April 29, 2022

Lithium Power International Limited (LPI:AX) (“LPI” or “the Company”) is pleased to provide shareholders with an overview of quarterly activities for the period ending 31 March 2022 (“Quarter”, “Reporting Period”), including subsequent events that might have a significant impact between 31 March 2022 and the date of issuance of this Report.

HIGHLIGHTS

- Positive results delivered in the updated Definitive Feasibility Study for the Stage One Maricunga Lithium Brine project:

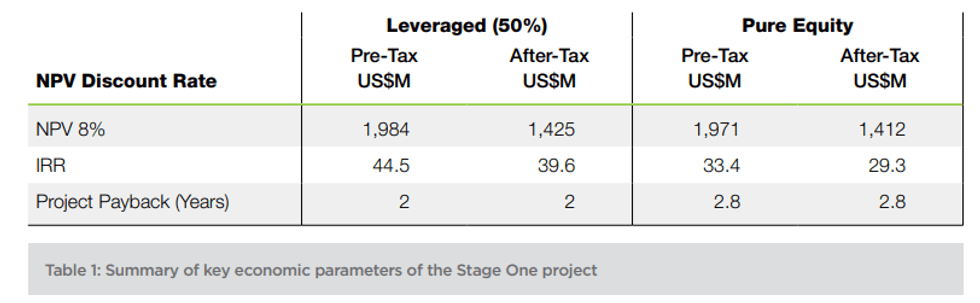

- Maricunga Stage One DFS delivers US$1.4B NPV (after tax) at an 8% discount rate, providing an IRR of 39.6% and a two-year payback. Average annual EBITDA of US$324M

- 15,200 tonnes per annum production of lithium carbonate (LCE) for 20 years with an exceptional ESG profile

