- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

January 05, 2025

Provaris Energy Ltd (Provaris; ASX:PV1) is pleased to advise the collaboration with Uniper Global Commodities SE (Uniper) and Norwegian Hydrogen AS has advanced to the execution of a conditional Term Sheet for the supply, transport and offtake of RFNBO compliant hydrogen. The Term Sheet provides the basis of negotiating a binding Hydrogen Sale and Purchase Agreement (Hydrogen SPA) which is targeted for June 2025.

Highlights:

- Provaris, Uniper and Norwegian Hydrogen sign a conditional Term Sheet for hydrogen supply, transport and offtake.

- Agreed Key Terms and Conditions to form the basis of negotiating a binding Hydrogen SPA, targeted for June 2025.

- Annual volume of 42,500 tonnes per year of RFNBO1-certified hydrogen to be delivered as gaseous compressed hydrogen using Provaris’ H2Neo carriers.

- Uniper Global Commodities SE will be the buyer of hydrogen at an agreed fixed price and responsible for the receiving terminal in North-Western Europe for delivery.

- Commencement of cargos deliveries is targeted for early-2029, for a minimum term of 10-years, making it Europe’s first regional hydrogen marine transport project at scale.

- Term Sheet for supply of hydrogen using Provaris carriers demonstrates Uniper’s commitment to a portfolio of supply sources, including a focus on supply from the Nordic Region.

- Provaris’ approach to hydrogen supply and transport provides a standardized, efficient and flexible approach to scaling hydrogen supply, which is exactly what Germany and Europe needs to meet its 2030 decarbonisation targets.

Execution of the Term Sheet achieves a significant milestone under the Memorandum of Understanding (MOU), announced in August 2024, and facilitates ongoing co-operation on developing hydrogen supply chains based on Provaris’ compressed hydrogen carriers from Norway and other potential Nordic sites to import locations in North- Western Europe.

Provaris’ Managing Director and CEO, Martin Carolan, stated: “We are delighted to see the collaboration has progressed to a Term Sheet for hydrogen supply and offtake. This represents a key milestone for Provaris and validation towards developing regional bulk-scale hydrogen supply chains within Europe using Provaris’ H2Neo compressed hydrogen carriers.”

Norwegian Hydrogen CEO, Jens Berge, added: “We’re very excited about this tri-party collaboration, and it’s rewarding for all three parties to see our efforts progress into increasingly concrete and advanced stages”

Uniper Global Commodities SE, Senior Vice President - New Energies Origination, Benedikt Messner, commented: “We think that the innovative transport concept by Provaris might be a solution to connect commercially interesting hydrogen supply locations with our core markets and look forward to the continuation of our collaboration.”

Compression Replaces Complexity with Simplicity to Lower the Delivered Cost of Hydrogen

Analysis by the collaboration partners has highlighted that when customer demand is for hydrogen (not a derivative), regionally sourced hydrogen from the Nordics, transported through Provaris’ compressed hydrogen carriers, provides an efficient and cost-effective supply chain, limiting the losses in the entire chain from electrolyzer through to the distribution pipeline in Europe.

Lowering the energy consumption over the entire supply chain results in more renewable energy available for hydrogen production and higher volumes delivered.

