- WORLD EDITIONAustraliaNorth AmericaWorld

Top 5 ASX Nickel Stocks

Overview

Electric vehicles (EVs) are poised to explode in popularity in the next decade and beyond. In fact, EV sales are forecasted to reach an astonishing 48 percent of all new cars sold in 2030, a massive increase from the 5 percent in 2020. But reaching these targets, and manufacturing the batteries needed to support it, will require a large amount of nickel and lithium.

Nickel is used in manufacturing cathode components that are required for high-quality lithium-ion batteries. Most of the world’s nickel is used to produce stainless steel, creating plenty of demand for the mineral already. Now, nickel sulfide is needed to make high-capacity lithium batteries that will power EVs of the future. Only 49 percent of the world’s nickel can be used for this purpose, which means one thing: the world needs more nickel and preferably nickel sulfides.

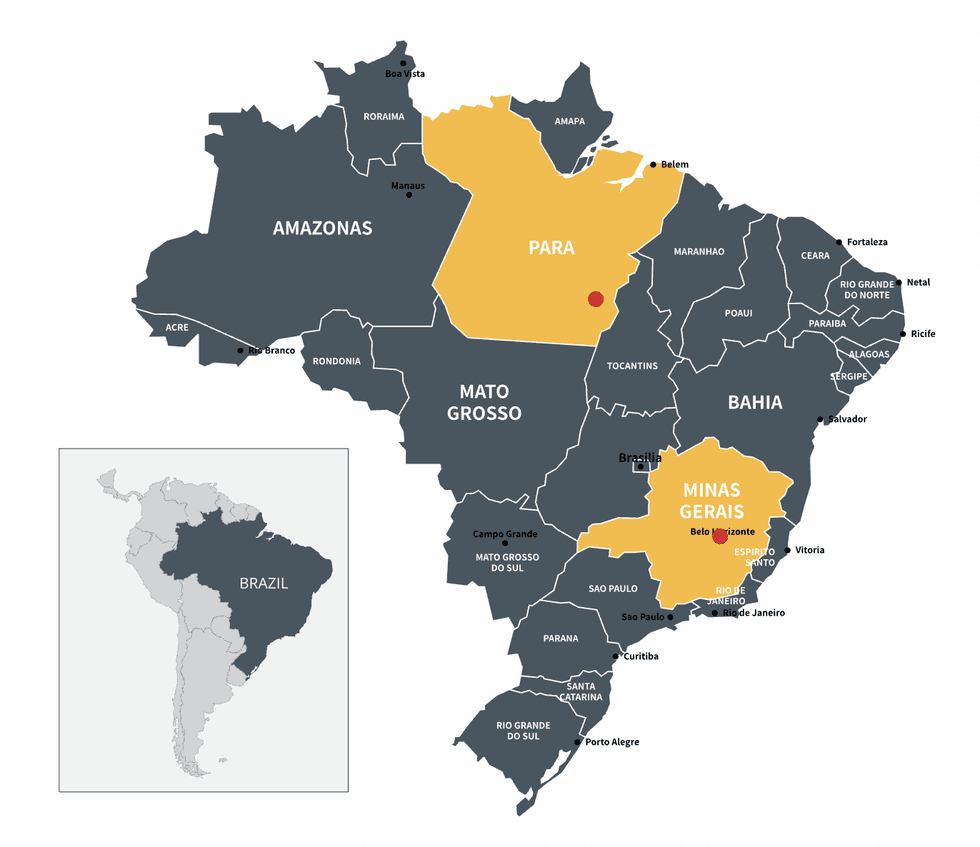

Centaurus Metals (ASX:CTM,OTCQX:CTTZF) is a mineral exploration company listed in Australia but focused on the near-term production of a nickel sulfide project in Brazil. The Company’s goal is to have a nickel sulfide-producing mine by the end of 2024 to answer the increasing demand for the mineral in the production of lithium-ion batteries. Centaurus Metals is operated by a strong management team with decades of experience in nickel and the Brazil operating environment, creating confidence in its ability to deliver a +20,000tpa nickel production base and with this become a Top-10 nickel sulphide producer globally.

