- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

February 04, 2025

Strategically positioned to unlock the value of its Venatica and Olympic Domain projects, Altair Minerals (ASX:ALR) is leveraging cutting-edge exploration techniques and its seasoned technical team’s expertise for significant copper and gold discoveries. Through a disciplined and systematic approach, Altair centers on building a portfolio of high-quality assets with the potential to become Tier-1 discoveries.

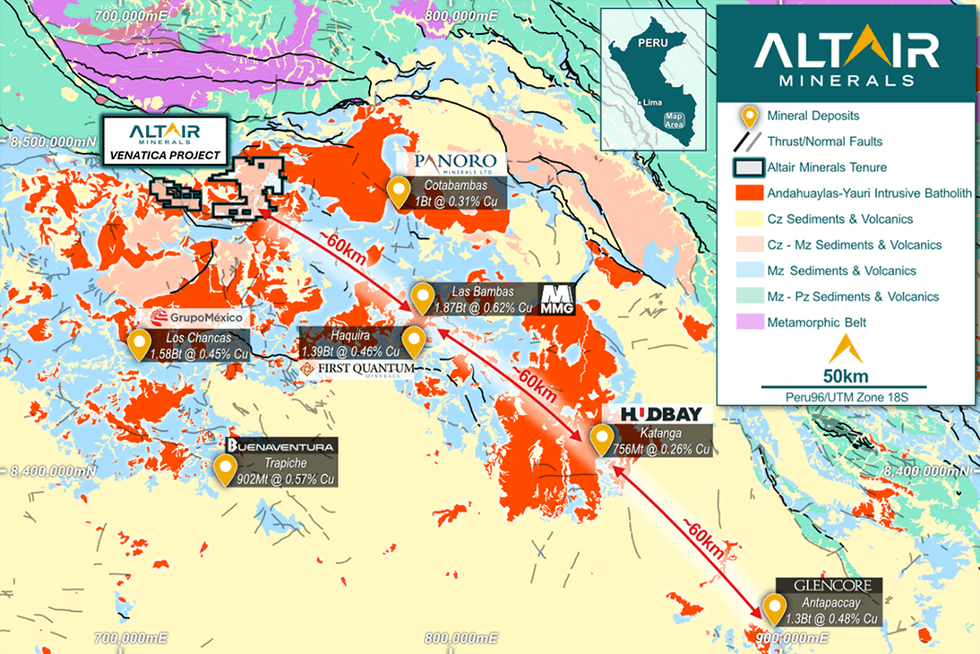

Altair Minerals' flagship Venatica Project is strategically situated in Peru’s Andahuaylas-Yauri Porphyry Belt, a globally significant copper-producing region. The project is neighboring and sitting along strike Tier-1 mines, including Las Bambas, Antapaccay and Haquira, collectively establishing the area as one of the world’s premier porphyry copper districts.

Location of Venatica Project, sitting along the Las Bambas trend and on key contact of Andahuaylas-Yauri Intrusive Batholith which is the main structural feature facilitating Tier-1 Copper deposits on the belt.

Location of Venatica Project, sitting along the Las Bambas trend and on key contact of Andahuaylas-Yauri Intrusive Batholith which is the main structural feature facilitating Tier-1 Copper deposits on the belt.Venatica’s land package is strategically positioned along the northern extension of the batholith intrusion contact zone, a geological anomaly known for hosting large-scale copper deposits with no modern exploration. Altair holds a first-mover advantage, being the first company to test the extension of this trend which has without failure made Tier-1 discoveries every ~60 km. The project’s geology is characterized by a combination of porphyry and skarn mineralization, which underpins its exceptional exploration potential.

Company Highlights

- Altair Minerals’ two world-class projects - Venatica in Peru and Olympic Domain in Australia - are located in globally significant mining districts, targeting Tier-1 copper and gold deposits.

- Venatica Project is a 337 sq km exploration project in the world-famous Andahuaylas-Yauri Porphyry Belt, featuring extensive copper-gold porphyry and skarn mineralization with proven high-grade historical production.

- The Olympic Domain project, located in South Australia’s Gawler Craton, is an 831 sq km IOCG project adjacent to BHP’s Oak Dam deposit (1.34 Bt @ 0.66 percent copper and 0.33 g/t gold) and boasts major analogous geophysical anomalies just 5 km from the Oak Dam deposit, indicative of significant mineralization.

- Historic sampling and exploration work was conducted at Venatica by INMET prior to its subsequent take over First Quantum for C$5.1 billion. The historic work has shown two major porphyry targets of 6 sq kmand 4 sq km, respectively, which have demonstrated abundant copper mineralisation at surface.

- Historic sampling at Venatica covers a small portion of the overall target, leaving substantial scope to expand its target size which remains open in all directions, these samples include:

- 7.0 percent copper and 33 g/t silver (sample 2254)

- 5.7 percent copper and 43 g/t silver (sample 4807)

- 4.8 percent copper and 32 g/t silver (sample 15245)

- 6.5 percent copper and 0.52 g/t gold (sample 4803)

- 4.8 percent copper and 0.40 g/t gold (sample 4801)

- Advanced geophysical techniques, modernized modelling has refined drill at Olympic Domain which shows previous impressive holes have narrowly missed the true core of the IOCG body, which shows a target size larger than the adjacent Oak Dam deposit owned by BHP.

- Altair’s boasts a first class and leading technical exploration team, who have cumulatively contributed to 11.4 Mt of copper and 26 Moz of gold discoveries in the past two decades.

This Altair Minerals profile is part of a paid investor education campaign.*

Click here to connect with Altair Minerals (ASX:ALR) to receive an Investor Presentation

ALR:AU

The Conversation (0)

10 September 2025

Olympic Domain Project Update with BHP

Altair Minerals (ALR:AU) has announced Olympic Domain Project Update with BHPDownload the PDF here. Keep Reading...

09 September 2025

World Class Exploration Team Formed & Fieldwork Imminent

Altair Minerals (ALR:AU) has announced World Class Exploration Team Formed & Fieldwork ImminentDownload the PDF here. Keep Reading...

03 September 2025

Ex-Reunion Gold Team Joins & New Targets Defined

Altair Minerals (ALR:AU) has announced Ex-Reunion Gold Team Joins & New Targets DefinedDownload the PDF here. Keep Reading...

27 August 2025

Olympic Domain Project Update with BHP

Altair Minerals (ALR:AU) has announced Olympic Domain Project Update with BHPDownload the PDF here. Keep Reading...

26 August 2025

South Oko Geochemistry Confirms Oko West Look-Alike Target

Altair Minerals (ALR:AU) has announced South Oko Geochemistry Confirms Oko West Look-Alike TargetDownload the PDF here. Keep Reading...

19h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

19h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

23h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00