- WORLD EDITIONAustraliaNorth AmericaWorld

April 03, 2024

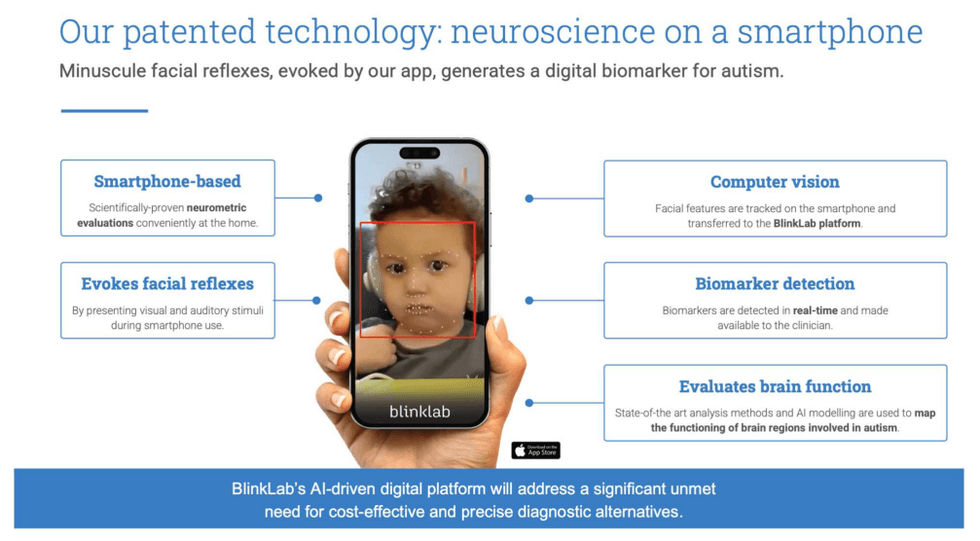

BlinkLab Limited (ASX:BB1) (“BlinkLab” or the “Company”), a company focused on developing new smartphone-based AI-powered mental healthcare solutions, is excited to announce its upcoming listing on the Australian Securities Exchange (ASX) on 4 April 2024 at 12:00pm AEDT 9:00am AWST under the ticker code BB1. BlinkLab, a company started by neuroscientists at Princeton University, over the past several years has fully developed a smartphone-based test for early diagnosis of autism, ADHD, and other neurodevelopmental conditions. Funds raised will be used to finalize an FDA Class II medical device registration study in autism in partnership with leading US university hospitals.

- BlinkLab Limited shares to commence trading on the Australian Securities Exchange (ASX) on 4 April 2024 at 12:00pm (AEDT) under the ticker code BB1.

- The oversubscribed IPO raised A$7m at $0.20 per share.

- Capital raised will be used to progress smartphone-based autism diagnostic test into FDA registrational study, initiate further clinical studies in other programs including ADHD as well as continue to advance in-house AI/ML algorithms.

BlinkLab Chairman, Brian Leedman, said: “I believe BlinkLab is the next groundbreaking venture in digital healthcare. Our innovative approach leverages the power of smartphones, AI and machine learning to deliver autism screening tests specifically designed for children as young as 18 months old. This will aid healthcare providers to identify these children at a much younger age than presently available providing a pathway to effective treatment and better outcomes for the child and their families. This cutting-edge digital technology is poised to capture the imagination of major industry players, eager to embrace transformative solutions in healthcare.”

The BlinkLab Test combines a smartphone’s ability to deliver stimuli and acquire data using computer vision with a secure cloud-based platform for data storage and analysis. In the experiments, each audio and/or visual stimulus is presented with millisecond-precise control over parameters such as timing, amplitude, and frequency. To maintain participant attention, an entertaining video of choice is shown with normalized audio levels. Participants’ responses are measured by the smartphone’s camera and microphone and are processed in real time using state-of-the art computer vision techniques, fully anonymized, and transferred securely to the analysis portal. There, BlinkLab’s in-house AI/machine learning algorithms then perform clustering and statistical analysis to identify the predictive value of the test in a particular data set. This AI-based smartphone based platform is designed to be used under supervision of medical healthcare practitioners.

