Precious and Base Metal Exploration in the USA

Overview

Northern Lights Resources Corp. (CSE:NLR) is a growth-oriented exploration and development company with promising projects in Nevada and Arizona.

In Arizona, Northern Lights Resources owns 100 percent of the Secret Pass gold project. Secret Pass is located 15 kilometers north of the historic Oatman gold mining district in northwest Arizona that produced 2 million ounces of gold between 1892 and 1940 at an average gold grade of over 15 g/t.

Over the last several years, the area has been rediscovered with several gold exploration and production projects active. Producing gold projects in the area include the Northern Vertex Corp.’s (TSXV:NEE) Moss mine, which is an open-pit heap leach operation, as well as the Gold Roads underground mine operated by Aura Minerals (TSX:ORA).

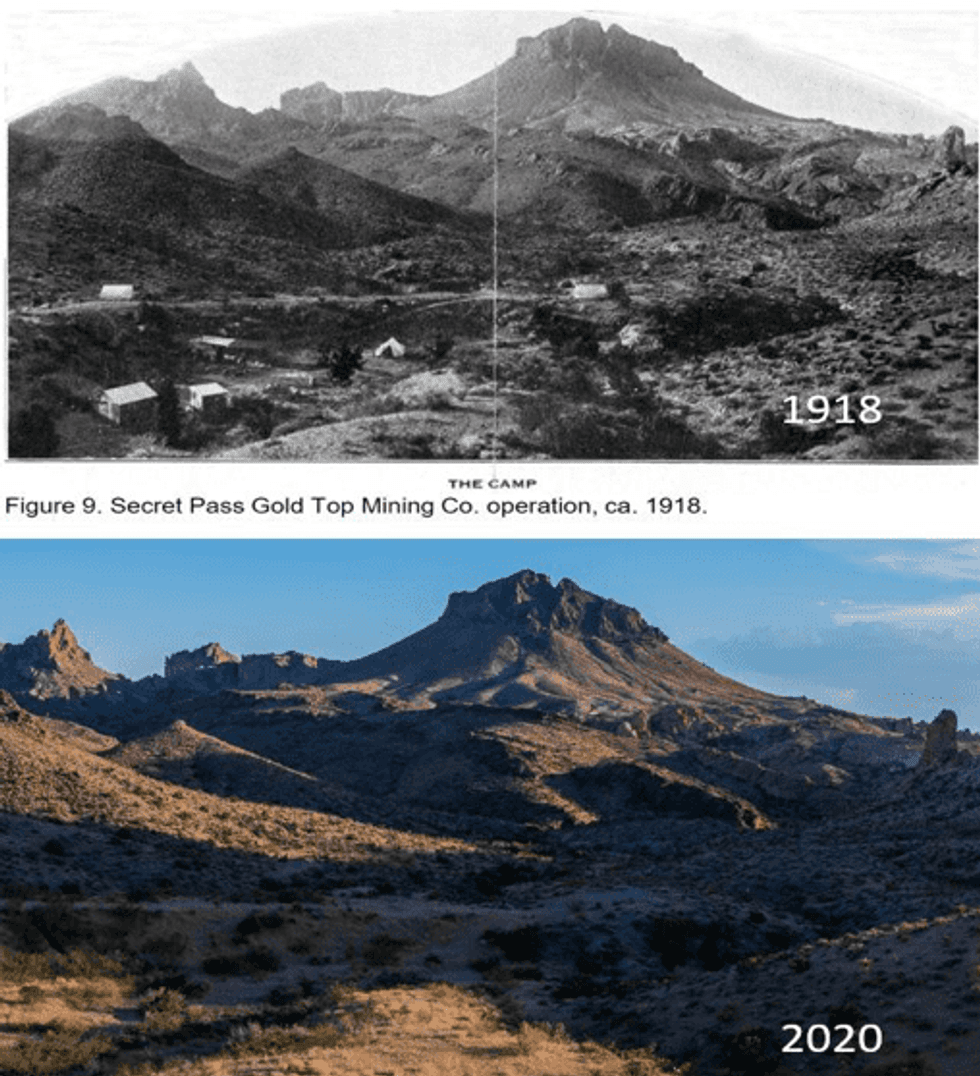

The Tin Cup mine at Secret Pass operated from the early 1900s to approximately 1930.

