- WORLD EDITIONAustraliaNorth AmericaWorld

May 31, 2022

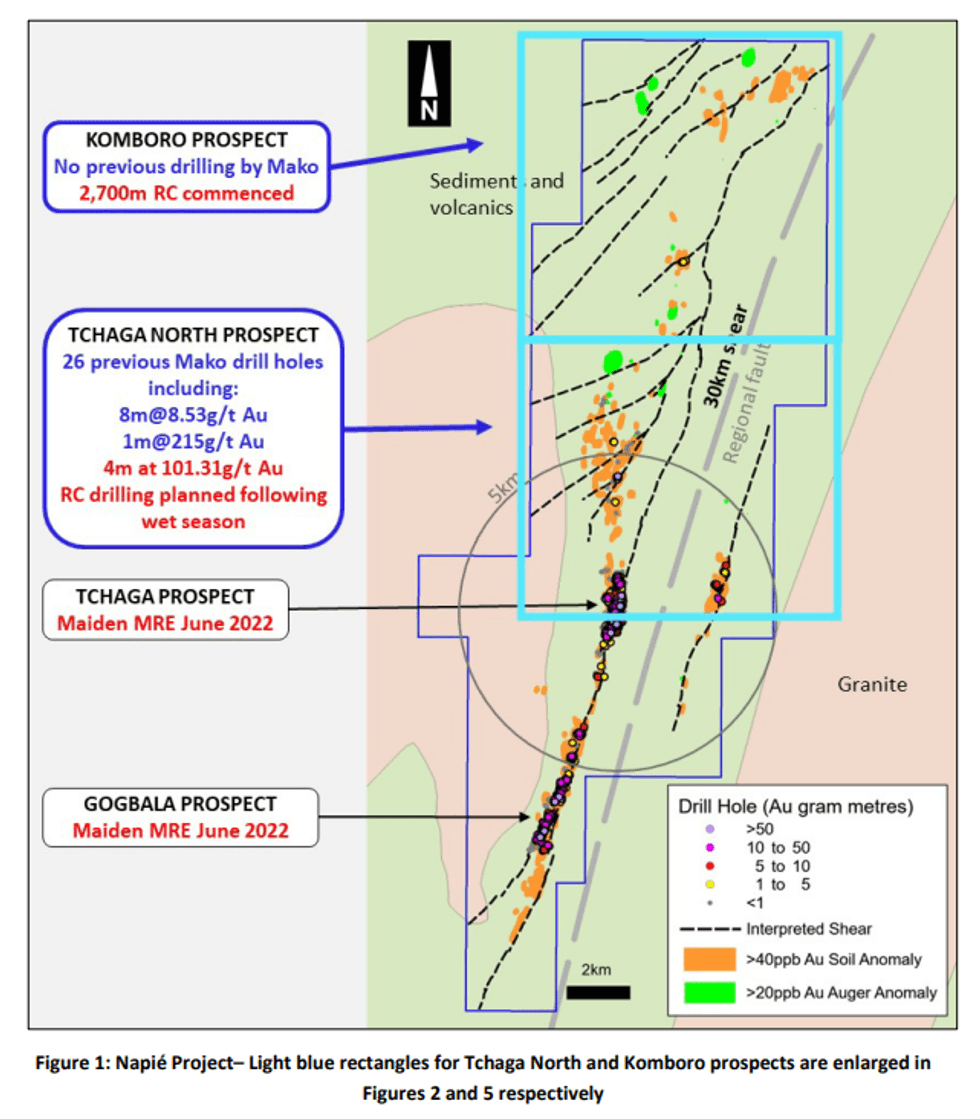

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) advises that it has received all assay results from the recent shallow aircore (AC) drilling program from the Tchaga North and Komboro prospects, within the Company’s flagship Napié Project in Côte d’Ivoire1 . Tchaga North and Komboro are located on a +23km soil anomaly and coincident 30km-long Napié Fault (Figure 1). The average depth of the holes is 28m with all holes ending within the oxide zone. Samples were composited to 4m intervals.

HIGHLIGHTS

- Aircore (AC) drill results received from Tchaga North Prospect with assays up to 4m at 101g/t Au

- Tchaga North and Komboro are high priority regional prospects located on the +23km soil anomaly and coincident 30km-long Napié Fault at Mako’s flagship Napié Gold Project in Côte d’Ivoire

- RC drilling planned at Tchaga North on 2km-long high-priority target following wet season

- 2,700m drill program commenced at Komboro Prospect at Napié Project

- High-priority targets identified from AC drilling, geological mapping and rock chip sampling and 9km-long current and historic artisanal mining sites

- No previous RC drilling on zone of artisanal mining

- Strategy for drilling Komboro and Tchaga North is to identify new areas for resource drilling following maiden Mineral Resource Estimate (MRE) on Tchaga and Gogbala prospects to underpin broader strategy of identifying a multi-million-ounce deposit on the Napié Project

- Maiden MRE for Tchaga and Gogbala on track for delivery by mid-June 2022

Mako’s Managing Director, Peter Ledwidge commented:

“We are delighted with the results of aircore drilling at the Tchaga North Prospect with assays up to 4m at 101g/t Au. The results received from the aircore drilling in conjunction with our mapping and rock chip sampling has identified a 2km-long high-priority mineralised area which we will RC drill test following the current wet season.