Hydrogen Supply Chain Development

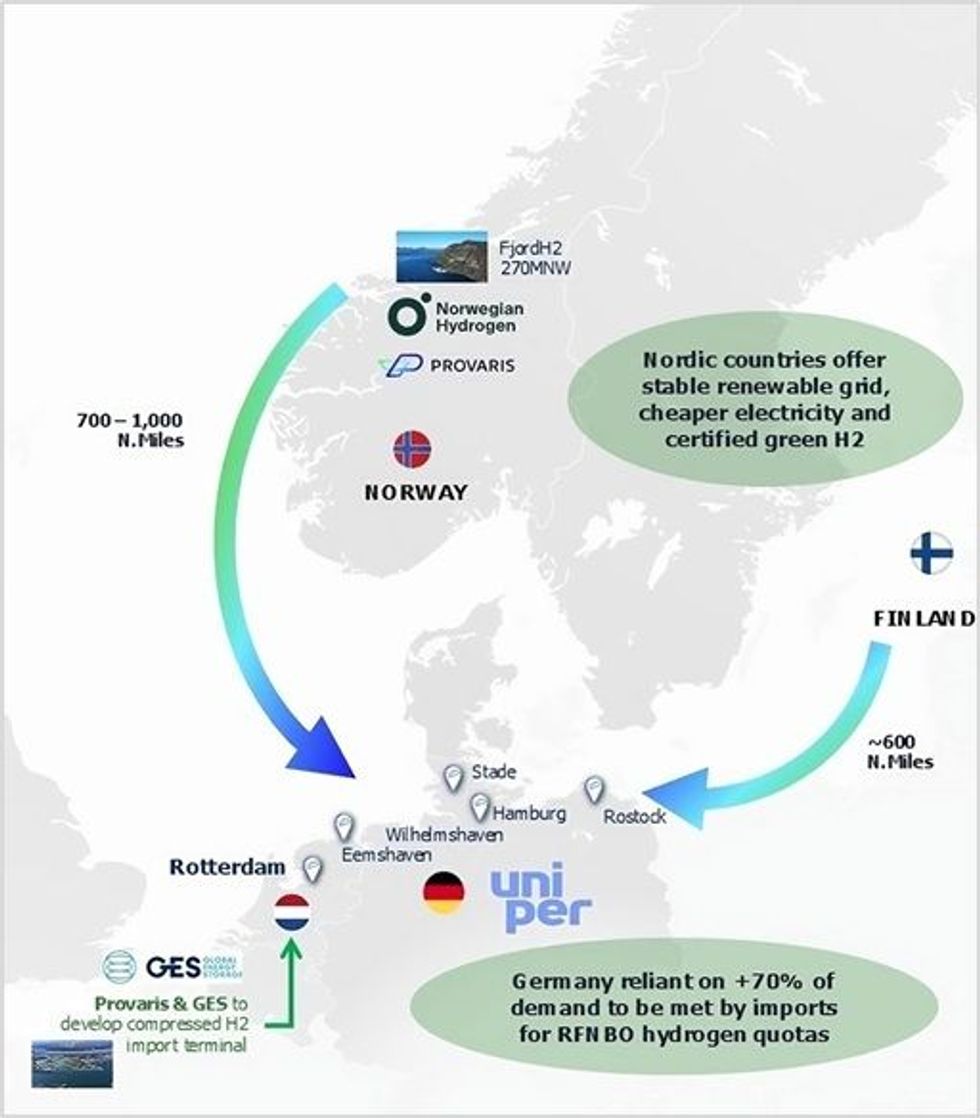

Provaris and Norwegian Hydrogen are collaborating on the development of the supply of RFNBO compliant hydrogen, which will be stored and transported using Provaris’ H2Neo carriers. Work is underway to outline the preferred sites in the Nordics, including Norway and Finland. Sites with a detailed feasibility include the FjordH2 Project located in the Alesund region, Norway.

Based on the proposed hydrogen volumes and shipping distance, the supply chain’s storage and shipping infrastructure using Provaris’ proprietary shipping solutions will include one (1) H2Leo barge storage at the production site, with a capacity of 450 tonnes of compressed hydrogen at 250 barg pressure, and two (2) H2Neo hydrogen carriers with an individual storage capacity of 450 tonnes of compressed hydrogen at 250 barg pressure. Provaris continues to progress both the H2Neo and H2Leo towards Final Class approvals in the first half of 2025.

Uniper will be responsible for the selection and development of the import terminal and are working with Provaris to outline the capital and operating equipment to discharge the H2Neo carriers, which includes an assessment of optimal storage and connection to the European Hydrogen Backbone for distribution to industrial sectors. Simplicity of port infrastructure provides for the flexibility of nominating one or more entry ports.

The Term Sheet remains conditional upon, among others, the negotiation and execution of a fully termed Hydrogen SPA and obtaining all necessary approvals.

Illustration of the Regional Supply locations from the Nordic Region into North-West European ports with hydrogen import development plans linked to the future development of Germany’s core hydrogen network

Click here for the full ASX Release

This article includes content from Provaris Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PV1:AU

Sign up to get your FREE

Provaris Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 May 2025

Provaris Energy

Enabling the scale-up of clean energy supply chains through innovative hydrogen and CO2 storage and transport solutions.

Enabling the scale-up of clean energy supply chains through innovative hydrogen and CO2 storage and transport solutions. Keep Reading...

04 March

Funding to Advance 2026 Development Milestones

Provaris Energy (PV1:AU) has announced Funding to Advance 2026 Development MilestonesDownload the PDF here. Keep Reading...

02 March

Trading Halt

Provaris Energy (PV1:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 February

Appendix 4D & Half-Year Accounts 31 December 2025

Provaris Energy (PV1:AU) has announced Appendix 4D & Half-Year Accounts 31 December 2025Download the PDF here. Keep Reading...

05 February

LCO2 Tank FEED Achieves Key Milestones

Provaris Energy (PV1:AU) has announced LCO2 Tank FEED Achieves Key MilestonesDownload the PDF here. Keep Reading...

01 February

MOU with Yinson and Himile to Advance LCO2 Tank Production

Provaris Energy (PV1:AU) has announced MOU with Yinson and Himile to Advance LCO2 Tank ProductionDownload the PDF here. Keep Reading...

25 February

Acquisition of Critical Infrastructure Services Platform

European Green Transition plc (AIM: EGT) announces that in line with its strategy set out at IPO, EGT has entered into a share purchase agreement ("SPA") to acquire an established, EBITDA profitable onshore wind turbine operating, maintenance, repairing, and remote monitoring business (the "O&M... Keep Reading...

25 February

CHARBONE confirme de nouvelles commandes en hydrogene UHP et une premiere commande en oxygene UHP aux Etats-Unis

(TheNewswire) Brossard, Quebec, le 25 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

25 February

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

(TheNewswire) Brossard, Quebec, February 25, 2026 TheNewswire - Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

24 February

Carbonxt Secures $500,000 Convertible Note Funding

Carbonxt Group (CG1:AU) has announced Carbonxt Secures $500,000 Convertible Note FundingDownload the PDF here. Keep Reading...

23 February

CHARBONE Presente a la Conference Emerging Growth le 25 fevrier 2026

(TheNewswire) Brossard, Quebec TheNewswire - le 23 février 2026 CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

Latest News

Sign up to get your FREE

Provaris Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00