July 18, 2022

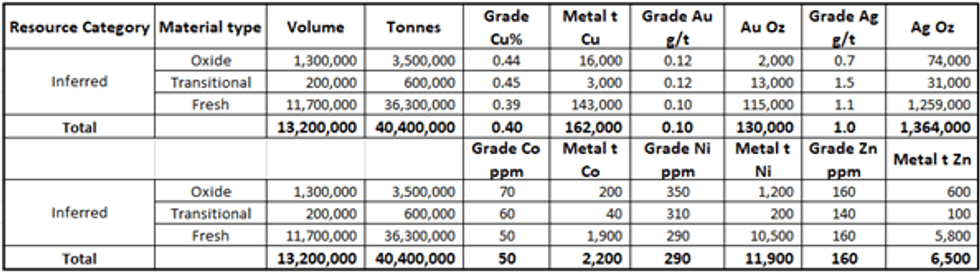

Cyprium Metals Limited (ASX:CYM) (“CYM”, “Cyprium” or “the Company”) is pleased to announce the Company’s maiden Mineral Resource Estimate for the Nanadie Well deposit to a JORC 2012 standard, as detailed in Table 1 below.

HIGHLIGHTS

- Nanadie Well polymetallic orebody, preliminary Mineral Resource Estimate contains:

- Copper 162,000 tonnes

- Gold 130,000 ounces

- Silver 1,364,000 ounces

- Cobalt 2,200 tonnes

- Nickel 11,900 tonnes

- Zinc 6,500 tonnes

- Nanadie Well extends to within one metre of surface

- Mineralisation is shallow and broad, remaining open at depth and along strike to the north

- Significant potential for extension

Executive Director Barry Cahill commented:

“We are very pleased to announce the results of our maiden mineral resource estimate at the Nanadie Well Copper Project in the east Murchison region. The mineral resource highlights the extensive polymetallic potential of the Nanadie Well Project. This mineral resource estimate also now means the Company has 2012 JORC compliant mineral resources at all of our copper projects.

The shallow Nanadie Well Resource and the Hollandaire Resource are complimentary deposits which are expected to deliver operational synergies. The Nanadie Well diamond drill core obtained in 2021 will provide sample material for metallurgical leach test work for inclusion in a scoping study.”

Table 1: Nanadie Well 2012 JORC Mineral Resource Estimate

Note: Differences in sum totals of tonnages and grades may occur due to rounding Cut-off at 0.25% Cu

Reported Grades and tonnages for all metals are estimated top-cut grades and tonnages

Discussion

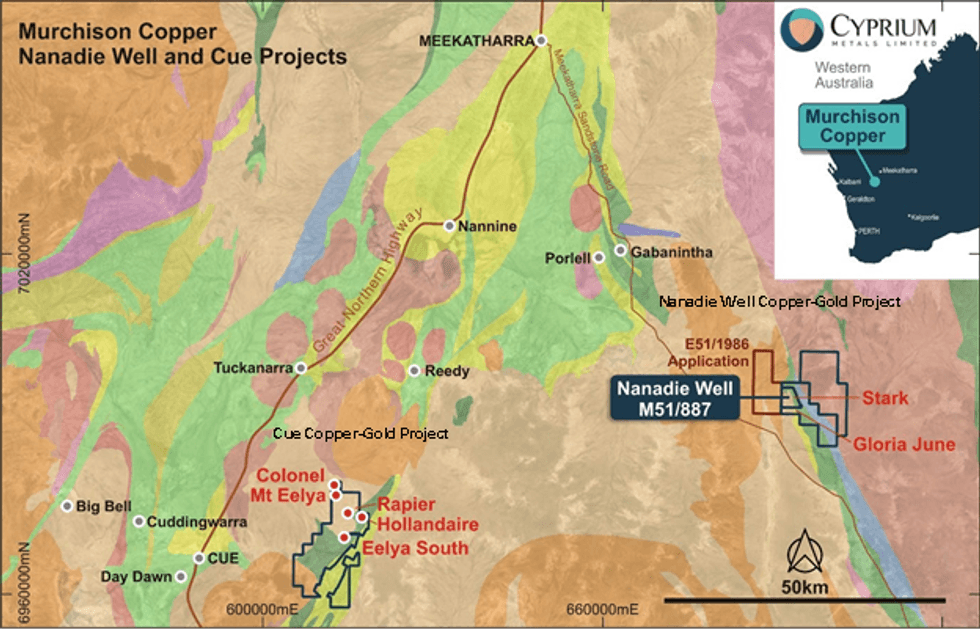

The Nanadie Well Copper-Gold Mineral Resource Estimate forms part of Cyprium’s broader Murchison Copper-Gold Project, as illustrated in Figures 1 and 6.