Drilling has commenced at the highly prospective Komboro Prospect within the growing expanse of our Napié Project. We are very excited by the compelling targets we are drilling, which are generated from geological mapping, rock chip sampling and aircore drilling.

Recent geological mapping has identified new and historic artisanal sites which intermittently align over a 9km strike length, largely the focus of our current drilling program at Komboro, underpinning our belief in the district scale potential at Napié”.

Intervals above 0.25g/t Au cut-off are reported in Appendix 1.

A table and map of the drill hole locations are shown in Appendix 2.

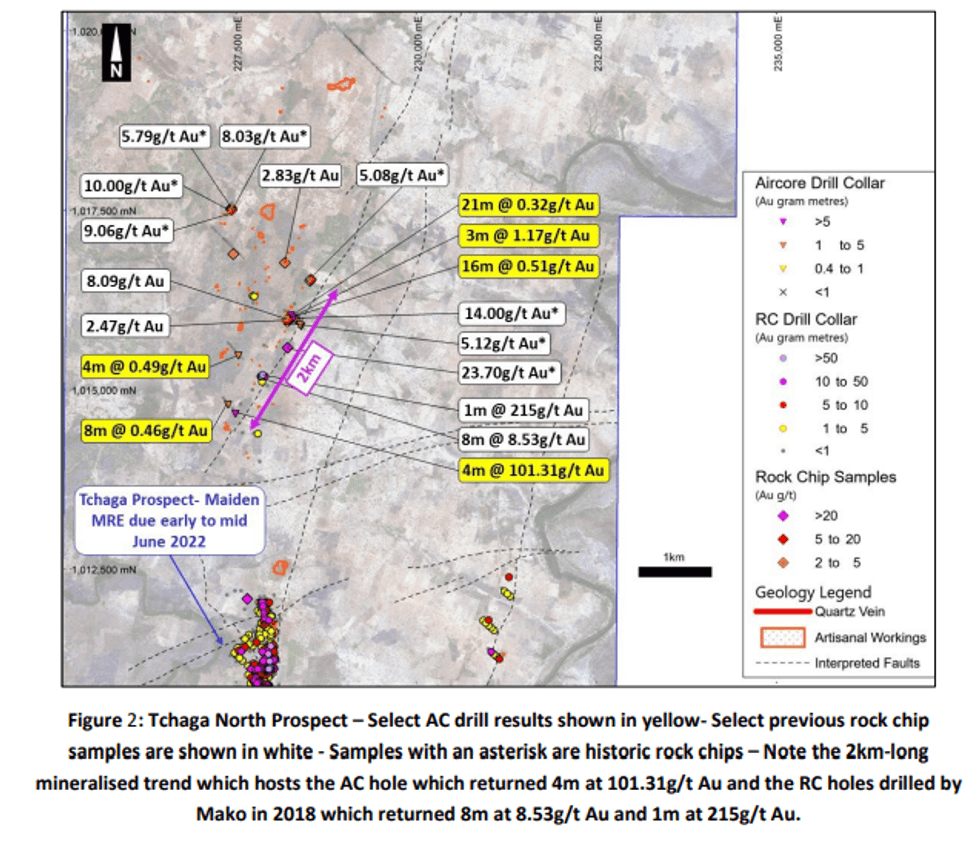

Results have been received from 151 shallow AC holes drilled on six targets at Tchaga North from a costeffective scout drilling program1 .

A 2km-long gold mineralised zone (purple arrow on Figure 2) has been identified where AC drilling returned up to 4m at 101.31g/t Au and previous RC drilling by the Company in 2018 returned 8m at 8.53g/t Au and 1m at 215g/t Au with visible gold2 (Figures 3 and 4). This zone lies 2km north of the Tchaga Prospect on our Napié Project which continues to deliver district scale potential.

In addition, historic rock chip sampling in the 2km mineralised zone returned results which include 23.70g/t Au, 14.00g/t Au, 8.09g/t Au and 5.12g/t Au3 .

Click here for the full ASX Release

This article includes content from Mako Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

3h

Peruvian Metals Closes Private Placement

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce the closing of its non-brokered private placement (the "Offering") previously announced on January 29, 2026. Pursuant to the Offering, the Company issued an aggregate of 10,000,000 units... Keep Reading...

5h

Blackrock Silver Commences 17,000 Metre Two-Phased Expansion Drill Programs at Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") announces the mobilization of drill rigs for two major resource expansion drill campaigns at the Tonopah West project ("Tonopah West") located along the Walker Lane Trend in Nye and Esmeralda... Keep Reading...

16h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

16h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

20h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

23h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00