October 28, 2024

Condor Energy Limited (ASX: CND) (Condor or the Company) is pleased to provide the following report on exploration activities for the quarter ending 30 September 2024.

Highlights

- Condor Energy Ltd (ASX: CND) (Condor or the Company) is pleased to advise that Mr Serge Hayon has been appointed as Managing Director of the Company effective from the 1st of October 2024.

- Significant new oil targets identified from fast-track interpretation of the 3,800km2 of legacy 3D seismic data.

- The Salmon Lead exhibits stacked structural traps with potential Direct Hydrocarbon Indicators (DHIs). It Offers several follow-on targets if successful, with a repeated structural configuration.

- Successfully reprocessed 1,000 km2 of legacy 3D seismic data across three leading prospects, providing enhanced insights into prospectivity that will guide our ongoing interpretation and resource estimation efforts.

- New seismic inversion and AVO studies have produced indications of high-quality reservoirs and hydrocarbon fill at the Raya Prospect, significantly upgrading its prospectivity.

Technical Evaluation Agreement (TEA) LXXXVI - Offshore Oil and Gas Block (CND 80% Working Interest)

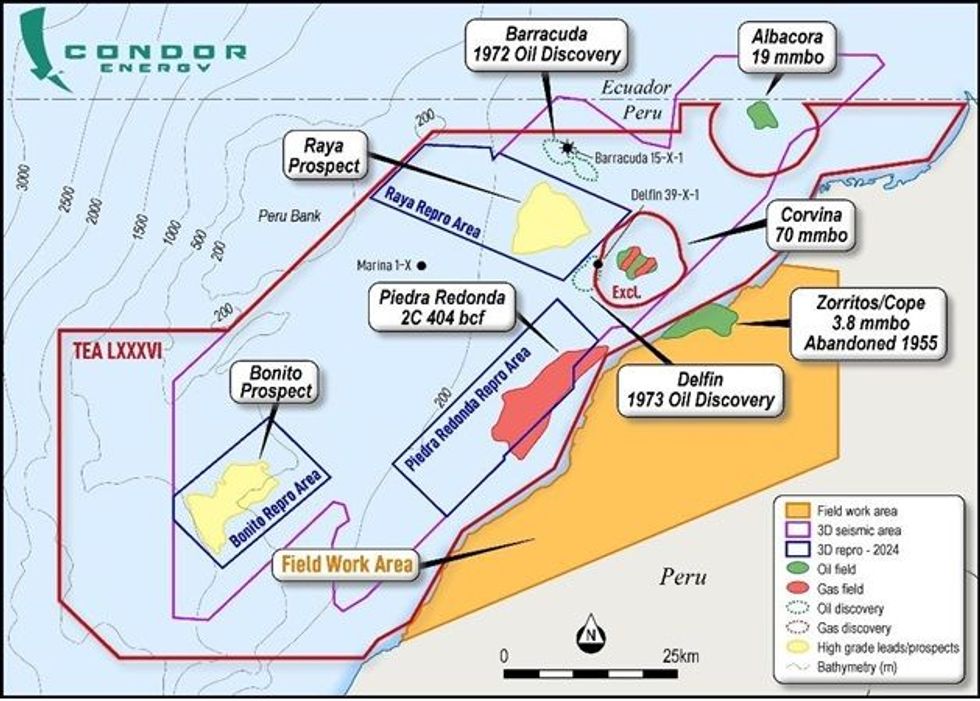

During the reporting quarter, Condor and US-based joint venture partner Jaguar Exploration Limited (Jaguar), continued the evaluation of the 4,858km2 Technical Evaluation Agreement (TEA or block) offshore Peru in conjunction with the Company’s technical advisors Havoc Services Pty Ltd (Havoc).

Condor’s block comprises over 3,800km2 of existing 3D seismic data from which an aggregate of 1,000km2 have been selected to undergo pre-stack depth migration (PSDM) reprocessing and interpretation across three discrete highly prospective areas (Figure 1). The three areas selected for reprocessing were chosen following the identification of the Raya and Bonito prospects and the Piedra Redonda gas field.

The Raya1 and Bonito2 prospects are large features in the Zorritos Formation, which present structural closure at multiple levels and the potential for stacked pay with multiple Zorritos reservoir-seal pairs present. The Piedra Redonda gas field contains ‘Best Estimate’ Contingent Resources (2C) of 404 Bcf (100% gross)3 which potentially underpins a standalone gas development and additional low-risk upside located updip from the C-18X discovery well with ‘Best Estimate’ Prospective Resources (2U) of 2.2 Tcf# (gross unrisked) of natural gas4.

Click here for the full ASX Release

This article includes content from Condor Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CND:AU

The Conversation (0)

26 September 2024

Condor Energy

Rare world-class hydrocarbon exploration opportunity

Rare world-class hydrocarbon exploration opportunity Keep Reading...

29 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Condor Energy (CND:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

22 January 2025

A$3M Placement to Advance High-Impact Workplan for Peru

Condor Energy (CND:AU) has announced A$3M Placement to Advance High-Impact Workplan for PeruDownload the PDF here. Keep Reading...

20 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

15 January 2025

Piedra Redonda Gas Field Best Estimate Resource of 1 Tcf

Condor Energy (CND:AU) has announced Piedra Redonda Gas Field Best Estimate Resource of 1 TcfDownload the PDF here. Keep Reading...

13 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

3h

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel, and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00