March 17, 2024

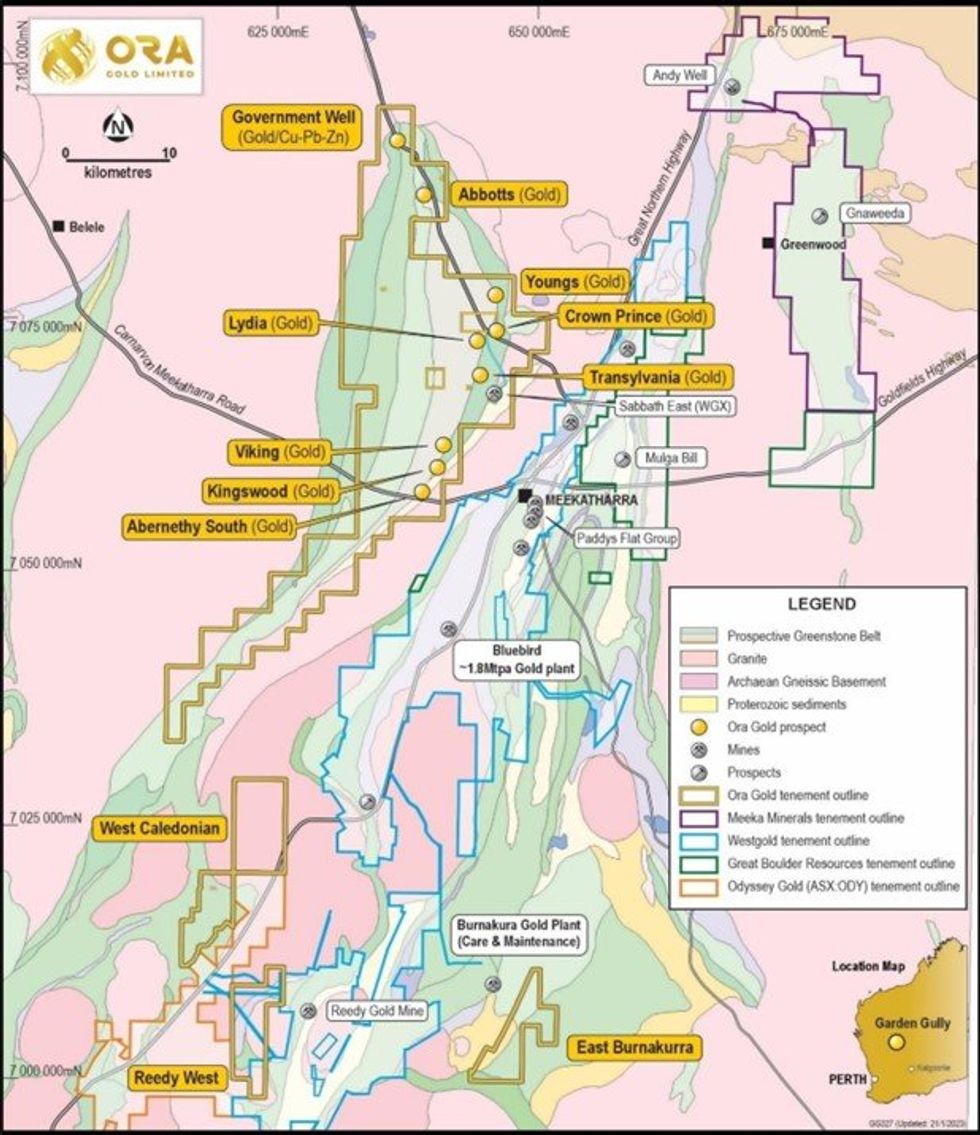

Ora Gold Limited (“Ora” or the “Company”, ASX: OAU) is pleased to report exploration results from RC drilling at the Crown Prince Prospect (M51/886) part of Ora’s Garden Gully Gold Project (Figure 1).

