July 03, 2024

Tempest Minerals Ltd (TEM) is pleased to update the market on the status of planned drilling at the Company’s Remorse Target. TEM has received all the necessary regulatory approvals to commence drilling at the Remorse Target and has completed preparations. TEM expects to commence drilling in mid July 2024 (weather permitting) as Earthworks has been delayed due to inaccessibility as a result of heavy rainfall and partial flooding of the area.

Key Points

- Approvals received for drilling

- Preparation complete and field team ready to commence program

- Earthworks and drilling to commence immediately upon safe weather and ground conditions

Yalgoo Project

Background

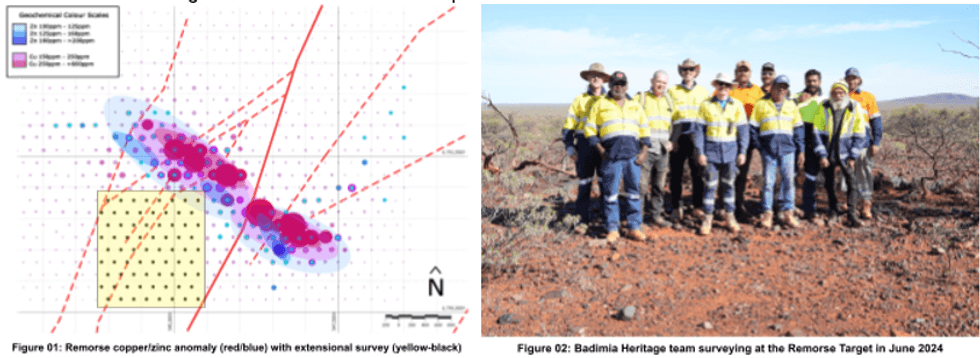

The Remorse Target is located on the eastern side of the Company’s flagship Yalgoo Project. TEM has previously noted the presence of large-scale copper-zinc geochem and geophysical anomalies 1 and the intention to drill test these 2. An extensional geochem survey was also recently completed at the target 3.

Status

All the necessary regulatory approvals to commence drilling at the Remorse Target have been received. TEM continues to work closely with the traditional owners 4 to ensure cultural heritage is respected. All preparation is complete and the Tempest team eagerly awaits ground and weather conditions to improve so Earthworks and drilling can commence as soon as possible.

Next Steps

- Initial 5,000m RC drilling program planned for mid-July

- Results of recent geochem survey expected mid-July

This article includes content from Tempest Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

9h

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

9h

What Was the Highest Price for Gold?

Gold has long been considered a store of wealth, and the price of gold often makes its biggest gains during turbulent times as investors look for cover in this safe-haven asset.The 21st century has so far been heavily marked by episodes of economic and sociopolitical upheaval. Uncertainty has... Keep Reading...

19h

Peruvian Metals Closes Private Placement

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce the closing of its non-brokered private placement (the "Offering") previously announced on January 29, 2026. Pursuant to the Offering, the Company issued an aggregate of 10,000,000 units... Keep Reading...

21h

Blackrock Silver Commences 17,000 Metre Two-Phased Expansion Drill Programs at Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") announces the mobilization of drill rigs for two major resource expansion drill campaigns at the Tonopah West project ("Tonopah West") located along the Walker Lane Trend in Nye and Esmeralda... Keep Reading...

21h

American Eagle Reports Breakthrough Drilling at NAK, Encountering Continuous Mineralization over Previously Untested 1.7 km Trend, Including 901 m of 0.43% CuEq from Surface

Highlights: A broad zone of mineralization intersected within rocks of the Babine porphyry stock, previously interpreted to be barren; NAK mineralized system has significantly expanded. Prospective footprint effectively quadrupled, with porphyry Cu-Au-Mo mineralization now demonstrated... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00