May 12, 2024

Horizon Minerals Limited (ASX: HRZ) (“Horizon” or “the Company”) is pleased to announce that it has entered into a binding Toll Milling Agreement (“TMA”) with FMR Investments Pty Ltd (“FMR”) to treat 200kt of Horizon ore from the Cannon underground project, or other deposit, commencing in the December 2024 Quarter.

HIGHLIGHTS

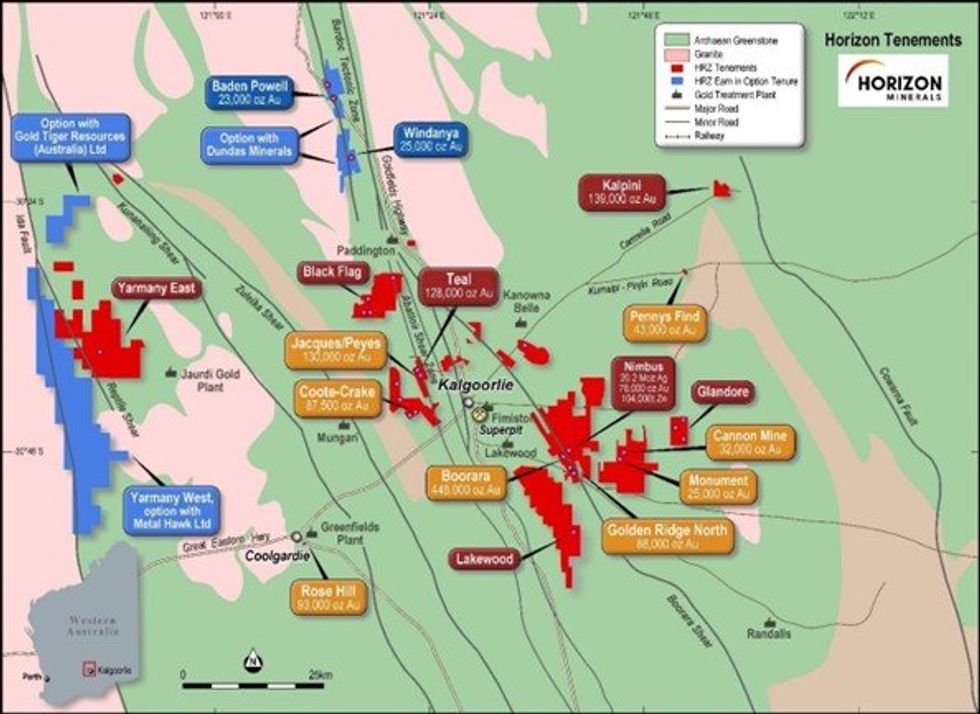

- Binding TMA has been executed with FMR, which owns the Greenfields Mill located northeast of Coolgardie and 30km southwest of Kalgoorlie-Boulder in WA

- Horizon will arrange contract mining and hauling of ore from Cannon for ore processing at FMR’s 1.0Mtpa Greenfields Mill, located ~67km by road from the Cannon Project

- An agreed 200kt of ore will be processed over a period of eight months, commencing in the December 2024 Quarter

- The TMA contains competitive ore treatment rates with the payment structure as follows:

- Horizon is responsible for delivery of each stockpile to the Greenfields Mill ROM near Coolgardie

- Payment of processing costs must be made before the value of the processed and refined gold at the Perth Mint is transferred from FMR’s metal account to Horizon

- If the delivery schedule is missed Horizon will forfeit its allocated tonnes for that month and from the overall 200kt allocation

- An Ore Reserve for Cannon has already been established including forecast economics for the ore to be processed via a Toll Milling Agreement 1

- Cannon is fully environmentally permitted (with last mining in 2017) with pre-production activities are already underway, including dewatering of the open pit in preparation for underground mining

- The TMA has flexibility that Horizon can treat Horizon ore other than Cannon, including Horizon’s own current resources or those acquired through the proposed merger with Greenstone Resources Limited, provided sufficient notice is provided to FMR

Commenting on the toll milling agreement, Chief Executive Officer Mr Grant Haywood said: 2

“We are very pleased to have converted our 200,000 tonne allocation with FMR into a formal Toll Milling Agreement, and look forward to working closely with them as ore deliveries will commence later this calendar year. This agreement is in addition to our 1.4Mt ore sale agreement with Paddington announced a week ago. Together this will see us generating cash flow from two fronts in this fantastic gold price environment before the end of 2024.”

Next Steps 1

- AMC Consultants has been engaged and undertaken a review of the Cannon Ore Reserve and will progress the revised key financial outcomes for the June 2024 Quarter

- Finalise engagement with underground mining and haulage contractors to finalise tenders for Cannon

- Complete the proposed merger with Greenstone Resources to enhance the long-term production profile with development ready high-grade projects

Click here for the full ASX Release

This article includes content from Horizon Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 August 2025

Horizon Minerals

Emerging stand-alone gold producer in Western Australia

Emerging stand-alone gold producer in Western Australia Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

6h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00