February 13, 2025

American Rare Earths (ASX:ARR,OTCQX:ARRNF,ADR:AMRRY) unlocks the USA’s rare earths potential through its strategic, high-value asset in Wyoming. The flagship project, Halleck Creek, is one of North America’s largest REE deposits. With a 2.63-billion-ton JORC resource at 3,292 ppm TREO, American Rare Earths is ramping up its development to bolster the North American critical minerals supply chain.

Halleck Creek offers significant exploration upside, presenting a multi-generational opportunity to establish a sustainable rare earths supply chain in the US. The support from EXIM Bank further highlights the strategic importance of Halleck Creek in reducing U.S. dependency on foreign suppliers.

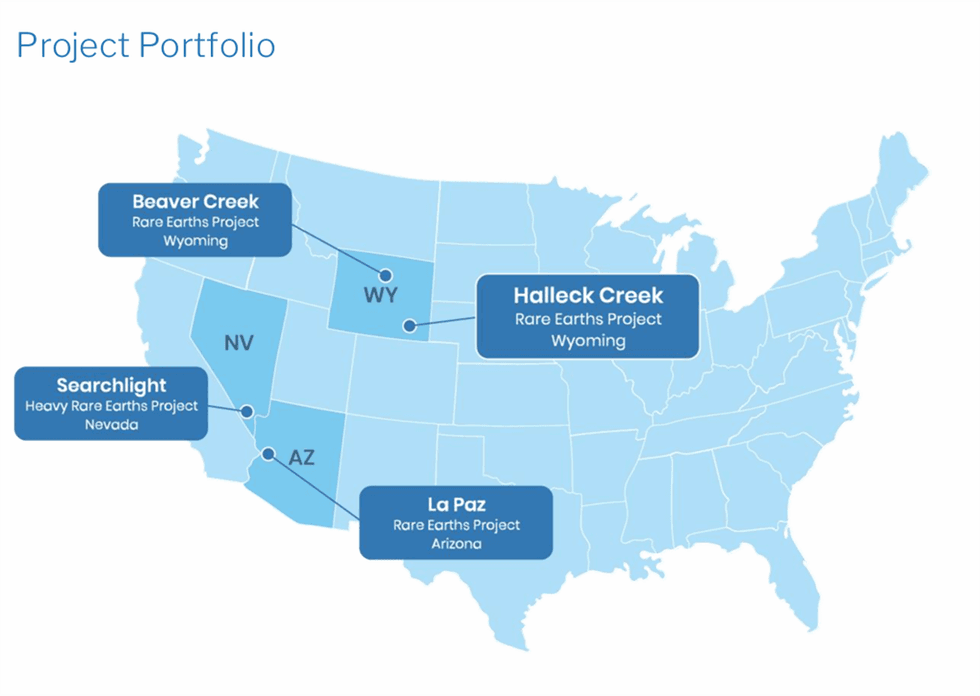

Key Projects

Key ProjectsThe Halleck Creek project in Albany County, Wyoming, is the cornerstone of ARR’s growth strategy. Recognized as one of the largest, rare-earth deposits in North America, it boasts a JORC-compliant resource of 2.63 billion tons at 3,292 ppm TREO. The deposit is hosted in Precambrian granites and metamorphic rocks, which contain REE-enriched minerals like monazite and bastnaesite. The coarse-grained nature of the mineralization ensures cost-effective extraction and processing.

Company Highlights

- American Rare Earth’s flagship project, Halleck Creek, is one of North America’s largest REE deposits. With a 2.63-billion-ton JORC resource at 3,292 ppm TREO, it holds the potential to meet US rare earths demand for approximately 100 years.

- The company is completely focused on developing a US-based critical minerals supply chain, aligning with US policies to reduce reliance on China for rare earth supply.

- The Halleck Creek project’s planned development consists of two phases. Phase 1 entails development of the Cowboy State mine, which is located entirely on Wyoming state land, enabling faster permitting and streamlined regulatory processes. Subsequently, cash flow generated from CSM will support development of the federal portions of Halleck Creek in Phase 2.

- This phased approach allows ARR to accelerate its pathway to production, enhance shareholder value, and strengthen its position as a key domestic supplier of rare earth elements in the United States.

- Well-positioned to address critical supply chain vulnerabilities, Halleck Creek benefits from strong federal and state support, including a non-binding EXIM Bank letter of interest for funding up to $456 million.

This American Rare Earths profile is part of a paid investor education campaign.*

Click here to connect with American Rare Earths (ASX:ARR) to receive an Investor Presentation

ARR:AU

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 February

American Rare Earths Limited

Advancing one of the largest REE deposits in North America

Advancing one of the largest REE deposits in North America Keep Reading...

6h

Optimisation Update

American Rare Earths Limited (ARR:AU) has announced Optimisation UpdateDownload the PDF here. Keep Reading...

16 October

Quarterly Activities/Appendix 5B Cash Flow Report

American Rare Earths Limited (ARR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 October

Successful Completion-Impurity Removal Neutralization Tests

American Rare Earths Limited (ARR:AU) has announced Successful Completion-Impurity Removal Neutralization TestsDownload the PDF here. Keep Reading...

02 October

COB: Repayment of Promissory Note

American Rare Earths Limited (ARR:AU) has announced COB: Repayment of Promissory NoteDownload the PDF here. Keep Reading...

30 July

Quarterly Activities/Appendix 5B Cash Flow Report

American Rare Earths Limited (ARR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

06 November

Top 5 Australian Mining Stocks This Week: Mount Ridley Holds Top Spot with New CEO

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mount Ridley once again takes the top spot this week, building on its momentum last week. The company is joined by a mix of critical... Keep Reading...

06 November

Locksley Share Rises as US-backed EXIM Bank Signals Support

The market has responded positively to news that Locksley Resources (ASX:LKY,OTQB:LKYRF, FSE: X5L) has received a letter of interest (LOI) from US-backed EXIM Bank for up to US$191 million (AU$288 million) in potential funding package to fast-track its Mojave antimony and rare earths project in... Keep Reading...

06 November

CoTec to Host Investor Update

CoTec Holdings Corp. (TSXV:CTH)(OTCQB:CTHCF) ("CoTec" or the "Company") is pleased to announce that the Company's CEO, Julian Treger, will host an investor update on Wednesday, November 19, 2025, at 7:00am PST / 10:00am EST.The investor update presentation will highlight progress and strategic... Keep Reading...

04 November

Trump Admin Takes Equity Stake in US$1.4 Billion Rare Earth Partnership

The Trump administration continues its push to rebuild domestic supply chains for critical technologies through a US$1.4 billion public-private partnership with Vulcan Elements and ReElement Technologies -a subsidiary of American Resources Corporation (NASDAQ:AREC)- to expand US production of... Keep Reading...

03 November

Detailed Ground Gravity, Magnetic and Radiometric Surveys Refine Priority REE Targets at Desert Star Projects, California, USA

Bayan Mining and Minerals Ltd (ASX: BMM; "BMM" or "the Company") is pleased to announce the results of detailed ground gravity, magnetic and radiometric surveys completed across its 100% owned Desert Star Projects, located in California, USA. The integrated datasets have delivered a coherent,... Keep Reading...

03 November

Drill Targets Finalised at Harts Range Heavy Rare Earth and Niobium Project, NT

New Frontier Minerals Limited (LSE/ASX: NFM) is pleased to announce the maiden reverse circulation ("RC") drill program comprising up to 46 holes to test near surface mineralistion at the Harts Range Heavy Rare Earths Project, located 140km north-east of Alice Springs in the Northern Territory,... Keep Reading...

Latest News

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00