July 11, 2024

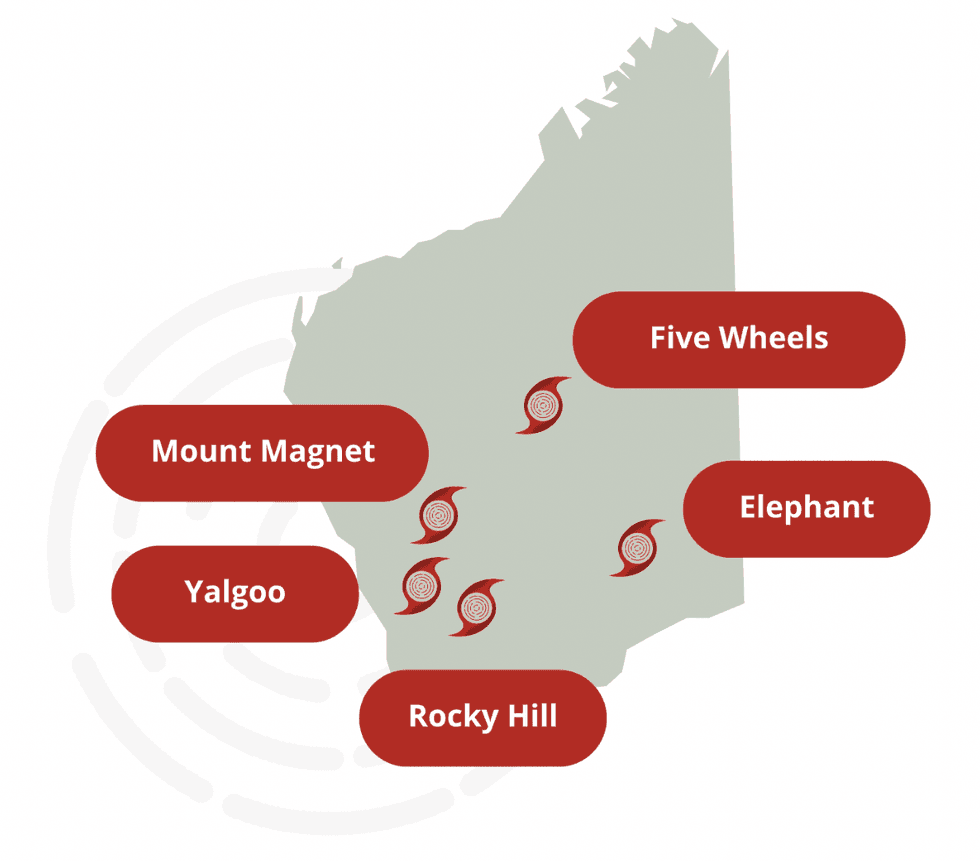

Tempest Minerals (ASX:TEM) is targeting gold, copper, rare earths (REE), lithium and base metals with a diversified portfolio of mineral assets in Australia. The company's five projects are located in prolific territories in Western Australia. The flagship Yalgoo project explores for gold, copper, zinc, silver, iron ore, tungsten, rare earths and more. The Mt Magnet project is focused on gold and REE while the Five Wheels project explores for gold and base metals. The Elephant project targets gold and Rocky Hill for lithium.

The Yalgoo property is a large land package comprising several targets, located in the prolific Yalgoo Region of Western Australia. Following extensive field exploration and a large geophysical survey, Tempest has defined two exceptional targets - Remorse (copper) and Sanity (gold) - which will be the focus of drill programs in the near term. A third drill target, Wrangler (gold), has also been identified in the Mt Magnet project.

Tempest Minerals is headquartered in Perth, Australia.

The Yalgoo property covers more than 1,000 square kilometres and is highly prospective for gold and base metals with world-class potential. It is located four hours from Perth, close to major infrastructure and adjacent to world-class gold and copper mines, including Golden Grove, Minjar, Rothsay, Mt Mulgine and Deflector.

Company Highlights

- Tempest Minerals’ exploration and development projects are primarily located in Western Australia and highlight a multi-commodity strategy in regions with a strong mining history.

- The company’s main strategy is to promote a project pipeline coupled with hands-on exploration methods aimed at identifying high-growth assets.

- Tempest is embarking on a 5,000 metre drilling campaign at the Remorse target at its Yalgoo project that should generate positive news flow and provide near-term support for the stock.

- This year’s work will focus on delineating additional mineralised systems to define larger targets.

This Tempest Minerals profile is part of a paid investor education campaign.*

Click here to connect with Tempest Minerals (ASX:TEM) to receive an Investor Presentation

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00