Highlights

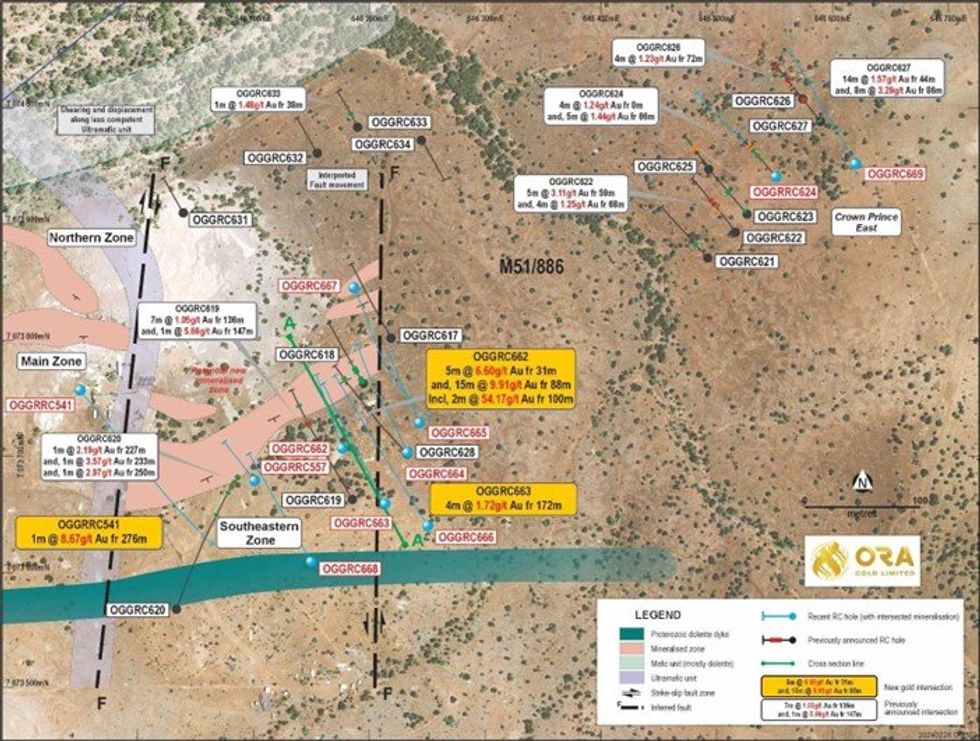

- Initial assay results from the start of 2024 RC drilling at Southeastern Zone (SEZ) has delivered further high-grade gold mineralisation down dip from previously reported intersections.

- Recent new intercepts include:

- 15m at 9.91g/t Au from 88m including 2m at 54.17g/t Au from 100m and 5m at 6.60g/t Au from 31m in OGGRC662

- 1m at 8.67g/ t Au from 276m in OGGRC541

- 4m at 1.72g/t Au from 172m in OGGRC663

- The results in this announcement relate to the first batch of assays received from drilling which commenced in early February 2024.

- Results are pending for 39 holes totaling 4,151m drilled in February and March 2024.

The advanced Crown Prince Prospect (“Crown Prince”) continues to be a focus as a key growth area for gold resources. The prospect predominantly comprises the Southeastern and Main Zones. High-grade gold assay results discussed in this release include results from OGGRC662. Importantly this hole successfully targeted depth extensions of the eastern area of Southeastern Zone mineralisation. The intersection sits just within the resource block model (northeastern end of the deposit) and is likely to result in a grade uplift and strike extensions when incorporated into future models.

Assay results discussed in this announcement are shown in Appendix 1 & Figures 2-5. RC hole details are included in Table 1.

Alex Passmore Ora Gold’s CEO commented: “We are very pleased with the initial assay results from Ora’s RC drilling program targeting growth at Southeastern Zone which continues to demonstrate high-grade gold mineralisation at depth. We look forward to following up with further drilling which is focused on adding to the known strike and depth extent of Crown Prince.”

The best intersection returned in the initial results from RC drilling was returned in OGGRC662 being 15m at 9.91 g/t Au from 88m including 2m at 54.17g/t Au from 100m (Figures 2-5 and Appendix 1). The intersection is at the eastern end of the existing resource model (Figure 3) and is expected to increase the grade profile in this area (Figure 4).

This is down dip of the previously intersected high grade within OGGSRC563 (12m at 8.26g/t Au from 28m, refer OAU ASX release 21 September 2023).

Assays received from OGGRC663 further down dip from OGGRC662 (around 75m away) intersected the mineralised structure at depth, albeit at a lower grade (4m @ 1.72g/t Au). Refer Figure 5. Follow up drilling to confirm grades in this deeper area is planned.

This article includes content from Ora Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

1h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately repossess a lease area known... Keep Reading...

3h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

18h

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

19h

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

20h

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

20h

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00