January 10, 2023

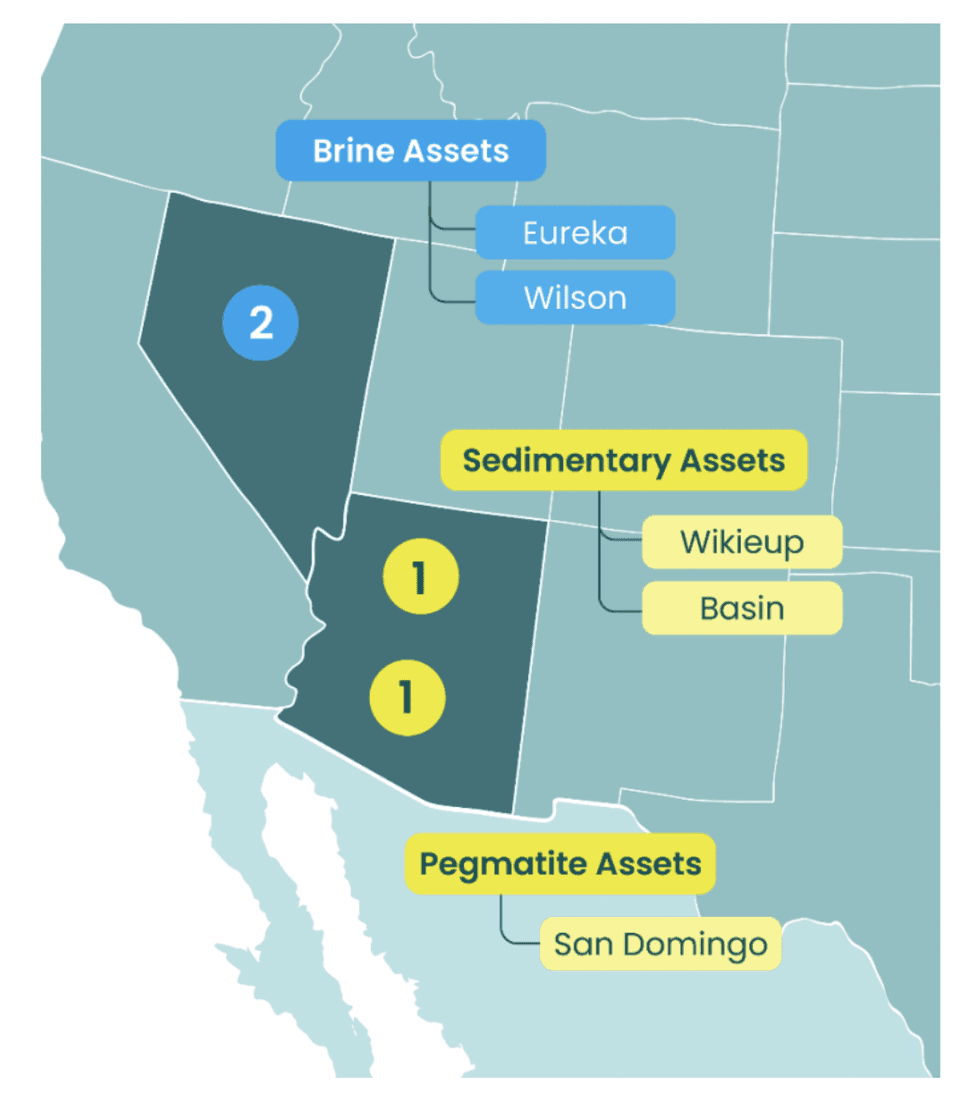

Bradda Head Lithium (AIM:BHL, TSXV:BHLI, OTCQB:BHLIF) is exploring and developing lithium assets in Arizona and Nevada in the United States, both Tier-1 mining jurisdictions. The company’s 100-percent-owned assets include all three types of lithium deposits and are near highly prolific operations. Bradda Head’s presence within the US and its potential to serve the growing demand for lithium creates significant potential for the company to become a major supplier of low-carbon lithium.

The company’s assets span all three types of lithium deposits: brine, clay (sedimentary) and hard rock (pegmatite). This project diversity gives Bradda Head a unique position with the capability to benefit from the strengths of each deposit type.

Company Highlights

- Bradda Head Lithium is an exploration and development mining company with 100 percent owned assets in Arizona and Nevada, both Tier-1 mining jurisdictions.

- The company’s presence within the United States allows them to serve the growing need for domestic lithium as clean technologies become more prominent and significant to the country’s future goals.

- The company’s asset portfolio includes all three types of lithium deposits: brine, clay (sedimentary) and hard rock (pegmatite), allowing the company to benefit from the strengths of each deposit type.

- Bradda Head’s operations are near known prolific deposits, indicating the discovery potential of its portfolio.

- One of the company’s flagship assets, the San Domingo project in Arizona, is currently undergoing exploratory drilling and assays will be made available soon.

- Bradda Head Lithium is dedicated to maintaining a solid ESG rating throughout the exploration and development of its assets by prioritizing sustainability and cultural sensitivity at every step.

- An experienced management team with a track record of success leads the company toward its goals of fully developing its assets and serving the emerging domestic lithium supply chain.

This Bradda Head Lithium profile is part of a paid investor education campaign.*

BHLI:CA

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20h

AuKing Mining

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania.

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00