priority targets at Arkun following successful land access negotiations.

- Drill assay results awaited at Doonia.

- Negotiations in progress for the Commonwealth and Broken Hill projects in NSW.

- Renounceable rights issue to close on Friday 27th May 2022.

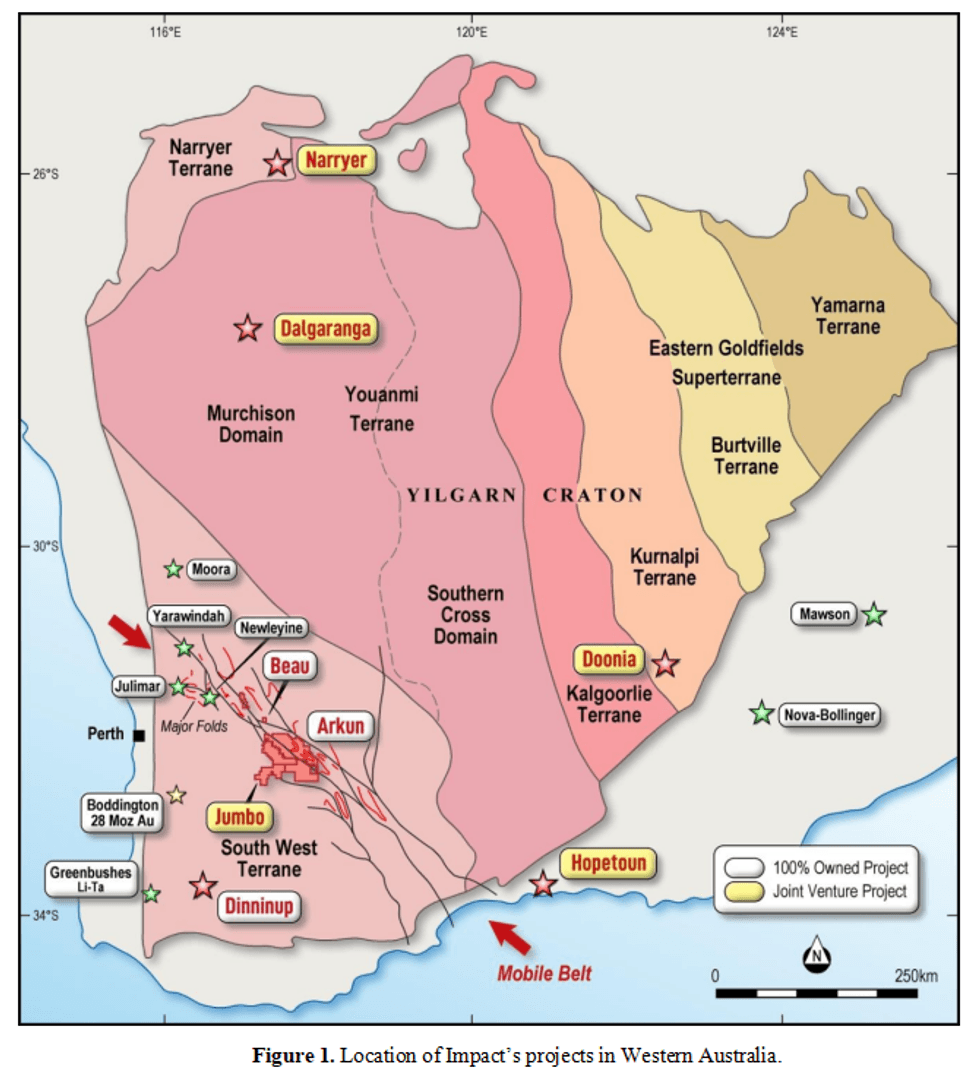

This work is part of the Company’s change in strategic focus from eastern Australia to the emerging mineral province of south west Western Australia following the recent Julimar PGE-Ni-Cu discovery (ASC:CHN) and also home to the world class Greenbushes lithium-tantalum mine (ASX:IGO and Figure 1).

Impact has assembled a significant number of projects in this highly prospective region, both 100% owned, (Arkun-Beau and Dinninup) and in joint venture (Hopetoun, Jumbo, Narryer and Dalgaranga). In addition, the company is in a joint venture at the Doonia gold project near Kambalda where drill results are awaited (Figure 1).

Current work programmes are aimed at defining drill targets at the flagship Arkun-Beau project and progressing with drill targets already defined at Hopetoun. The other projects are also being progressed via compilations of previous work and preliminary interpretations of the surface and bedrock geology with a view to identifying areas of interest for on-ground follow up exploration.

Funds from the current Renounceable Rights Issue, which closes this Friday, the 27th May 2022, will be used to fund this work which will include extensive drill programmes later in the year and into 2023.

Shareholders who still wish to participate and who have not yet received their entitlement forms, or who are unsure of the process to follow to apply for their entitlement, should contact the Impact office.

HOPETOUN

At Hopetoun, where Impact is earning an 80% interest in the project (ASX Release 8th December 2021), six drill ready targets have been identified of which two, the Top Knotch and Silverstar copper-gold-silver prospects, are fully permitted for drill testing. Four diamond drill holes, two each at Top Knotch and Silverstar were recently completed (ASX Releases 19th April 2022 and 22nd April 2022).

At Silverstar, a second drill hole was recently completed to test the up-dip extension of a 25 metre thick (true width) shear zone with extensive alteration minerals and minor disseminated chalcopyrite-pyrrhotite mineralisation (ASX Release 22nd April 2022).

The second drill hole intersected the same shear zone at about 180 metres down hole and 60 metres up dip from the first hole. The shear zone is of a similar thickness and appearance in the second hole but in addition, one narrow zone of deformed quartz veins about 25 cm thick was intersected at 190 metres down hole which contains up to 5% molybdenite together with anomalous bismuth values up to 250 ppm as measured with a handheld XRF instrument (Figure 2).

The Company emphasises that these estimates are based on visual observations only and that chemical assays will be required to determine the absolute amounts of any metals present. The core is being transported to Perth where it will be logged and sampled in detail. Assays are expected in July.

Click here for the full ASX Release

This article includes content from Impact Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

9h

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

9h

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

9h

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

15h

Winston Tailings: Traxys Letter of Interest Signed

Panther Metals PLC (LSE: PALM), an exploration company focused on mineral projects in Canada, is pleased to announce that it has signed a letter of interest ("LOI") with Traxys Europe SA, a division of Traxys Group ("Traxys"), a global commodity trading and marketing market leader.The... Keep Reading...

16h

Selta Project - Exploration Update

Rare-Earth Element Stream Sediment Sampling Results and Target Refinement

First Development Resources plc (AIM: FDR), the UK-based, Australia-focused exploration company with mineral interests in Western Australia and the Northern Territory, is pleased to provide results and interpretation from the December 2025 stream sediment sampling programme completed at its... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00