January 21, 2025

Terra Balcanica Resources Corp. (“Terra” or the “Company”) (CSE:TERA; FRA:UB10) is pleased to announce strong assay results from a new discovery at the Brezani target within its principal Viogor-Zanik project in eastern Bosnia and Herzegovina.

Highlights

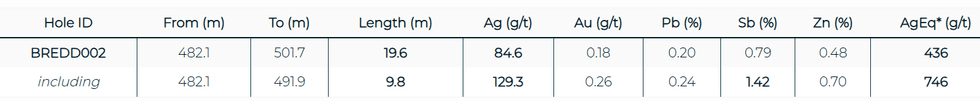

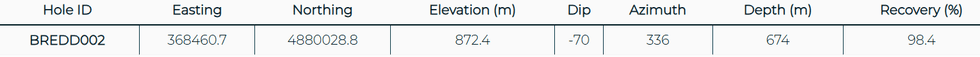

- Drillhole BREDD002 returned 436 g/t AgEq over 19.6 m including 746 g/t AgEq and 1.42 wt.% Sb over 9.8 m;

- Another mineralization style confirmed at Brezani in addition to the gold skarn with 0.61 g/t AuEq over 88.0 m from surface (see Company’s news release dated 24th January 2023);

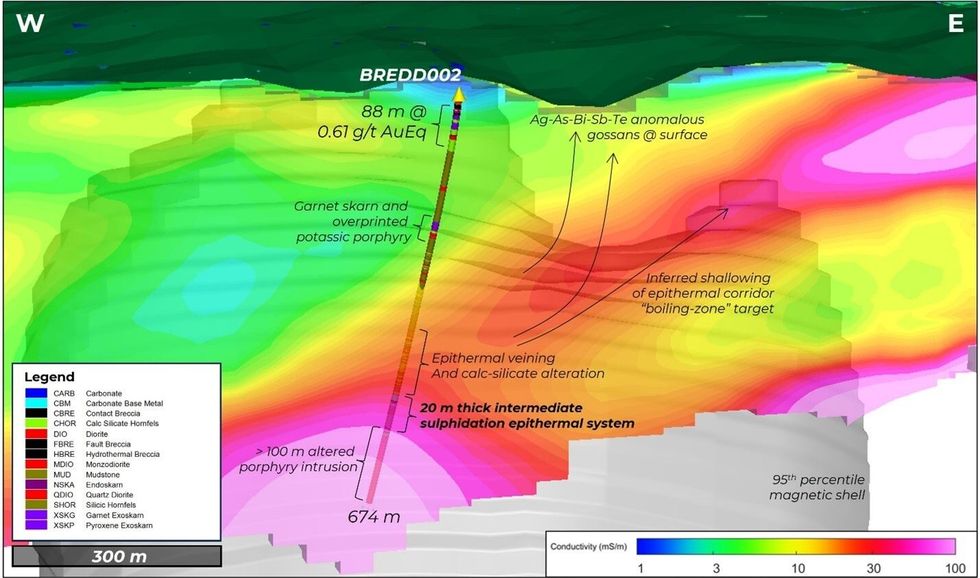

- Mineralization trends towards surface and daylights in a topographic depression with As-Bi-Sb-Te anomalism in soil samples with a shallow “boiling-zone” drill target (Figure 1);

- 4 shallow drillholes, aimed at expanding the footprint of the gold skarn have been completed within the > 800 m strike length gold in soil anomaly, with assay results pending.

Terra Balcanica CEO, Dr. Aleksandar Mišković, comments:

" We are very pleased with the polymetallic assays from an interval thrice as wide as that average reported at our other Viogor-Zanik target at Cumavici. Not only have we discovered a new type of mineralization that shallows toward northeast, and as such could be easily explored from top down, but we have also confirmed the significant presence of antimony at Brezani which continues to be a scarce commodity worldwide due to supply issues and trade restrictions imposed on certain countries. Now, the drill-confirmed surficial Au bearing skarn is confirmed to be underlain by the significant fault-hosted polymetallic mineralization which itself is underpinned by andesitic porphyry. It is encouraging to see this resulted from the very first drill hole leaving a lot of upside potential at Brezani as Terra releases additional assays from the four shallower intercepts drilled into the surficial skarn."

Drillcore Observations

Watch Brezani Technical Webinar on YouTube.

