March 10, 2025

New Age Exploration (ASX: NAE) (NAE or the Company) is pleased to announce the successful completion of additional geophysical surveys at its highly prospective Wagyu Gold Project in the Pilbara, WA. The Passive Seismic (Tromino) and Ground Gravity surveys were conducted across the dry Yule River bed, facilitating a deeper understanding of the geological structures and linking data from both sides of the project area.

HIGHLIGHTS

- Completion of Passive Seismic and Ground Gravity surveys across the dry Yule River bed at the Wagyu Gold Project in Pilbara, WA

- Several new gravity anomalies have now been identified, which may indicate the presence of more gold-mineralised intrusions, similar to those intersected in 2024 aircore drilling

- Enhanced geological connectivity established by linking data from the east and west sides of the tenement

- Both geophysics surveys were completed with “zero impact” on this culturally sensitive area

- This is the third ground gravity survey and the second passive seismic survey to take place at the Wagyu Project, with previous surveys outside the river completed in April and May 2024

- Additional targets 8 and 10 confirmed on east side of the project from gravity survey

- 3000m of Reverse Circulation Drilling to commence imminently

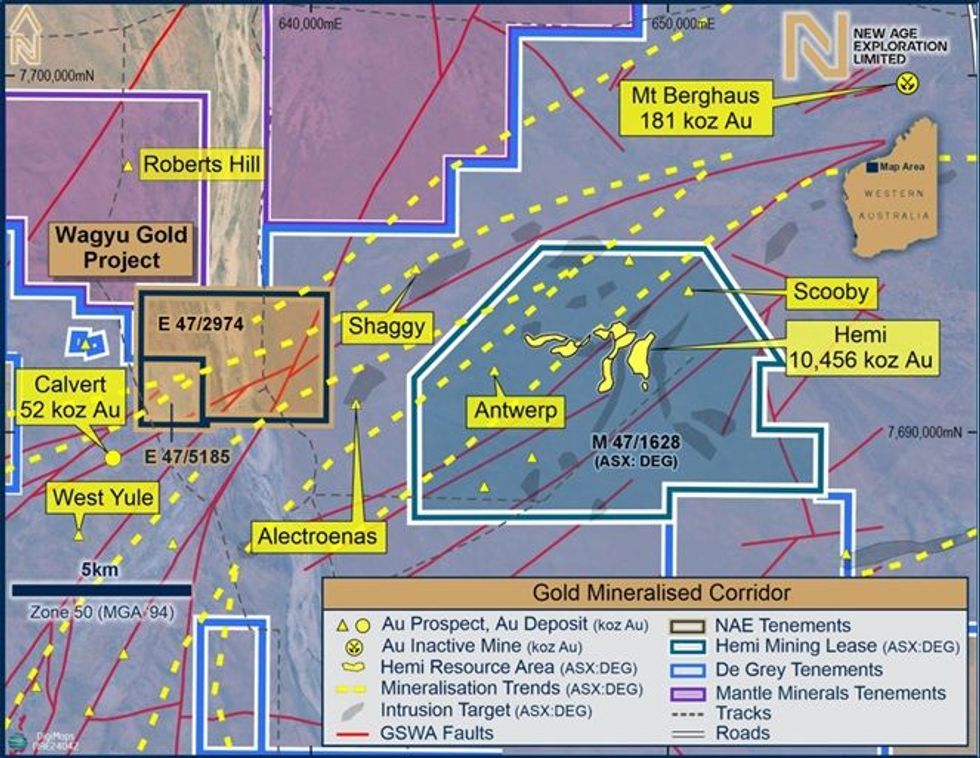

- The Wagyu Project is located in the Central Pilbara’s fast-emerging gold region, adjoining De Grey Mining (ASX:DEG) tenure containing its ~11.2Moz1 Hemi Gold deposit

The Wagyu Gold Project, located within a fast-emerging gold mineralised corridor, represents a highly prospective Gold opportunity ~9km within the same mineralised trend as De Grey Mining’s (ASX:DEG) Hemi Gold Deposit containing ~11.2 Moz1 (refer to Figure 1) in the Central Pilbara.

The Hemi Gold Mineral Resource was last updated by De Grey Mining on 14 November 20241. The estimate is for 264Mt @ 1.3g/t Au for 11.2Moz, which can be broken down into 13Mt @ 1.4g/t for 0.6Moz, 149Mt @ 1.3g/t Au Indicated for 6.3 Moz, and 103Mt @ 1.3g/t Au for 4.3 Moz Inferred.

NAE confirms that it is not aware of any new information or data that materially affects the information included in De Grey’s reported Mineral Resources referenced in this market announcement. To NAE’s full knowledge, all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed.

NAE Executive Director Joshua Wellisch commented:

"The completion of these Geophysical Surveys and identification of new targets marks a pivotal step in our exploration efforts and stakeholder relations at Wagyu. With the support of the Kariyarra People, we have gathered data that links structures and anomalies across the tenement, providing a foundation of our geological understanding. We look forward to using these insights to unlock further potential at Wagyu in the lead up to the imminent 3000m RC Drill Programme.”

Geophysical Surveys and Geological Continuity

The Passive Seismic (Tromino) and Ground Gravity surveys at Wagyu have provided valuable data across the Yule River bed, enhancing the geological connectivity between the east and west portions of the tenement. The Passive Seismic survey, conducted at 200-meter intervals across nine lines, offers insights into bedrock continuity, while the Ground Gravity survey (Figure 4), with spacings of 200m x 200m and infill at 50m x 50m over specific targets, reveals density contrasts associated with mineralisation.

Click here for the full ASX Release

This article includes content from New Age Exploration Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

New Age Exploration

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand Keep Reading...

18h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

18h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

21h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00