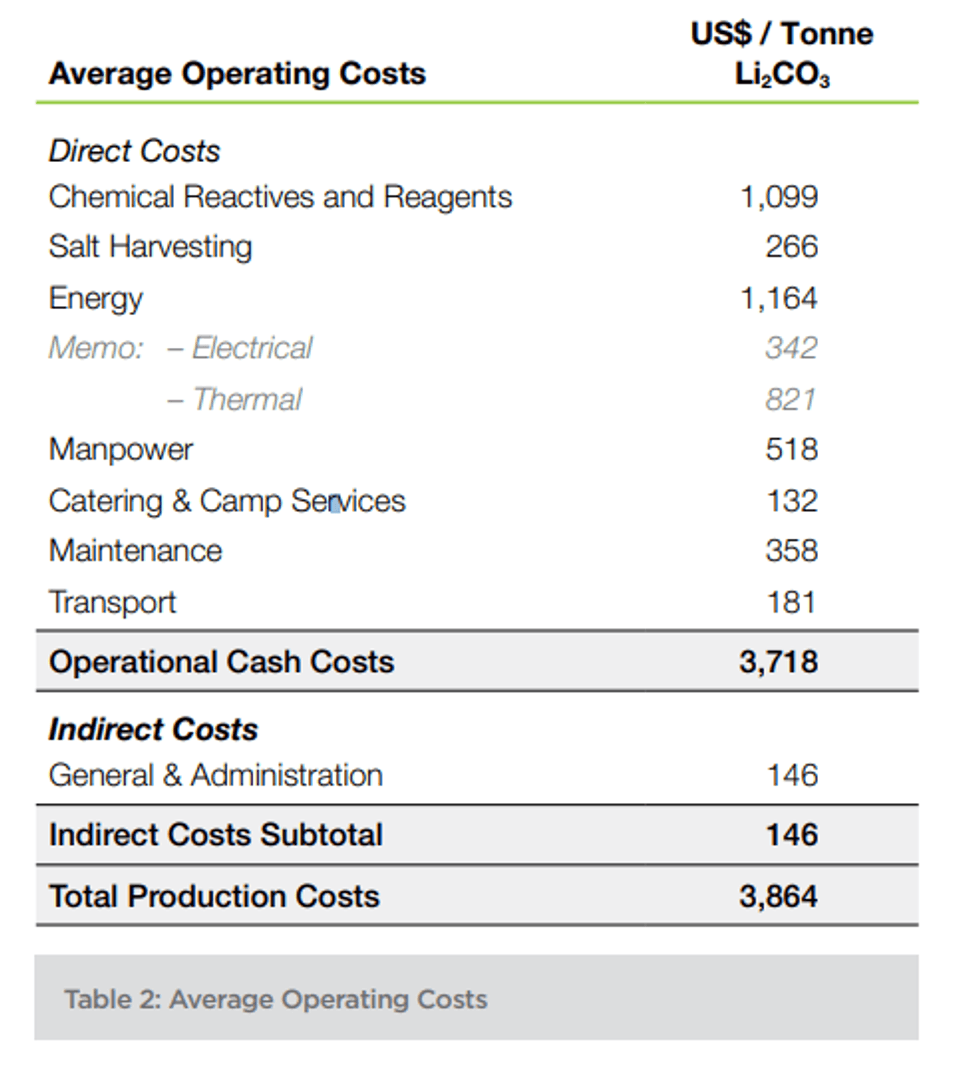

- Operating cost (OPEX) of US$3,718 per tonne of LCE produced, placing the Stage One project in the lower quartile of LCE producers

- Project direct development cost estimated at US$419M, indirect costs at US$145M and contingency costs at US$62M to provide a total project CAPEX of US$626M

- Revised DFS completed by Tier-1 engineering consultancy Worley to international standards, with inputs from EPC contractors to provide greater certainty on cost estimates.

- Preliminary indications of interest received from international and Chilean financial institutions and private funds for debt financing and future equity financing of the project. LPI’s financial advisers, Canaccord and Treadstone, are assisting with this process.

- Updating of the EPC proposals has commenced by two selected international engineering firms, Worley and Bechtel, with a final Investment Decision expected in Q4 2022. Construction is likely to start immediately after.

- LPI to spin-out its Western Australian Greenbushes and Pilgangoora lithium assets during the next six months. These interests are held by a wholly owned subsidiary of LPI, DemergeCo, which will seek to list on the ASX as Western Lithium Limited subject to ASX, ATO and shareholder approval.

- LPI shareholders to receive DemergeCo shares on a pro rata basis via a capital reduction and in-specie distribution, subject to shareholder and regulatory approvals.

- At the Blackwood Prospect at Greenbushes, an initial Ground Penetrating Radar survey and further soil sampling has been completed.

- An updated Conservation Management Plan for additional sampling was approved at Blackwood by DBCA. Phase 1 and 2 of the detailed baseline flora and fauna assessments have been completed.

MARICUNGA – CHILE

STAGE ONE – DEFINITIVE FEASIBILITY STUDY

LPI provided details of the completed Definitive Feasibility Study (DFS) during the quarter for the Maricunga Stage One lithium brine project in northern Chile. The study confirms that the operation would be one of the world’s lowest-cost producers of lithium carbonate, along with a solid ESG strategy to support a sustainable future.

DFS Highlights:

- The updated Maricunga Stage One Lithium Brine project’s Definitive Feasibility Study (DFS) supports 15,200 tonnes per annum production of lithium carbonate (LCE) for 20 years.

- Project NPV (leveraged basis) of US$1.425B (after tax) at 8% discount rate, providing an IRR of 39.6% and a two-year payback. Estimated steady-state annual EBITDA of US$324M.

- Project operating cost places Maricunga among the most efficient producers, with an estimated OPEX of US$3,718 per tonne not including credit from potassium chloride (KCl) by-product. KCI production was not considered in the DFS.

Click here for the full ASX Release

This article includes content from Lithium Power International, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LPI:AU

Sign up to get your FREE

Lithium Power International Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 December 2021

Lithium Power International

A Pure-Play Mining Company Developing Multiple Lithium Mines

A Pure-Play Mining Company Developing Multiple Lithium Mines Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

Lithium Power International Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00