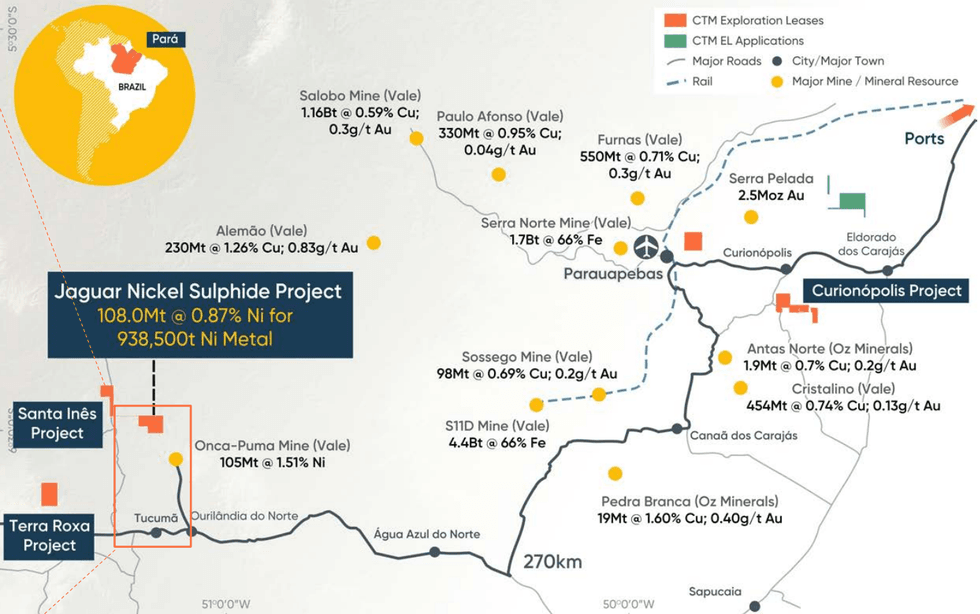

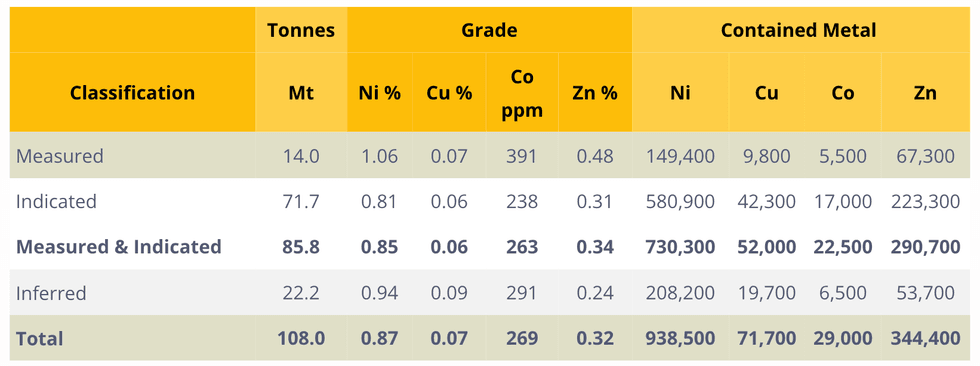

The Jaguar Nickel Sulphide Project is the company’s flagship project and is located in a world-class mining region in Brazil known as Carajás Mineral Province. Centaurus Metals formally completed the acquisition of the asset in 2020 and delivered its maiden Mineral Resource Estimate later that year. Two Mineral Resource updates were delivered in 2021 with the most recent being a massive 80.6Mt at 0.91 percent Ni for 730,700 tonnes of contained nickel metal. In 2022, the company released another mineral resource estimate comprising 108.0Mt @ 0.87 percent Ni for 938,500 tonnes of contained nickel. This is one of the largest nickel sulphide resources held by an ASX-listed company and the largest outside of the majors. Strong presence of high-grade nickel sulfide means that Centaurus Metals has the potential to become a Class-1 nickel producer.