Exploration drilling completed at Tin Cup from 1984 to 1991 by Santa Fe Gold and other companies intersected high-grade gold mineralization from near-surface to a depth of approximately 180 meters. The average depth of the 145 historic holes completed on the Secret Pass property was 95 meters. Assay results from the historic drilling at Tin Cup ranged up to 40 g/t Au.

Prior to ownership by Northern Lights, exploration on the Secret Pass Gold Project was limited to the Tin Cup and FM zones that represent only 10 percent of the total project area. Ninety percent of the claim area has never been explored by modern methods and technology. There are over 20 historic workings that have been identified on the Secret Pass claim area.

Exploration work completed by Northern Lights during 2020 has identified significant potential for high-grade gold mineralization at the Tin Cup and FM zones plus the newly identified Fiery Squid zone as well as 20 additional targets based on field work and aeromagnetic and IP geophysical survey results.

The Secret Pass Gold Project is a promising gold exploration property with no production royalty NSR allowing NLR shareholders potentially significant exploration upside.

Northern Lights Resources’ second strategic property is the Medicine Springs silver, lead and zinc project located in Elko County in North Eastern Nevada.

The Medicine Springs project comprises 149 unpatented Federal mineral claims covering 1,189 hectares located in the Ruby Mountains Valley just off the famous Carlin Trend. The Medicine Springs project has the potential to host a large scale high grade silver-zinc-lead Carbonate Replacement Deposit (CRD) deposit.

On October 5, 2020, Northern Lights announced a Option and Joint Venture Agreement with Reyna Silver Corp. (TSXV:RSLV) on the Medicine Springs silver project.

Under the terms of the Agreement, Reyna Silver can earn up to 80 percent equity in the Medicine Springs Project by completing minimum exploration expenditures of US$2.4 million plus other commitments and paying a cash payment of US$1 million to Northern Lights by no later than December 31, 2023. Northern Lights has a free carry (with no future repayment) until Reyna Silver has spent US$4 million on exploration on the project.

Dr. Peter Megaw, Technical Advisor to Reyna Silver, commented: “Medicine Springs ticks the most important boxes we look for in CRD exploration including location on a large regional structure that hosts significant CRDs, situated at the top or a thick section of potentially favorable carbonate host rocks and evidence of high silver grades. Some of the dump and rock chip samples run well over our 400 g/t (12 oz/t) silver threshold and it is quite likely that similar grades were diluted by the Reverse Circulation drilling used historically in the district. We will be drilling core to get a true picture of the clearly structurally-controlled mineralization as we trace it towards its source.”

Northern Lights Resources’ management team and insiders, currently own a 30 percent stake in the company. Led by an experienced board with strong capital markets and project development expertise. Northern Lights Resources is well financed, no debt and will shortly be drilling on both properties.

Company Highlights

- Successfully closed a non-brokered private placement of $2.1 million in September 2020

- Debt free with over $1.5 million of cash to progress exploration on Secret Pass

- Both projects are situated in mining-friendly jurisdictions in the US.

- Both projects are drill ready.

- Signed Option/Joint Venture agreement with Reyna Silver to acquire up to 80 percent of the Medicine Springs property, allowing Northern Lights Resources to focus on Secret Pass and future possible property acquisitions

- Potential for high-grade silver and large scale CRD silver zinc lead deposit at Medicine Springs.

- Significant exploration upside potential with drilling to begin on Secret Pass

- Strong, experienced management team and board.

Get access to more exclusive Graphite Investing Stock profiles here