September 11, 2024

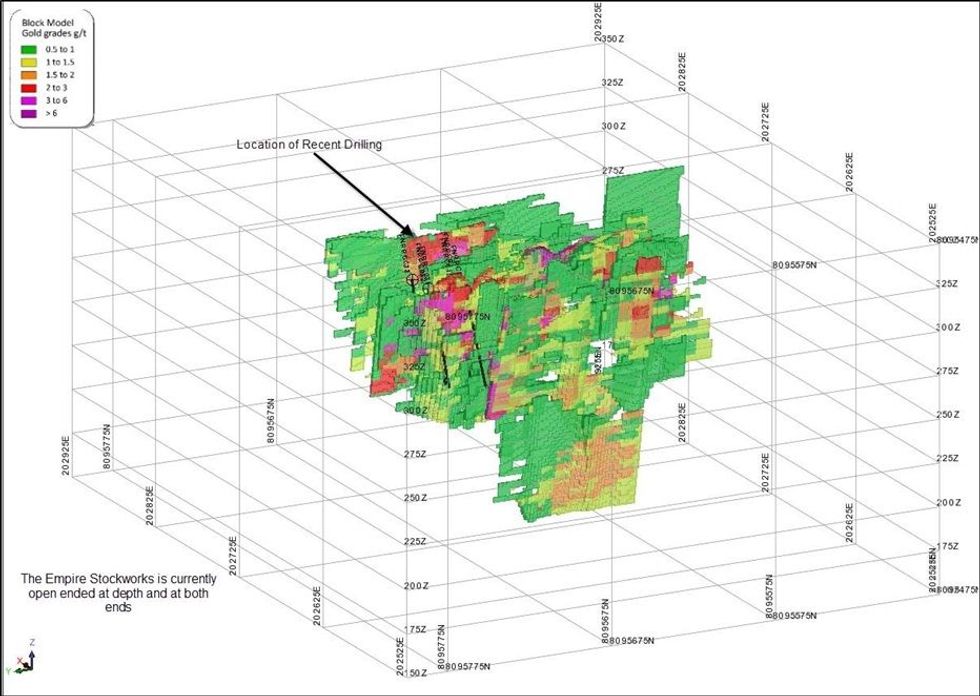

Far Northern Resources (ASX:FNR) (FNR or the Company) is pleased to report that a recent targeted drilling program at the Empire Mining Lease confirmed the presence of a zone in the primary vein at the northern end of the Empire Stockworks consisting of a high-grade gold zone (>3 g/t Au refer to Figure 1). The zone is within the greater Empire Stockworks gold system, with mineralisation open at depth and along strike.

Highlights

- FNR has recently completed a small RC drilling program at the Empire gold deposit. The program was designed to update and infill the 2020 resource model (see pp 28 to 36 of the Company’s Prospectus lodged with ASX on 10 April 2024 and provide a potential starting point for future mining operations.

- Assays from all 6 drill holes intercepted the high-grade quartz veins that formed the basis of the previous modeling.

4m @ 1.24g/t Au from 28m in FNRRC031

(incl. 1m @ 2.90 g/t Au)

1m @ 1.20g/t Au from 43m in FNRRC031

1m @ 1.01g/t Au from 13m in FNRRC032

3m @ 0.93g/t Au from 50m in FNRRC032

1m @ 14.96g/t Au from 9m in FNRRC033

1m @ 9.05g/t Au from 44m in FNRRC033

1m @ 2.49g/t Au from 11m in FNRRC034

8m @ 3.03g/t Au from 18m in FNRRC034 (incl. 5m @ 4.31 g/t Au)

1m @ 1.32g/t Au from 32m in FNRRC034

1m @ 1.02g/t Au from 41m in FNRRC034

1m @ 2.80g/t Au from 0m in FNRRC035

1m @ 1.45g/t Au from 11m in FNRRC035

1m @ 1.24g/t Au from 14m in FNRRC035

6m @ 1.23g/t Au from 29m in FNRRC035

1m @ 1.30g/t Au from 32m in FNRRC036

- These results will provide further data to the known resources at the Empire Stockwork. and an updated model. This will enable FNR to update the resource and economic modelling at the current gold prices, with a view to moving into future feasibility studies

- FNR is in a unique position with a mill located less than 20km away from the current mining lease.

- FNR will continue to advance the project.

Commenting on the initial assays results the board of Far Northern Resources Ltd, said.

“We are pleased with the assays from the Mining Lease as it will add critical data to the resource model at Empire that is open at depth and in all directions. FNR has been exploring this area for some time and it is pleasing to release some very exciting new gold results from our 2024 drilling campaign that clearly show there is a much bigger picture at play at our Empire Project. We are excited to now have the funding to continue to drill out and model what has the potential to be FNR’s first mine.”

Click here for the full ASX Release

This article includes content from Far Northern Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FNR:AU

The Conversation (0)

23 June 2025

Bridge Creek Phase 1 Assays

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 AssaysDownload the PDF here. Keep Reading...

21 May 2025

Bridge Creek Phase 1 Assay Composites Received

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 Assay Composites ReceivedDownload the PDF here. Keep Reading...

29 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Far Northern Resources (FNR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

08 April 2025

Drilling to Commence on Bridge Creek Mining Lease

Far Northern Resources (FNR:AU) has announced Drilling to Commence on Bridge Creek Mining LeaseDownload the PDF here. Keep Reading...

17 February 2025

Amended Appendix 5B

Far Northern Resources (FNR:AU) has announced Amended Appendix 5BDownload the PDF here. Keep Reading...

19h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00