Darren Gordon, CEO, recently said in an interview that, “We really like nickel as a commodity of the future, particularly nickel sulfide, and we have some guys on our team who have seen the opportunities when nickel runs really hard and you get the opportunity to leverage some of that value.”

The management team behind Centaurus Metals brings decades of experience that creates confidence in their ability to develop the Jaguar project into a world-class nickel sulfide mine. Managing Director, Darren Gordon, has over 25 years of experience working in the mining industry as a finance and resource executive. Executive Director and Brazil Country Manager, Bruno Scarpelli, has over 20 years’ experience in Brazil with a strong focus on ESG and Environmental approvals. John Westdorp, CFO, brings 30 years of financial and management experience specific to the mining industry. Roger Fitzhardinge, General Manager of Exploration and Growth, is a geologist with over 20 years of experience who lived in Brazil for over 10 years and recently appointed, Wayne Foote, General Manager of Operations has over 30 years’ experience managing operations throughout the mining industry globally.

Company Highlights

- The Jaguar Nickel Sulphide Project is the company’s flagship asset and historical and new survey results indicate the presence of high-grade nickel sulfide

- Its 2022 JORC Mineral Resource Estimate indicates that the project contains 108.0Mt at 0.87 percent Ni for 938,500 tonnes of contained nickel metal.

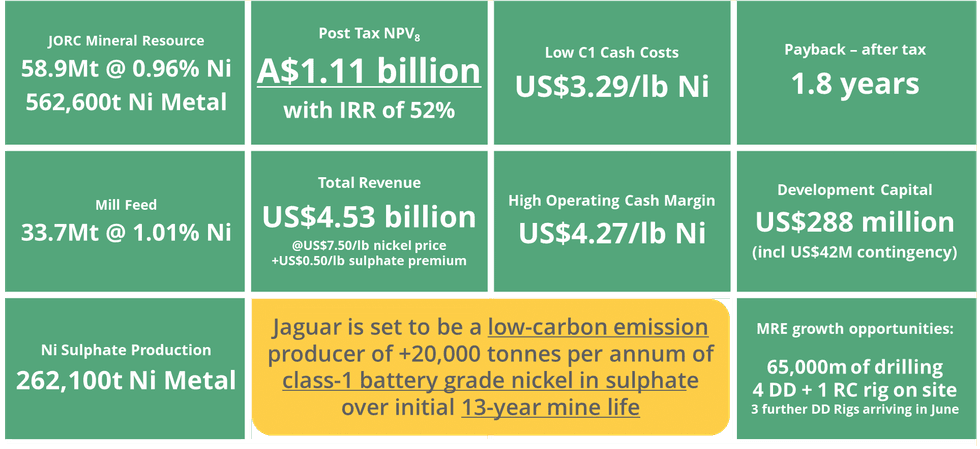

- Scoping Study work completed in May 2021 demonstrates the potential to become a Class-1 nickel producer.

- At conservative nickel price of US$7.50/lb and sulphate premium of only US$0.50/lb, the Scoping Study showed that by producing +20,000 tonnes of nickel in sulphate over an initial mine life of 13 years, the project could generate cash flows in the order of US$200m per annum and had a post-tax NPV of A$1.1 billion and IRR of 52%.

- These NPV increases to over A$2.2 billion with an IRR of 89 percent at a nickel price of US$10.00/lb.