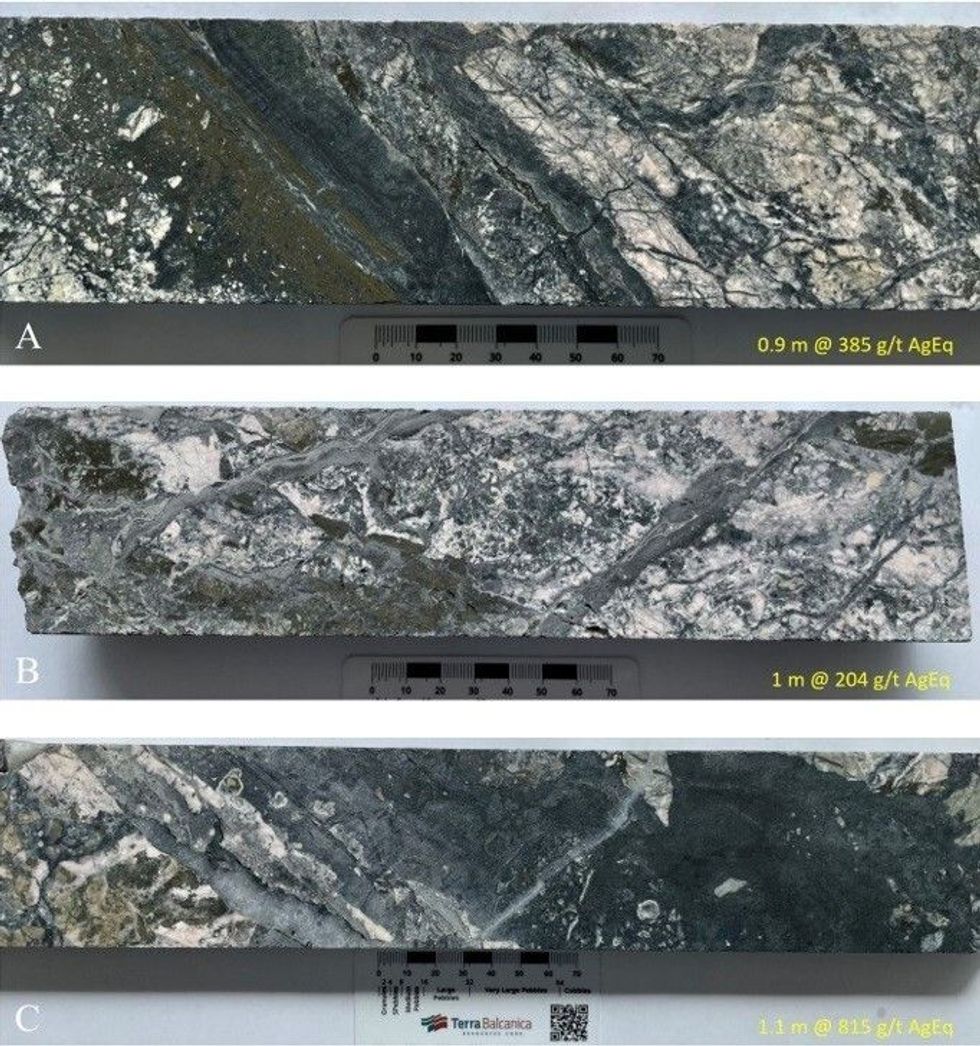

The zone of mineralization from 482.1 m consists of banded veins and sulphide cemented breccias with characteristics of both low and intermediate sulphidation epithermal deposits. The upper vein contact is sharp with minimal alteration progressing into the hornfels, whereas the vein footwall is brecciated and hosts strong clay alteration. The margins of the vein host repeating bands of chalcedonic quartz-rhodochrosite-calcite and sulphides/sulphosalts stibnite-pyrite-arsenopyrite-sphalerite-galena-jamesonite (Figure 2). The centre of the structure is dominated by hydrothermal breccia with a sulphide-quartz-carbonate cement. Clasts are banded vein fragments.

Future Exploration Program

2023 drilling at the Brezani target uncovered a new style of mineralization at the contact between the skarn-hornfels package and underlying chlorite-sericite altered diorites. The epithermal mineralization encountered 482.1 m downhole is interpreted to shallow to the ENE creating a conductivity feature which passes through a magnetic low. A topographic low with an anomalous epithermal assemblage in soil and rock chip geochemistry is interpreted as the surface expression. Future drilling efforts will aim to intersect the epithermal mineralization shallow and explore for a “boiling zone” where precious metals may have been favourably precipitated.

