Stillwater Critical Minerals (formerly Group Ten Metals) (TSXV:PGE)(OTCQB:PGEZF)(FSE:5D32) (the "Company" or "SWCM") today reports wide, high-grade intervals of nickel sulphide mineralization with palladium, platinum, rhodium, cobalt, copper and gold in a final tranche of first-pass drill results from the 14-hole resource expansion campaign completed at the Company's flagship Stillwater West PGE-Ni-Cu-Co + Au project in Montana, USA. Additional rhodium results are pending

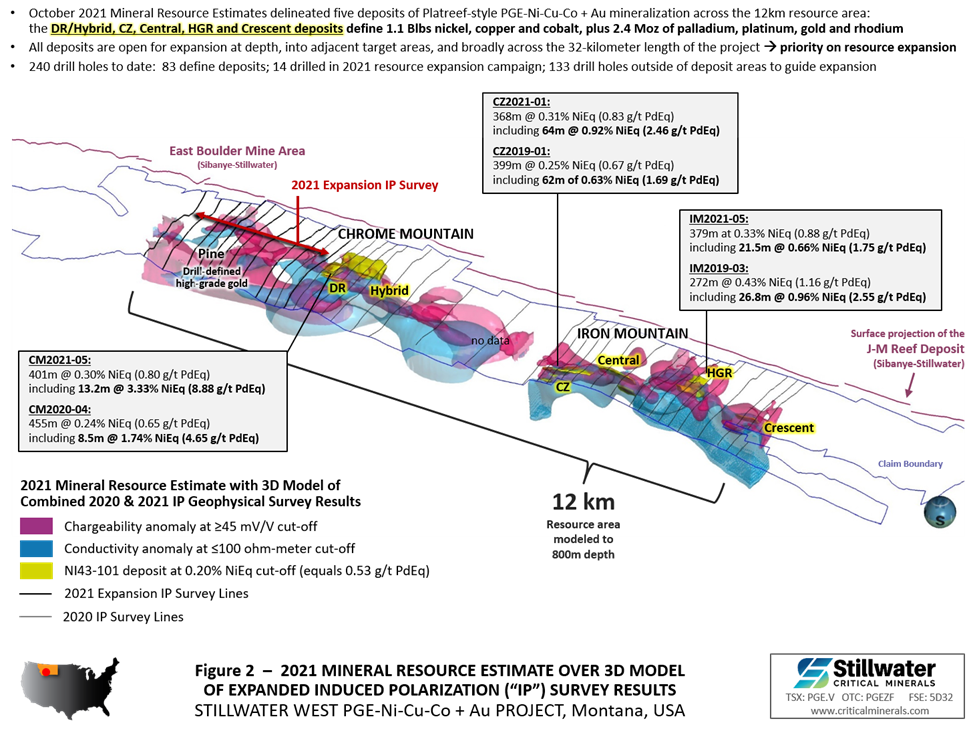

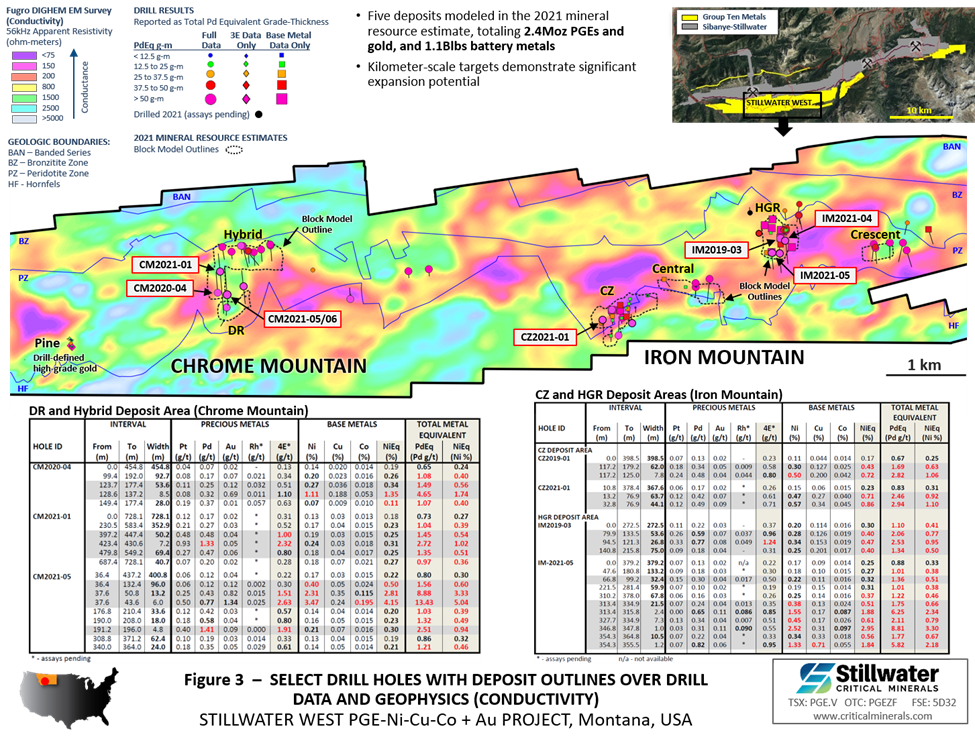

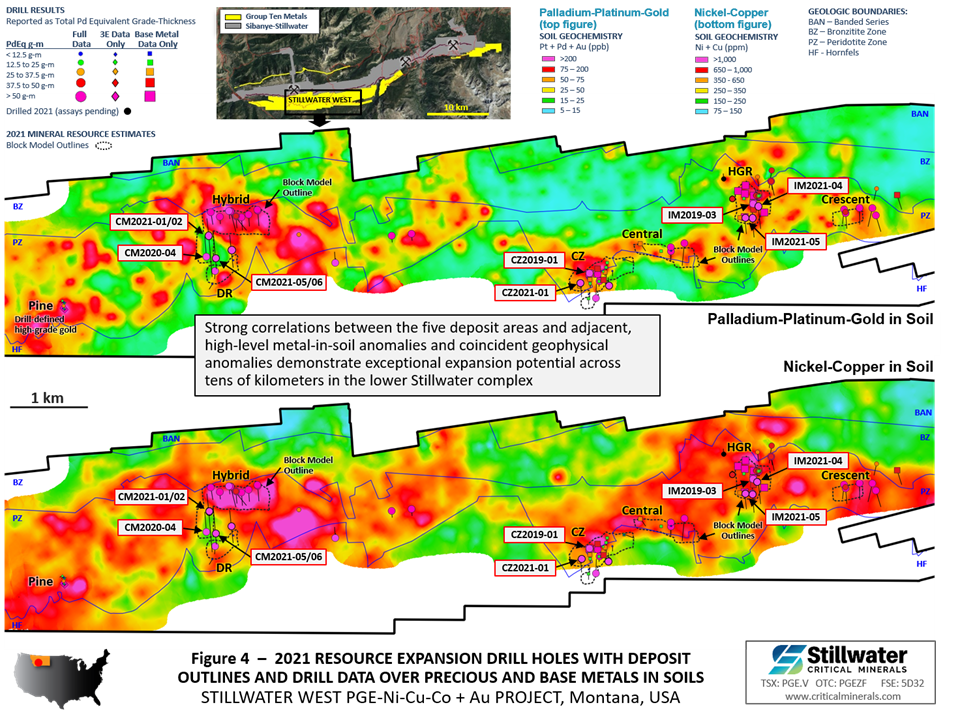

Results continue to support the Company's priority objective of expanding the October 2021 inaugural mineral resource estimates with multiple wide and highly mineralized intervals returned in step-out drilling in six holes at the HGR deposit area at Iron Mountain (see Table 1 and Figure 1). Drilling in 2021 focused on resource expansion in three of the five deposit areas delineated by the 2021 estimates. Similar wide and well-mineralized intervals have now been reported from all three deposit areas as announced December 20, 2021, March 7, 2022, and May 3, 2022. Mineralization remains open to expansion along trend and at depth in all five deposit areas, which are set within 12 kilometers of the broader 32-kilometer-long land package in the lower Stillwater Igneous Complex (see Figure 2).

Highlights from six holes drilled in the HGR deposit area in 2021 include:

- IM2021-05 returned 379.2 meters of continuous battery and precious metal mineralization starting at surface and grading 0.33% Nickel Equivalent ("NiEq"), equal to 0.88 g/t Palladium Equivalent ("PdEq"), with successive contained higher-grade intervals including:

- 133.2 meters of 0.38% NiEq (1.01 g/t PdEq);

- 21.5 meters of 0.66% NiEq (1.75 g/t PdEq); and

- 7.3 meters of 0.79% NiEq (2.11 g/t PdEq) as 0.45% Ni, 0.51 g/t Pd+Pt+Au+Rh ("4E"), 0.17% Cu and 0.026% Co .