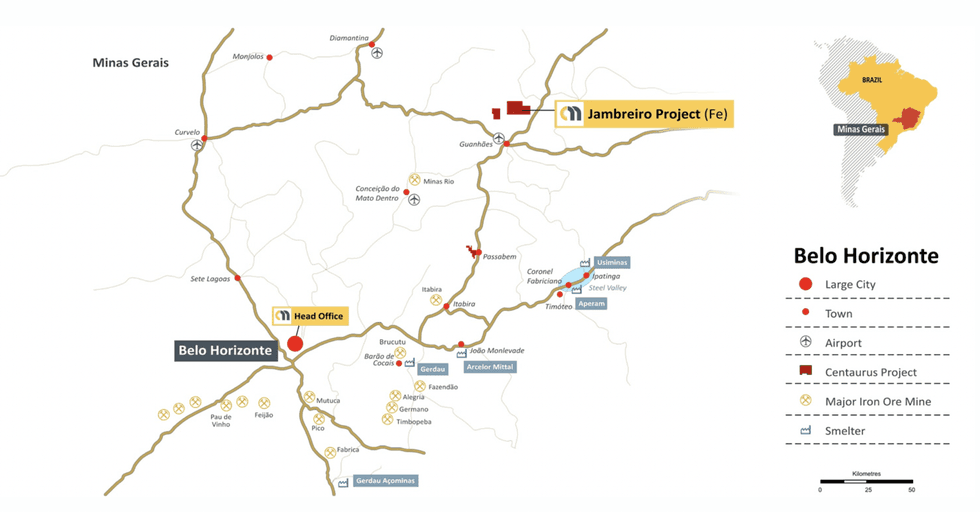

- The company also operates the Jambreiro Iron Ore Project in Brazil, which helped establish a foothold in the country.

- An updated Pre-Feasibility Study on Jambreiro outlined a 1Mtpa start-up project capable of generating life-of-mine revenues of A$1.08 billion and EBITDA of A$647 million over its initial 18-year life.

- A strong management team with applicable experience in developing mining assets in Brazil and nickel means they have the potential to create a highly productive asset at Jaguar.

Key Projects

Jaguar Nickel Sulphide Project

The company’s flagship project spans 30 square kilometres and contains multiple nickel sulfide deposits. The December 2021 JORC Mineral Resource Estimate indicates that the project contains 80.6Mt at 0.91 percent Ni for 730,700 tonnes of contained nickel metal. Additionally, approximately 500,000 tonnes of the project’s contained nickel are located within 200 meters of the surface, which allows open pit mining from the start of the project. Subsequent resource estimate in 2022 included 108.0Mt @ 0.87 percent Ni for 938,500 tonnes of contained nickel. This is one of the largest nickel sulphide resources held by an ASX-listed company and the largest outside of the majors.

Jaguar Nickel Sulphide Project – JORC Mineral Resource Estimate

A Base Case Scoping Study at the end of March 2021, for the production of a nickel concentrate at the project (using conservative revenue assumptions), indicated that the project has the potential to become a sustainable, long-term, low-cost producer of nickel sulfide. The report also indicated the project will generate strong financial returns and create jobs for surrounding communities.

A Value-Add Scoping Study on the Jaguar Project for the production of nickel sulphate followed in May 2021, demonstrating exceptional economic outcomes and that downstream processing adds significant value to the project. Centaurus Managing Director Darren Gordon shared that, “By further processing our nickel concentrate to a sulphate product on site at Jaguar, the project NPV increases by over 80 percent to approximately A$1.1 billion with an IRR of 52% using a very conservative nickel price of only US$7.50/lb - an outstanding result from a truly global-scale project."

Centaurus Metals was encouraged by the positive scoping studies and commenced a Definitive Feasibility Study based on producing 20,000 tonnes of nickel sulfide per year. Currently, multiple major drilling efforts are being carried out throughout the project area to prepare for further development.

