Overview

Australia is no stranger to gold production. The country stands as the second-largest gold producer, following behind China. Despite exploration and mining disruptions from COVID-19, the country produced a record AU$25 billion at the average gold price in the 2019-2020 financial year.

That level of production for Australia is no anomaly, either. Mining companies are taking advantage of the resource-rich and mining-friendly jurisdiction, especially in the southern regions of the country where a new gold rush is occurring. With such high grade and high yield gold mineralization, it’s no wonder many are excited about the region.

Outback Goldfields Corp. (TSXV:OZ,OTCQB: OZBKF,FSE: S600) is an exploration mining company focused on developing highly prospective gold assets adjacent to Kirkland Lake Gold’s (TSX:KL) Fosterville mine in Victoria, Australia. The company’s experienced exploration team has positioned it in one of the world’s most historically prolific gold districts and plans to apply modern mining techniques to find the source of the historically high grade near surface gold.

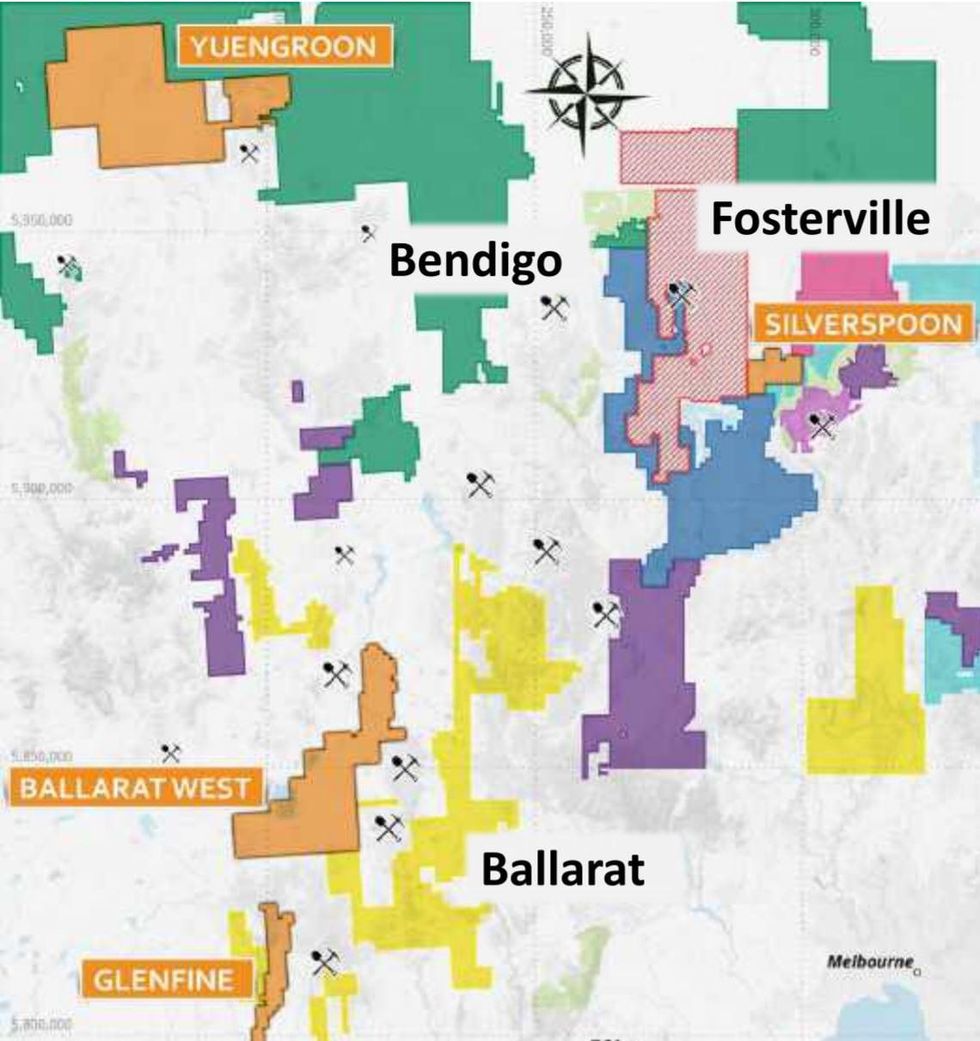

Outback is currently operating a large land package in the high-grade, low-cost mining district of Victoria, which has produced over 80 million ounces of gold historically. Current mineral reserves at the Fosterville mine including the Swan Lake reserve measure 2.7 million ounces at 31.0 g/t gold. Outback has a unique first-mover advantage to explore previously overlooked areas for high-grade epizonal gold mineralization.

Additionally, the company’s land package is often considered the premier of any junior company in the area. In December 2020, Outback completed the acquisition of four prospective gold projects from Petratherm (ASX:PTR). “After months of diligence, the company is finally in a position to start exploring for high-grade gold in the Victorian goldfields,” CEO Chris Donaldson stated. This acquisition represents an exciting step for this emerging player in Australian gold mining.

Outback’s key assets provide investors with an entry opportunity to explore a world-class gold belt with limited modern exploration outside of near-surface mining campaigns. Assets Yuengroon, Ballarat West, Glenfine and Silverspoon have a combined 1,100 hectares of documented gold occurrences and mineralization. These deposits also have the potential to mimic positive drill results from nearby mining companies like Fosterville South Exploration (TSXV:FSX), Navarre Minerals (ASX:NML) and Mawson Gold (TSX:MAW).

Entering into 2021 with positive growth, the company intends to continue evaluating priority drill targets and commence Phase One of its drill program early in the first quarter.

Outback has an experienced board and management team with years of experience in gold mining, community relations and exploration. In late 2020, the company welcomed Eric Zaunscherb and Penny Jaski to the board. These deeply connected leaders have a track record of creating significant shareholder value and, together with the existing team, prime Outback for mining and project development success.

Company Highlights

- Outback Goldfields is a well-financed exploration mining company focused on the resource-rich Fosterville gold district in Victoria, Australia.

- The company announced the acquisition of several high-grade gold projects from Petratherm in December 2020. This acquisition has positioned the company for initial exploration of these prospective gold projects.

- Outback currently operates four key gold assets, the Yuengroon, Glenfine, Silver Spoon and Ballarat West projects. These projects host limited modern exploration but are in the position to leverage past production histories.

- The company’s large land package is a premier of any junior mining company in the area. It strategically positions Outback Goldfields Corp for first-mover advantage for prospective high-grade and high-yield gold mining.

Get access to more exclusive Gold Investing Stock profiles here