ACME Lithium Inc. (CSE: ACME) (OTCQX: ACLHF) (the "Company", or "ACME") is pleased to announce that it has entered into option and purchase agreements with Saskatchewan-based Gem Oil Inc. ("Gem Oil") to acquire the Bailey Lake Pegmatite Discovery Area (the "Project Claims"), located in the northeastern region of Saskatchewan, Canada.

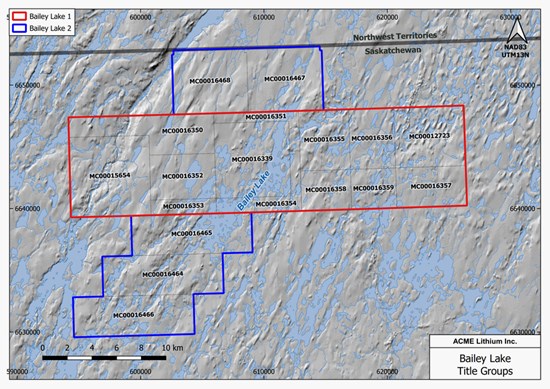

ACME has entered into two agreements, an option ("Option") to purchase a 100% interest in a core block of 13 contiguous mineral claims encompassing 25,900 hectares (or 100 square miles) and a purchase ("Purchase") of five additional contiguous claims comprised of 15,794 hectares (61 square miles). Together, the Project Claims comprise 41,694 hectares (or 161 square miles).

Highlights:

The large Project Claims area contains multiple indications of spodumene-bearing pegmatites with potentially economic grade lithium

Spodumene-bearing pegmatites with evolved mineralogy are found on surface in outcrop and boulder trains.

Historical reported sampling by Gem Oil includes up to 3950 ppm Li in the Bailey Lake region

Historical reported sampling by the Saskatchewan Geological Survey includes results up to 3470 ppm Li at Misaw Lake region to the east of Bailey Lake

Till sampling in the region by the Saskatchewan Geological Survey reported numerous sites with elevated lithium and lithium pegmatite associated elements.

The geological setting, granitic suite characteristics, evolved pegmatite characteristics, occurrence of float with potentially economic lithium grades, and absence of extensive historical exploration in the region is strongly encouraging for exploration expansion in this discovery area.

The Project Claims cover lithium occurrences in glacial float boulder trains near Bailey and Misaw Lakes underlain by granitic rocks of the Hudson suite that were emplaced from 1840-1818 Ma and the Nueltin suite dated at 1770-1730 Ma.

An initial interpretation for the Bailey Lake region is an albite spodumene or rare element spodumene type pegmatite in outcrop and boulder trains, and,

The Misaw Lake region contains a rare element complex lepidolite type pegmatite boulder train.

Figure 1: Banded pegmatite Boulder- Spodumene bearing, Gem Oil

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/7776/147599_d701767dd4a1c8b9_002full.jpg

Bailey Lake Region

A boulder train in the Bailey Lake region is characterized by glacial erratics that are locally spodumene-bearing. A rounded boulder of coarse-grained porphyritic leucocratic granite has large alkali-feldspar in a medium-grained groundmass of quartz, plagioclase and spodumene with minor muscovite and lepidolite. The boulder assayed 3320 ppm Li, 2060 ppm Rb, 113 ppm Be. The highest value reported from limited sampling by Gem Oil in the Bailey Lake boulder train was 3950 ppm Li based on samples from the boulder train plot in the lithium-cesium-tantalum (LCT) pegmatite field.

Figure 2: Spodumene bearing pegmatite in outcrop, GEM Oil

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/7776/147599_d701767dd4a1c8b9_003full.jpg

Misaw Lake Region

A boulder train has been identified in the Misaw Lake region consisting of pegmatitic K-rich granitic rocks enriched in Rb (2130 ppm), Ta (120 ppm), Nb (51 ppm) and Cs (71 ppm). The boulder train is up-ice from the apparent location of a lepidolite-bearing glacial erratic located by the Saskatchewan Geological Survey in NTS 64M/15 and reported in 2004. The highest value reported from limited sampling by Gem Oil in the Misaw Lake boulder train was 3470 ppm Li from a lepidolite boulder.