With higher nickel prices expected over the coming years as the push for electrification of industry occurs and the growing resource base, Centaurus expected these exceptional economics will only further improve

Jambreiro Iron Ore Project

Centaurus Metals has 100 percent ownership over this advanced development opportunity. Survey reports have indicated the potential of 3mtpa of iron ore production. Additionally, Brazil has a domestic iron market with a premium on high-grade 65% percent iron.

The company completed a Pre-Feasibility Study (PFS) on the project in 2019 and updated it in 2020. The PFS outlined a 1Mtpa start-up project capable of generating life-of-mine revenues of A$1.08 billion and EBITDA of A$647 million over its initial 18-year life.

The Company is investigating value realisation strategies for the project given Jaguar is currently the company’s primary focus.

Management Team

Darren Gordon - Managing Director and Chief Executive Officer

Darren Gordon is a Chartered Accountant with 25 years’ experience in the mining industry as a senior finance and resources executive. Mr Gordon has had extensive involvement in financing resource projects from both a debt and equity perspective, including his previous position as Chief Financial Officer for Gindalbie Metals Limited. Mr Gordon has over 12 years’ experience operating in Brazil and as a result has a deep understanding of the regulatory framework and general operating environment required to develop a mining project in-country.

Bruno Scarpelli - Executive Director and Brazil Country Manager

Bruno Scarpelli is based in the Company’s Brazil office and manages the day-to-day activities of the Brazilian based team. He joined Centaurus in 2011 bringing a wealth of stakeholder relations and regulatory approval experience to the Company, particularly in the field of environmental matters, health and safety and human resources. Prior to joining Centaurus, Mr Scarpelli was the Environmental Coordinator of the S11D Iron Ore Project, part of the world class Carajás Iron Ore Operations in the State of Para, Brazil. Mr Scarpelli has also previously held a number of roles in Minas Gerais, including with the leading environmental consulting group, Brandt Meio Ambiente, and the global mining consultancy, Golder Associates.

Wayne Foote - General Manager of Operations

Wayne Foote is a Mining Engineer with over 30 years’ experience in the mining industry. He has extensive operational experience in a number of senior executive roles both in Australia and overseas, including more than two years living in Brazil, and brings a strong skill-set in building and leading effective, disciplined teams. Previous operational roles have included General Manager – Major Projects with Wiluna Mining Corporation, Project Manager for Echo Resources, Senior Vice President – Operations with TSX-listed Endeavour Mining Corporation, General Manager – Operations with Gold Road Resources, Project Manager with Crusader Resources working in Brazil and General Manager (Operations) with CGA Mining.

Wayne currently resides in Perth leading the team undertaking the Definitive Feasibility Study (DFS) on the Jaguar Project, but will return to Brazil as the Project moves into construction and operations.

John Westdorp - Chief Financial Officer and Company Secretary

John Westdorp is a Certified Practicing Accountant with over 30 years’ experience in the resources sector, including roles as Chief Financial Officer and Interim Chief Executive Officer of mineral sands producer, MZI Resources Ltd. Westdorp has held senior roles with Murchison Metals Ltd and Burrup Fertilisers Pty Ltd and has financial, commercial and operations experience across a number of commodities including iron ore, gold base metals and mineral sands.

Roger Fitzhardinge - General Manager of Exploration and Growth

Roger Fitzhardinge is a geologist with more than 20 years’ experience in the exploration and mining industry. Mr Fitzhardinge joined Centaurus in 2010, initially as Exploration Manager and now as Operations Manager - Nickel. He manages all development activities for the Jaguar Nickel Sulphide Project, located in the Carajás Mineral Province of northern Brazil. Before joining Centaurus, Mr Fitzhardinge worked with Mirabela Nickel Ltd in Brazil as Manager of Technical Services. He has previously worked in gold exploration in the Yilgarn with Normandy (now Newmont) and Homestake (now Barrick) as well as BHP's iron ore operations in the Pilbara region. Mr Fitzhardinge lived in Brazil for 11 years and is fluent in Portuguese.