May 29, 2023

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to provide an update for drill holes completed at the Bang I Tum prospect. Drilling results support the geological model applied to the Exploration Target estimate with lithium mineralisation hosted in mica rich pegmatite dykes-veins and adjacent metasediments. The prospective zone is currently defined over a strike length of over 1km and remains open along strike and at depth on many sections.

HIGHLIGHTS

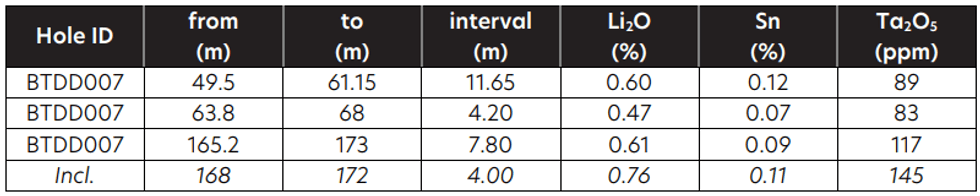

- First assay results received for hole BTDD007 at the Bang I Tum Lithium Prospect.

- Drilling confirms discovery of new pegmatite zones to the east and potentially to the west of the main zone.

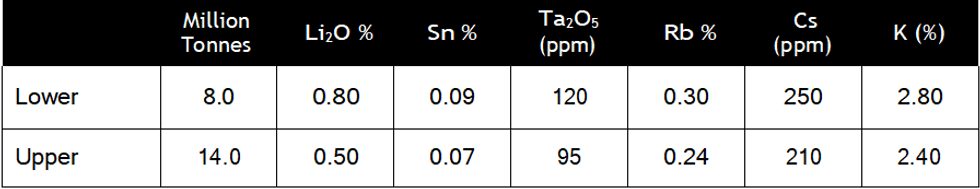

- Consistent with the Exploration Target of 8-14Mt @ 0.5-0.8% Li2O, results indicate higher Li2O grades compared to the Reung Kiet Mineral Resource Estimate.1

- In addition to lithium, intersections also contain Sn and Ta mineralisation.

- Visual results for holes (BTDD008-021, assays pending) demonstrate significant extensions of the pegmatite swarm along strike from previous drilling.

- Drilling is ongoing with the aim of reporting a Mineral Resource Estimate for the Bang I Tum Lithium Prospect later in 2023.

- Assay results from the first hole include:

Pan Asia Metals Managing Director said: “Initial assays and visual observations at the Bang I Tum Lithium Prospect are very pleasing, supporting the Exploration Target and indicating new extensions to the mineralised zones. Robust lithium assays have been reported in hole BTDD007. Visual observations in most other holes support and improve our initial expectations for the program. The next batch of assay results is due in June, and we are already drilling holes BTDD022 and 023, meaning we can expect an inaugural Mineral Resource Estimate for Bang I Tum to be reported later this year. Successfully incorporating Bang I Tum into the inventory will boost the scale of our project, making it more attractive as a strategic mineral resource in South East Asia.”

1 The potential quantity and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

The Reung Kiet Lithium Project (‘RKLP’), inclusive of the Bang I Tim prospect is one of PAM’s key assets. RKLP is a hard rock lithium project with lithium hosted in lepidolite/mica rich pegmatites chiefly composed of quartz, albite, lepidolite and muscovite, both lithium bearing micas, with minor cassiterite and tantalite as well as other accessory minerals. Previous open pit mining extracting tin from the weathered pegmatites was conducted into the early 1970’s.

Bang I Tum Lithium Prospect

The Bang I Tum Lithium Prospect (Bang I Tum or BIT), is located about 8km north of the Reung Kiet Lithium Prospect in southern Thailand. At Bang I Tum PAM has estimated a drill supported Exploration Target of 8 to 14 Million tonnes at a grade ranging between 0.5% to 0.8% Li2O (see PAM ASX announcement “Reung Kiet Lithium Project Exploration Target” dated 27 July, 2022). Grades were also estimated for Sn, Ta2O5, Rb, Cs and K, see Table 1.

The potential quantity and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

Further mapping and soil and rock-chip sampling has significantly increased the exploration potential at Bang I Tum. A new zone, approximately 800m long and 200m wide, is characterized by numerous lepidolite rich alpo-pegmatite dykes and veins that are interpreted to be a westerly extension of the dyke swarm and the existing Exploration Target (see PAM ASX announcement “Bang I Tum – High Grade Lithium Results” dated 24 October, 2022.

Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00