November 21, 2024

Altech Batteries Limited (Altech/Company) (ASX: ATC) (FRA: A3Y) is pleased to announce an update on funding of the CERENERGY® sodium-chloride solid-state battery project in Saxony, Germany.

Highlights

- Financing plan and target structure in place

- Funding investment teaser documents and data room established

- Reach out to 10 commercial banks and 2 venture debt funds – all positive interests

- Shortlisting potential lead bank

- Equity Funding – potential sale of minority interest of the project to realise capital and strategic value

- Discussions and draft term sheets shared with investors

- Offtake agreement LOI signed with ZISP

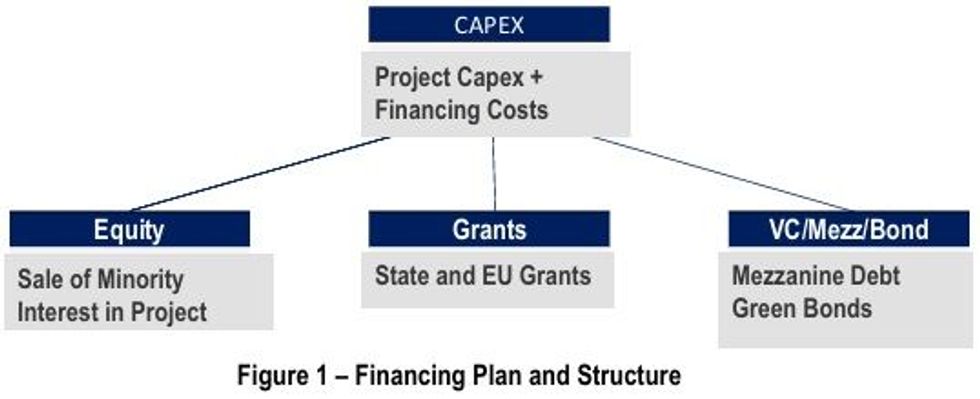

On 14 June 2024, the Company, through its Germany subsidiary Altech Batteries GmbH (“ABG”), announced the appointment of global big four professional services firm (“funding adviser”) to assist in securing finance for the construction of Altech’s 120MWh CERENERGY® battery manufacturing plant in Germany. The project's financing strategy is structured across three key areas: debt, equity, and grants. These sources will cover not only the capital expenditures but also financing costs, working capital, debt service coverage, and an additional contingency for potential business interruptions, See Figure 1.

CEO and MD Iggy Tan Discusses CERENERGY® Funding

Either click the thumbnail below, scan the QR code below or use the YouTube link https://youtu.be/EgMBHp1SRCA to listen to the discussion.

DEBT PROCESS

A funding invitation document (investment teaser) has been finalised and distributed to various financial institutions for debt funding in the project. The Group has engaged ten commercial banks and two venture debt funds in a first market round, receiving predominantly positive initial feedback. Several of these institutions have expressed strong interest in participating in the financing. The Group is now in the process of shortlisting potential lenders to identify the most suitable financial partners for the project. To support a thorough due diligence process, a secure data room has been set up, providing detailed project information to interested financiers and ensuring full transparency. The DFS financial model has been adjusted to stress-test various funding scenarios tailored to the lending institutions ABG has engaged with. Further steps involve determining the most suitable banks to form a syndicate and appointing a lead bank to guide the lending process. This syndicate will play a crucial role in structuring the financing arrangement to meet the project's requirements.

EQUITY FUNDING

In addition to ongoing debt financing efforts, the Group has engaged several equity advisers to support the equity component of the project's funding package. As part of this strategy, the Altech Group plans to divest a minority interest in the project to one or two strategic investors. This partial divestment aims to attract investors who can bring not only capital, but also strategic value to the project, aligning with the CERENERGY® project’s long-term growth and sustainability objectives.

The Group is specifically targeting large utility groups, data centre operators, investment funds and corporations that are heavily involved in the green energy transition. These entities are seen as ideal partners due to their strong alignment with the project’s focus on sustainable energy solutions, as well as their capacity to provide substantial financial backing.

To date, significant progress has been made in these equity discussions. Several Non-Disclosure Agreements (NDAs) have been signed, allowing for deeper engagement with prospective investors. Altech has also circulated draft term sheets to a number of interested parties, outlining the proposed terms and conditions for investment. These documents serve as a starting point for negotiations, paving the way for more detailed discussions regarding the potential equity stake and partnership structure.

The strategic decision to divest a portion of the project is aimed at reducing the overall financial burden on the Company while bringing in experienced partners who can contribute to the project’s success. By securing both the equity and debt components, the Company aims to finalise the full financing package, ensuring the timely construction and commissioning of the CERENERGY® battery plant. The next steps will focus on advancing these discussions and converting interest into formal commitments, which are crucial for moving forward with the project.

OFFTAKE ARRANGEMENTS

On 13 September 24, Altech announced the execution of an Offtake Letter of Intent between Zweckverband Industriepark Schwarze Pumpe (ZISP) and Altech Batteries GmbH. Under this Offtake Letter of Intent (LOI), ZISP will purchase 30 MWh of energy storage capacity annually, consisting of 1MWh GridPacks, for the first five years of production. The price of these batteries has been agreed and aligns with the sales price contained within Altech’s Definitive Feasibility Study. The purchase of these batteries is subject to performance tests, battery specifications and the batteries meeting customer requirements. This offtake LOI constitutes an important aspect of the financing process. This lays the foundation for additional offtake arrangements, which are currently in progress. These agreements are vital for advancing our financing and construction timelines for the CERENERGY® project.

CEO and MD Mr Iggy Tan stated "The funding stage of any project is the most complex and challenging process of any project. Securing a big four funding adviser with expertise and a global network is a major step in our financing efforts. Altech is advancing both debt and equity discussions, along with offtake agreements, to fully fund the CERENERGY® project. We are seeing strong interest, especially from European banks and potential equity partners”.

Click here for the full ASX Release

This article includes content from Altech Batteries, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ATC:AU

Sign up to get your FREE

Altech Batteries Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

11 May 2025

Altech Batteries

Revolutionary sodium-chloride solid state batteries for renewable energy storage and silicon in graphite anodes for higher energy density batteries.

Revolutionary sodium-chloride solid state batteries for renewable energy storage and silicon in graphite anodes for higher energy density batteries. Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Altech Batteries (ATC:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

06 January

Altech - CERENERGY Project Secures German Grant Approval

Altech Batteries (ATC:AU) has announced Altech - CERENERGY Project Secures German Grant ApprovalDownload the PDF here. Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

27 November 2025

Altech - Board and Management Changes

Altech Batteries (ATC:AU) has announced Altech - Board and Management ChangesDownload the PDF here. Keep Reading...

26 November 2025

Altech - Design Completed for UPS Battery System

Altech Batteries (ATC:AU) has announced Altech - Design Completed for UPS Battery SystemDownload the PDF here. Keep Reading...

24 February

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

27 November 2025

Major JORC Resource & Reserve Upgrade at Orom-Cross

Blencowe Resources Plc (LSE: BRES) is pleased to announce the completion of the updated JORC 2012 Mineral Resource and Ore Reserve Statement ("JORC") for its 100%-owned Orom-Cross Graphite Project in Uganda. This upgrade incorporates all the infill drilling undertaken in 2025 across the Camp... Keep Reading...

Latest News

Sign up to get your FREE

Altech Batteries Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00