The broader Nanadie Well model further highlights the potential to expand the known resource both along strike and down dip. The current resource tapers with depth and the potential exists to expand this laterally at depth with further deeper drilling. In addition, the current resource is modelled from near surface to a nominal depth of 220mRL (255m from surface) but potential exists to increase the depth extents to beyond the limits of the deepest drilling which is currently down to 160mRL (315m from surface).

Certainly, deeper holes that extend beyond the lower limits of the modelled 2022 resource have intersected mineralisation with similar down hole mineralised widths and grades as those included in the modelled resource. This further highlights the potential to identify additional mineralisation within the layered intrusive body at depth. The model also highlighted trends in the mineralisation with Nickel and Cobalt grades increasing towards the northern end of the current Inferred Resource. There is also potential to expand the known resource along strike with further closer spaced drilling.

The Cyprium Ordinary Kriged 2022 resource model is based on geological information sourced from all previous drill holes with only the assay data from the 145 RC holes and 6 diamond drill holes drilled since 2004 utilised in the latest resource estimate. The resource is reported at a 0.25% Cu cut-off (refer above to Table 1).

Figure 1: Location of the Nanadie Well and Cue Copper-Gold Projects

The Nanadie Well block model extends from 6993900mN to 6995350mN and 692600mE to 693600mE and from 160mRL to the topographic surface nominally around 475mRL. The Inferred Resource is confined to the more densely drilled area between 6994040mN and 6995120mN and 692800mE and 693180mE (refer to Figure 2). A broader block model has been generated to aid future drill planning and identify structural trends in the mineralisation.

The Nanadie Well Mineral Resource Estimate currently extends from the base of the Quaternary surface cover sands and clays from only 0.5m to 6m below surface, down to a maximum depth of 220mRL (255m from surface). The bulk of the currently defined resource lies above 250mRL (above a depth of 225m from surface, refer to Figures 2 to 5). The mineralisation remains open at depth.

The resource is estimated 60m beyond the last fence of drilling at the north end and 100m beyond the last fence of drill holes at the southern end (Figure 3). The estimated resource extends from 20m to 100m below the greatest depth of drilling in some areas but elsewhere the current drilling extends beyond the base of the estimated resource (Figures 2, 4 and 5). The wireframe models that were used to generate the model domains extend a further 140m to the south and 230m to the north of the reported resource limits.

The full model extends beyond the limits of reported Inferred Resource. This was done both to aid future drill planning and also to ensure that any preliminary open pit shells would lie within the modelled limits. More specific details on the estimation parameters used are summarised below and explained in further details in the accompanying JORC Tables (refer to Appendix 1).

Click here for the full ASX Release

This article includes content from Cyprium Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CYM:AU

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

Cyprium Metals

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth Keep Reading...

23 January

Capital Raise Presentation

Cyprium Metals (CYM:AU) has announced Capital Raise PresentationDownload the PDF here. Keep Reading...

22 January

A$41M Capital Raise via Placement & Entitlement Offer

Cyprium Metals (CYM:AU) has announced A$41M Capital Raise via Placement & Entitlement OfferDownload the PDF here. Keep Reading...

19 January

Paterson Exploration Review Update

Cyprium Metals (CYM:AU) has announced Paterson Exploration Review UpdateDownload the PDF here. Keep Reading...

19 November 2025

Cathode Restart Approved by Cyprium Board

Cyprium Metals (CYM:AU) has announced Cathode Restart Approved by Cyprium BoardDownload the PDF here. Keep Reading...

13 November 2025

Senior Loan Facility Refinanced with Nebari

Cyprium Metals (CYM:AU) has announced Senior Loan Facility Refinanced with NebariDownload the PDF here. Keep Reading...

8h

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

11h

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00