Company’s previous clinical trials have shown an impressive success rate in the diagnosis of autism, achieving sensitivity of 85 percent and specificity of 84 percent. These trials are very similar to regulatory studies required by US FDA and have shown a much higher accuracy of BlinkLab Test compared to currently approved products that do not use computer vision and a smartphone.

BlinkLab team has experienced management and leading experts in the field of machine learning, autism, and brain development, bridging the most advanced technological innovations with groundbreaking scientific research. These include Princeton University Professor Sam Wang, a co-founder of BlinkLab, who is recognized as a global key opinion leader in the field of brain research and autism. Professor Wang serves as Chair of Blinkab's Independent Advisory Board.

Click here for the full ASX Release

This article includes content from Blinklab Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BB1:AU

The Conversation (0)

25 September 2024

BlinkLab Limited

Revolutionising Mental Health Care Through Mobile Solutions

Revolutionising Mental Health Care Through Mobile Solutions Keep Reading...

01 May 2025

Successful Placement of A$7.66M to Underpin Growth Strategy

BlinkLab Limited (BB1:AU) has announced Successful Placement of A$7.66M to Underpin Growth StrategyDownload the PDF here. Keep Reading...

29 April 2025

Trading Halt

BlinkLab Limited (BB1:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 April 2025

Quarterly Activities/Appendix 4C Cash Flow Report

BlinkLab Limited (BB1:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

31 March 2025

BlinkLab Surpasses Key Milestone in Pivotal U.S. Trial

BlinkLab Limited (BB1:AU) has announced BlinkLab Surpasses Key Milestone in Pivotal U.S. TrialDownload the PDF here. Keep Reading...

30 March 2025

Trading Halt

BlinkLab Limited (BB1:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 February

AI Infrastructure Moving to the Edge to Transform User Experience

While the first phase of the AI gold rush was defined by massive investments in centralized data centers, 2026 is about proving those billions can translate into fast, reliable AI that people will use every day. One Canadian startup, PolarGrid, is betting that the answer lies at the edge rather... Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

Unith (UNT:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

20 January

The Performance Chasm: Is the AI Rally Over or Just Shifting Gears?

The investment landscape of 2025 will be remembered for its historic divide, where the widespread boom in artificial intelligence (AI) created a tale of two worlds in the stock market.On one side, the Magnificent 7 and specialized players like Palantir Technologies (NASDAQ:PLTR) drove massive... Keep Reading...

20 January

Nextech3D.ai Scales National Event Infrastructure to 35 Major U.S. Cities; Launches 58 New AI-Ready Experiences to Meet Enterprise Demand

Strategic Integration of Generative AI 'Semantic Memory' via OpenAI and Pinecone Vector Database Supports Rapid Expansion of Corporate Engagement Platforms TORONTO, ON / ACCESS Newswire / January 20, 2026 / Nextech3D.ai (OTCQB:NEXCF)(CSE:NTAR,OTC:NEXCF)(FSE:1SS), a leader in AI-powered event and... Keep Reading...

16 January

Tech Weekly: Chip Stocks Soar on Taiwan Semiconductor Earnings

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market. We also break down next week's catalysts to watch to help you prepare for the week ahead.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure: I, Meagen... Keep Reading...

16 January

Nextech3D.ai Partners with BitPay to Power Crypto and Stablecoin Payments for Events

Company Strengthens Event Tech Infrastructure with Milestone AWS Migration and Enhanced Blockchain CredentialingAWS Cloud Infrastructure OptimizationSmart Contract UniformityFlexible Asset Standards ERC721/ ERC1155 TORONTO, ON AND NEW YORK CITY, NY / ACCESS Newswire / January 16, 2026 /... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00