Steve Hanson, President and CEO of ACME, states, "ACME has established an aggressive strategy in identifying, acquiring, and exploring high quality lithium properties in both Canada and the United States. The Bailey Lake Pegmatite Discovery area is an underexplored region with great potential and provides an important entry for ACME into the Province of Saskatchewan."

Saskatchewan is a highly prospective region for critical mineral development. The Government of Saskatchewan recently announced an expansion to its existing investment and innovation incentive programs to include eligible lithium projects with the aim to become one of the best resource development jurisdictions in the world. The addition of the Bailey Lake Project Claims to ACME's extensive North American portfolio further positions the Company to advance its goal to provide a domestic supply of lithium to the Canadian and United States markets.

Agreement Terms

ACME may exercise the Option by paying a total of CAD$450,000, issuing a total of 450,000 common shares, and incurring a total of CAD$1,554,000 in exploration and development expenditures over a three-year period. The claims are shown as Bailey Lake group 1 on the following map.

| Date for Completion | Cash Payment | Common Shares | Exploration and Development Expenditures | Earn In |

| Initial Payment | CAD$100,000 | 100,000 | - | - |

| First Year | CAD$150,000 | 150,000 | CAD$388,500 | - |

| Second Year | CAD$200,000 | 200,000 | CAD$518,000 | 70% |

| Third Year | - | - | CAD$647,500 | 100% |

ACME may accelerate any or all the components comprising the Option Price, so as to exercise the Option at any time sooner than stated in the agreement.

Gem Oil will retain a 2% Net Smelter Returns Royalty ("NSR"), of which ACME may at any time and from time to time during the 24 months following the date of exercise of the Option buy-down or purchase up to one-half of the Royalty (1% NSR) by paying Gem Oil the sum of $2,000,000 for each one-half of one percent (0.5% NSR), for a maximum cost of $4,000,000, thereby reducing the Royalty in favor of the Holder to a minimum of one percent (1%) NSR.

ACME has also entered into a Purchase agreement with Gem Oil to acquire 5 additional Bailey Lake claims comprising of 15,794 hectares for the sum of $9,476.28 and the grant of a 1% NSR. These five claims are shown as Bailey Lake group 2 on the following map.

Figure 3: Core claim area red, with additional claim areas contiguous to the north and south in blue

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/7776/147599_d701767dd4a1c8b9_004full.jpg

Qualified Person

Mr. Dane A. Bridge, P.Geol., a "Qualified Person" (as defined in NI 43-101 -Standards for Disclosure for Mineral Projects) and a Senior Consultant to the Company, has reviewed and approved the technical disclosures in this news release.

About ACME Lithium Inc.

Led by an experienced team, ACME Lithium is a mineral exploration company focused on acquiring, exploring, and developing battery metal projects in partnership with leading technology and commodity companies. ACME has acquired or is under option to acquire a 100-per-cent interest in projects located in Clayton Valley and Fish Lake Valley, Esmeralda County Nevada, and at Shatford, Birse, and Cat-Euclid Lakes in southeastern Manitoba.

On behalf of the Board of Directors

Steve Hanson

Chief Executive Officer, President and Director

Telephone: (604) 564-9045

info@acmelithium.com

Neither the CSE nor its Regulations Service Providers accept responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statement

This news release may contain forward-looking information within the meaning of applicable securities laws ("forward-looking statements"). Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur and in this news release include but are not limited to the attributes of, timing for and expected benefits to be derived from exploration, drilling or development at ACME's project properties. Information inferred from the interpretation of drilling, sampling and other technical results may also be deemed to be forward-looking statements, as it constitutes a prediction of what might be found to be present when and if a project is actually developed. ACME's project location adjacent to or nearby lithium projects does not guarantee exploration success or that mineral resources or reserves will be defined on ACME's properties. Exploration, development, and activities conducted by regional companies provide assistance and additional data for exploration work being completed by ACME. These forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements, including, without limitation: risks related to fluctuations in metal prices; uncertainties related to raising sufficient financing to fund the planned work in a timely manner and on acceptable terms; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; risk of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; the risk of environmental contamination or damage resulting from the Company's operations and other risks and uncertainties. Any forward-looking statement speaks only as of the date it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/147599