January 01, 2024

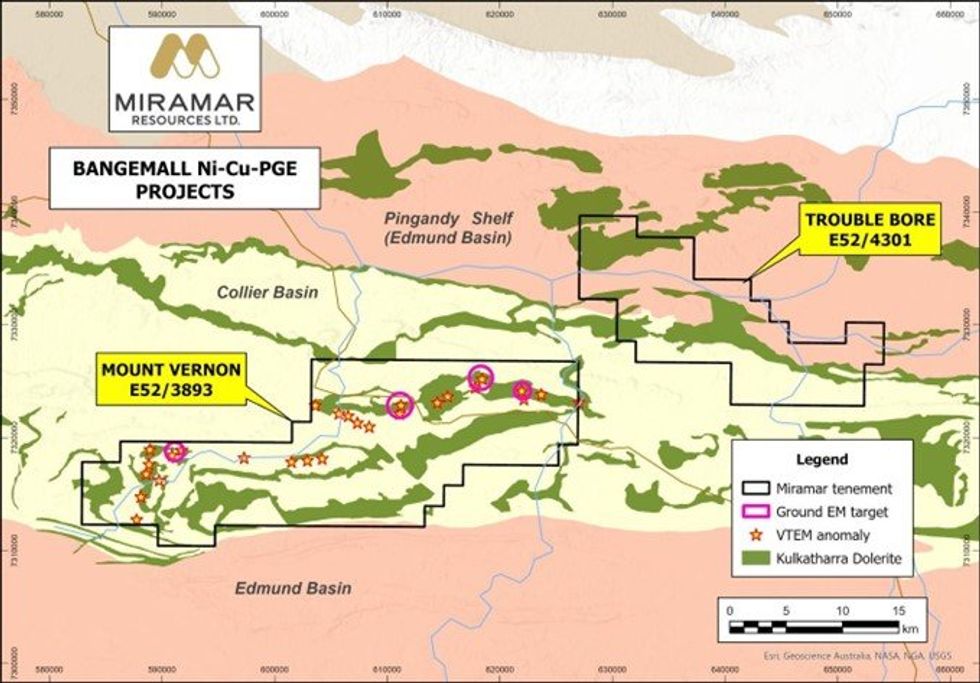

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that it has expanded its 100%-owned Bangemall Project in the Gascoyne Region of WA with the recent grant of Exploration Licence E52/4301, adjacent to the high-priority Mount Vernon Ni-Cu-PGE Project (Figure 1).

- New Exploration Licence granted adjacent to Mount Vernon Project

- Historic EM data highlights multiple anomalies and potential feeder dykes

- Ground EM and RC drilling planned for high-priority Mount Vernon targets

Miramar has a substantial landholding in the Bangemall region and believes there is potential for nickel (Ni), copper (Cu) and platinum group element (PGE) mineralisation related to Kulkatharra Dolerite sills, part of the Warakurna Large Igenous Province and the same age as the Nebo and Babel Ni-Cu deposits.

The new “Trouble Bore” Project contains a number of these dolerite sills, and potential feeder dykes, intruding into sediments of the Collier Basin but has never been effectively explored for Ni-Cu-PGE’s.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company was aiming to show “proof of concept” at Bangemall through the discovery of Ni-Cu-PGE sulphides, either in outcrop and/or through drilling.

“If we are successful at Mount Vernon, it opens up the entire Bangemall region as a new nickel province, one in which we have built a commanding land position,” he said.

Trouble Bore

Exploration Licence E52/4301 (“Trouble Bore”) is located mostly within the Collier Basin and straddles the contact with the older Edmund Basin sediments within the Pingandy Shelf (Figure 1).

Across the southern two thirds of the tenement, the local geology is dominated by Kulkatharra Dolerite sills which intrude into sediments of the Collier Basin (Figure 2). The northwestern portion of the tenement is underlain by sediments of the Edmund Basin, also intruded by a dolerite sill.

Previous exploration is limited and sporadic and focussed mainly on exploration for sediment-hosted copper, lead and zinc during the 1990’s and early 2000’s. More recent exploration since 2009 focussed on the search for channel iron deposits (CID) by Rio Tinto Exploration in the period 2012-2014.

Rio Tinto flew a SkyTEM electromagnetic survey in 2013, with N-S survey lines and a relatively broad line spacing of 1000m, and subsequently drilled three RC holes within the area now covered by E52/4301.

The RC drilling failed to intersect CID mineralisation and Rio Tinto subsequently surrendered the tenements (WAMEX reports a100526, a104395 and a106023).

The SkyTEM data highlights EM anomalies coincident with the EW-trending sub-horizontal dolerite sills as well as two N-S trending anomalies which may represent sub-vertical feeder dykes linking the sills.

Feeder dykes are an important component of the “plumbing systems” associated with Ni-Cu-PGE deposits, as shown in Figure 3.

There is minimal reported surface geochemical data across the Project.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

9h

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

22 January

Red Metal Resources Closes First Tranche of Financing

RED METAL RESOURCES LTD. (CSE: RMES) (OTC Pink: RMESF) (FSE: I660) ("Red Metal" or the "Company") announces that it has closed the first tranche of its previously announced non-brokered private placement financing (the "Offering") (see news releases dated January 7, 2026, and January 19, 2026)... Keep Reading...

22 January

Questcorp Mining and Riverside Resources Chip Channel Sample 30 Meters @ 20 g/t Gold and 226 g/t Silver at the Mexican Union Project

Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the "Company" or "Questcorp") along with its partner Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside"), is pleased to report a high grade interval of 20.2 g/t gold and 226 g/t silver with 2.7% zinc over a 30... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00