October 20, 2024

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to announce the execution of a non-binding Memorandum of Understanding (MOU) with AGI Development Group Pty Ltd, a part of the Australian Gas Infrastructure Group (AGIG).

HIGHLIGHTS

- Elixir executes MOU with Australian Gas Infrastructure Group (AGIG)

- AGIG is one of the largest gas infrastructure businesses in Australia

- The MOU promotes developing new gas infrastructure for Elixir’s Taroom Trough gas resources

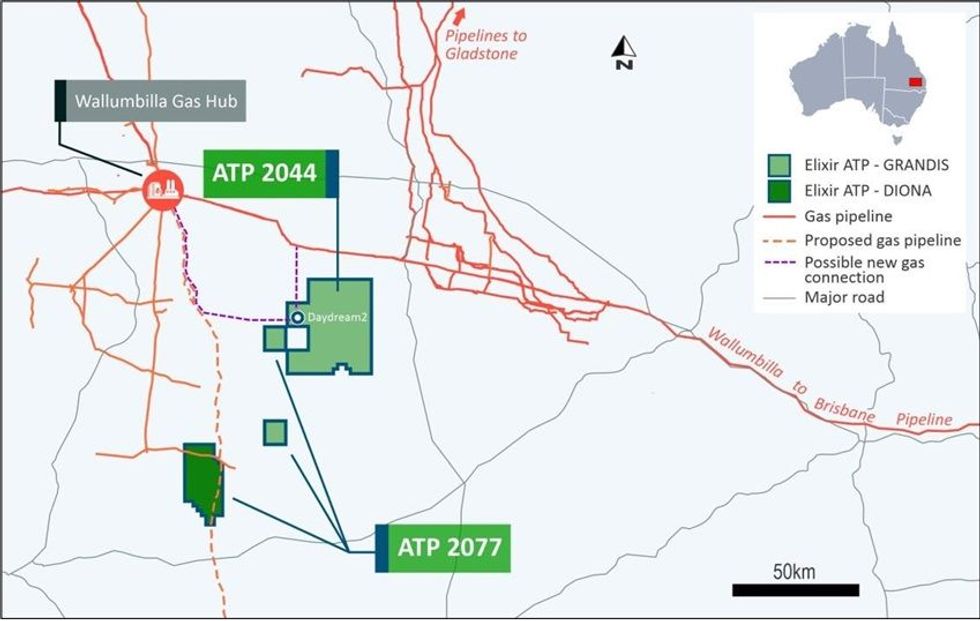

The MOU provides the parties with an initial framework under which to investigate the potential development of gas infrastructure assets to support the possible future production of gas from Elixir’s Grandis Gas Project in the Taroom Trough.

The key elements that the parties will initially consider will be in the areas of a new gas transmission pipeline to the Wallumbilla Hub; processing and compression facilities; and, gas storage facilities. The parties may seek to bring in parties such as the owners of other complementary upstream assets and Government bodies into this process.

About AGIG:

Australian Gas Infrastructure Group (AGIG) is one of Australia’s largest gas infrastructure businesses in Australia. It owns and operates infrastructure that delivers gas to more than two million Australian homes, businesses, manufacturers, large industrials and electricity generators. Key transmission and storage assets include the 1,600 kilometre Dampier to Bunbury Natural Gas Pipeline and the Tubridgi Gas Storage Facility in Western Australia, and the 140 kilometre Wide Bay Gas Pipeline in Queensland.

Elixir’s Managing Director, Mr Neil Young, said: “We are very pleased to enter into a MOU with a company of the calibre of AGIG. This serves as an initial framework to investigate how the massive gas resources of Project Grandis – and potentially the broader Taroom Trough – might be most effectively brought to market. Furthermore, it is a significant and timely confidence booster in the vast potential of the gas assets in this region from a very well regarded third party.”

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00