QA/QC

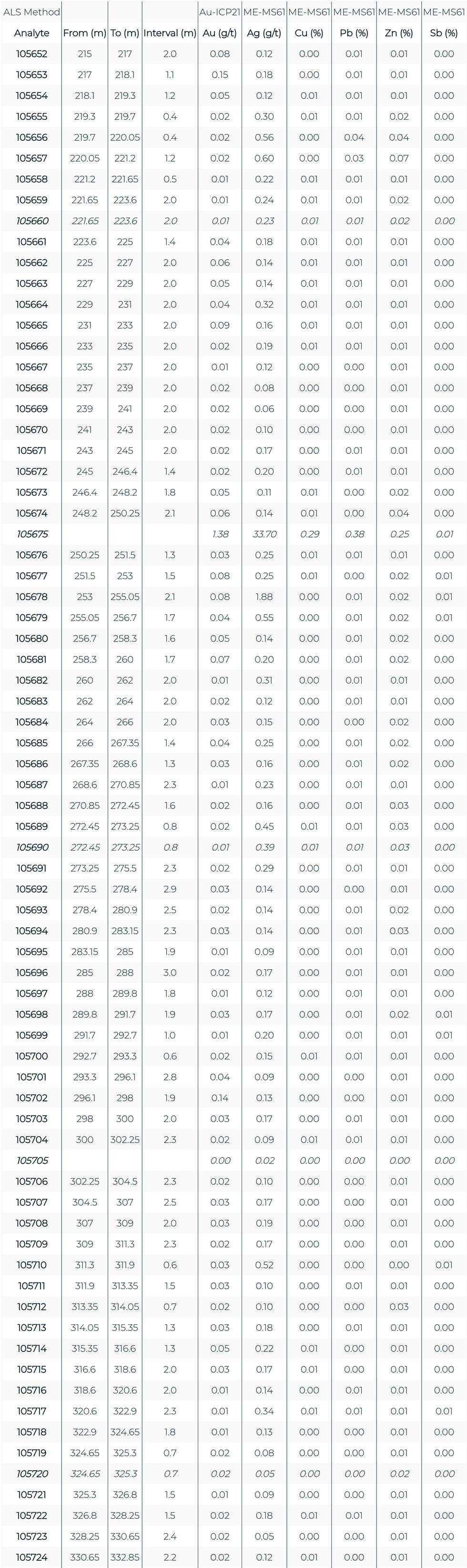

Half core (HQ3) samples were delivered to ALS Bor, Serbia for sample preparation and subsequent wet chemical analysis at the Loughrea laboratory in Ireland, an ISO/IEC 17025:2017 certified test facility. Sample preparation PREP-31BY method involved crushing the core to 70% less than 2 mm, rotary split 1.0 kg and pulverizing the split to greater than 85% passing 75 microns. Silver and base metals were analysed by ICP MS after a four-acid digest (ME-MS61). Gold was assayed by 30g fire assay with ICP AES finish (Au-ICP21). Over limit samples for base metals were re-analysed by the four-acid digest ICP-AES analyses termed ME-OG62. Control samples comprising the certified reference material CDN-ME-1810 (Canadian Resource Labs Ltd.), quarter core field duplicates and blanks were inserted at a rate of 9 % and investigated as part of the Company’s quality assurance and quality control program.

Qualified Person

Dr. Aleksandar Mišković, P.Geo, the Company’s designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”), has reviewed and validated that the information contained in this news release is factual and accurate.

About the Company

Terra Balcanica is a polymetallic and energy metals exploration company targeting large-scale mineral systems in the Balkans of southeastern Europe and norther Saskatchewan, Canada. The Company has 90% interest in the Viogor-Zanik Project in eastern Bosnia and Herzegovina. The Canadian assets comprise a 100% optioned portfolio of uranium-prospective licences at the outskirts of the world-renowned Athabasca basin: Charlot-Neely Lake, Fontaine Lake, Snowbird, and South Pendleton. The Company emphasizes responsible engagement with local communities and stakeholders. It is committed to proactively implementing Good International Industry Practice (GIIP) and sustainable health, safety, and environmental management.

On Behalf of the Board of Directors

Terra Balcanica Resources Corp.

“Aleksandar Mišković”

Aleksandar Mišković

President and CEO

For further information, please contact Aleksandar Mišković at amiskovic@terrabresources.com, +1 (514) 796-7577, or visit our website at www.terrabresources.com/en/news.

Cautionary Statement

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of any of the words “will”, “intends” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct. The Company does not undertake to update these forward-looking statements, except as required by law.

TERA:CC

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00