- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

June 22, 2025

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”) is pleased to announce the initial visual estimations from the reconnaissance exploration program at the Douala Basin HMS Project, Cameroon. Desktop studies incorporating detailed geological mapping, geophysics, and known mineral occurrences, were used to define initial, high priority targets for ground- truthing. The reconnaissance programme, which consisted of hand auger and channel sampling, was successful in identifying high estimated concentrations of heavy mineral (HM) mineralisation across all the six tenements that make up the project. Additionally, the Company’s consultants have observed the presence of natural rutile grains within panned concentrates.

HIGHLIGHTS

- The Company’s reconnaissance auger and channel sampling programme has been completed at the Douala Basin HMS Project

- Reconnaissance sampling undertaken across the 6 Douala Basin tenements has identified thick zones of high estimated concentrations of heavy minerals (HM) as well as natural rutile

- Work at the Douala Basin Project followed up on historical HM occurrences identified by previous Eramet drilling, as well as priority areas identified through the Company’s internal reviews

- Samples collected from the reconnaissance program are due to be submitted for laboratory analysis in the coming weeks, with results expected in the September quarter

- At Douala Basin, exploration will transition to a detailed campaign of auger drilling

Samples collected from this initial exploration programme are currently being prepped for dispatch to the Company’s laboratory for analysis in South Africa, with results expected in the September quarter.

Technical Consultant, Cliff Fitzhenry, commented: “While the Company’s primary focus is on the Central Rutile Project, where we have recently reported the presence of wide-spread residual natural rutile mineralisation, we believe that the Douala Basin HMS project has significant potential. The reconnaissance programme has over the last few weeks demonstrated the potential of the area, with the identification of high concentrations of visible heavy mineral sands across the project tenements through a mixture of auger, channel, and soil sampling work. Pleasingly, we have also observed natural rutile grains at Douala Basin.

We look forward to the assay results of the reconnaissance programme in the coming months.”

Reconnaissance exploration at the Douala Basin HMS Project

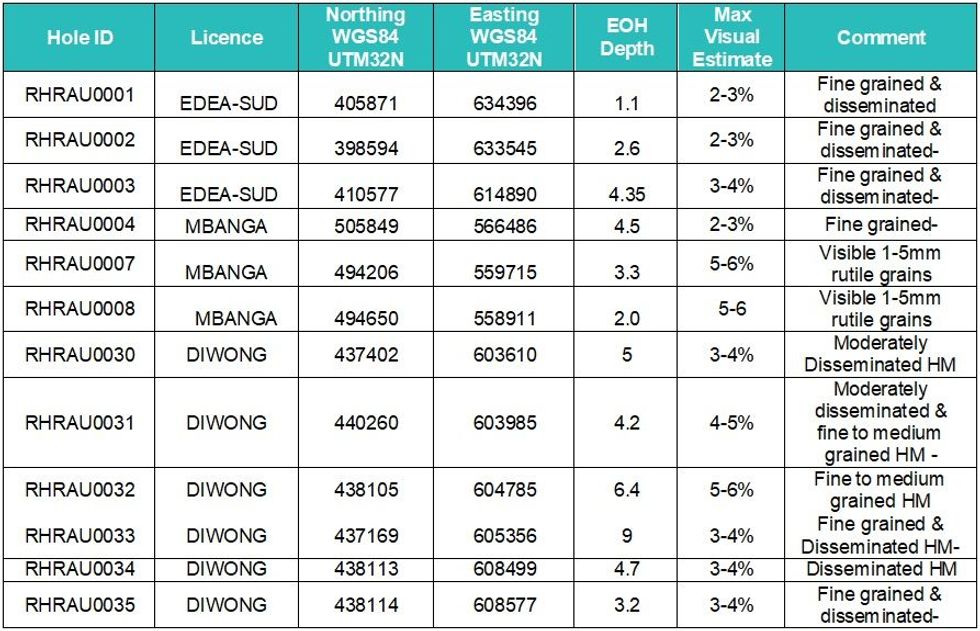

As announced on 5 June 2025, the Company commenced reconnaissance auger and grab sampling programmes at the Central Rutile and Douala Basin HMS projects, Cameroon. At the Douala Basin project, the Company has completed 12 hand auger drill holes (refer Figure 1), collecting 53 samples in the process, as well as collected 38 channel samples from 11 surfaces for analysis (refer Tables 1 & 2).

Cautionary Statement:

The Company cautions that, with respect to any visual mineralisation indicators, visual observations and estimates of mineral abundance are uncertain in nature and should not be taken as a substitute or proxy for appropriate laboratory analysis. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations. Assay results from the drilling and sampling programmes will be required to understand the grade and extent of mineralisation. Initial assay results are expected in August 2025.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

05 March

Top Australian Mining Stocks This Week: OD6 Metals Shines on US Fluorspar Acquisition

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Critical minerals companies dominate this week’s list, with OD6 Metals emerging as the top gainer.The Northern Territory government... Keep Reading...

26 February

Top Australian Mining Stocks This Week: European Resources Soars on Rare Earth Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Gold, lithium and copper companies continue to dominate our top ASX stocks of the week. This week, the Northern Territory's Minister... Keep Reading...

25 February

China's Rare Earths Export Ban Hits Japanese Defense Sector

China has moved to freeze exports of rare earth magnets and other critical materials to dozens of major Japanese companies, with the measures to take effect immediately.China’s commerce ministry said Tuesday (February 24) that it will suspend shipments of so-called “dual-use” goods — referring... Keep Reading...

24 February

Application to Trade on OTCQB Market

Altona Rare Earths plc (LSE: REE), the critical raw materials exploration and development company focused on Africa, is pleased to announce that it has applied for its ordinary shares to be admitted to trading on the OTCQB Venture Market in the United States ( "OTCQB").The Company has submitted... Keep Reading...

24 February

Brazil, India Ink Rare Earths Pact to Expand Supply Chain Cooperation

Brazil and India have signed a new agreement to deepen cooperation on rare earths and critical minerals as both countries seek to strengthen supply chains and reduce reliance on trading partners.The non-binding memorandum of understanding, sealed on February 21 during Brazilian President Luiz... Keep Reading...

22 February

LKY Commences Diamond Drilling at Desert Antimony Mine

Locksley Resources (LKY:AU) has announced LKY Commences Diamond Drilling at Desert Antimony MineDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00