IM2021-05 is the second most highly mineralized drill hole ever recorded in the Stillwater district with a grade-thickness value of 334 gram-meter PdEq, after CM2021-01 which returned 530 gram-meter PdEq.

- IM2021-06 returned 94.0 meters of 0.48% NiEq (1.28 g/t PdEq) within 333.0 meters of continuous mineralization grading 0.28% NiEq (0.73 g/t PdEq). Additional contained intervals at higher grades include 26.4 meters of 0.63% NiEq (1.69 g/t PdEq) and 4.8 meters of 1.38 g/t 4E which includes 0.077 g/t Rh .

- IM2021-04 , partially reported on March 7, 2022, returned 115.0 meters of 0.38% NiEq (1.02 g/t PdEq) within 306.5 meters of continuous mineralization grading 0.26% NiEq (0.68g/t PdEq). Additional contained intervals at higher grades include:

- 9.8 meters of high-grade PGE mineralization with 0.89% NiEq (2.38 g/t PdEq) as 1.54 g/t 4E including 1.02 g/t Pd, 0.39 g/t Pt, and 0.064 g/t Rh, along with base metal mineralization; and

- 4.8 meters of high-grade battery metal mineralization with 1.47% NiEq (3.91 g/t PdEq) as 0.74% Ni, 0.65% Cu, 0.070% Co, plus 0.30 g/t 4E including 0.055 g/t Rh (see photo below).

- Drilling in the HGR deposit area in 2021 focused on step-out holes in the area of IM-2019-03 which returned 272.5 meters of 0.42% NiEq (1.11 g/t PdEq) including 26.8 meters of 0.96% NiEq (2.55 g/t PdEq) as 0.34% Ni, 0.15% Cu, 0.019% Co, 0.33 g/t Pt, 0.77 g/t Pd, 0.08 g/t Au, and 0.049 g/t Rh (see Figures 1 to 4).

- These results, alongside results released May 3 and March 7, 2022, and December 20, 2021, demonstrate significant potential to expand the October 2021 mineral resource estimates with multiple long intervals at grades well above the 0.20% NiEq cut-off grade used in that study (see bolded assay values on Table 1). Potential is also shown to expand existing resources at higher cut-off grades, such as 0.35% and 0.50% NiEq (red values and shaded rows, respectively, on Table 1). Moreover, as shown in Figures 1 to 4, these results provide important intercepts in step-out drill holes located up to several hundred meters from the resource estimate block models.

- Results also continue to highlight the potential for significant co-product rhodium values at Stillwater West, with drill samples in Iron Mountain holes IM2021-04, -05, and -06 returning up to 0.365 g/t Rh within the mineralized horizons. At recent values, rhodium trades at more than 16 times the value of platinum and seven times the value of palladium on a spot price basis at over US$14,000 per ounce. Sibanye-Stillwater, adjacent to Stillwater Critical Minerals' Stillwater West project, is the primary US producer. Supply constraints for rhodium have supported rising prices since 2017.

- Complete first-pass assay results have now been reported from all 14 holes drilled in 2021. Additional rhodium assays are pending on mineralized intervals.

Dr. Danie Grobler, Stillwater Critical Minerals' Vice-President of Exploration, commented "Stillwater West continues to demonstrate significant equivalence with the Platreef deposits of the northern Bushveld Complex. Albie Brits and I are actively applying our combined four decades of Platreef experience in our new roles at Stillwater Critical Minerals with a priority on updating the geologic model to support planning and refining of drill targets for the next phase of follow-on work. Our current focus is to define detailed stratigraphic and structural controls within the 2021 Inferred Resource areas. We are also in the process of reviewing and prioritizing higher-grade pegmatoidal pyroxenite targets within the Stillwater stratigraphy that have not been fully tested."

Michael Rowley, President and CEO, commented, "Results from the Iron Mountain drill campaign continue to demonstrate the remarkable potential for expansion of our inaugural mineral resource with multiple wide intercepts of battery and precious metals and contained intervals at successive higher grades. In particular our success in targeting Platreef-style nickel sulphide mineralization in step-out holes in the area of IM2019-03 shows excellent potential for resource growth, similar to our success in the DR and Hybrid deposit areas over seven kilometers to the west. We continue to see confirmation of a large mineralized system with an impressive endowment of eight of the commodities listed as critical by the US government. We look forward to further updates on our planned resource expansion, exploration priorities for 2022, and other news in the near term."

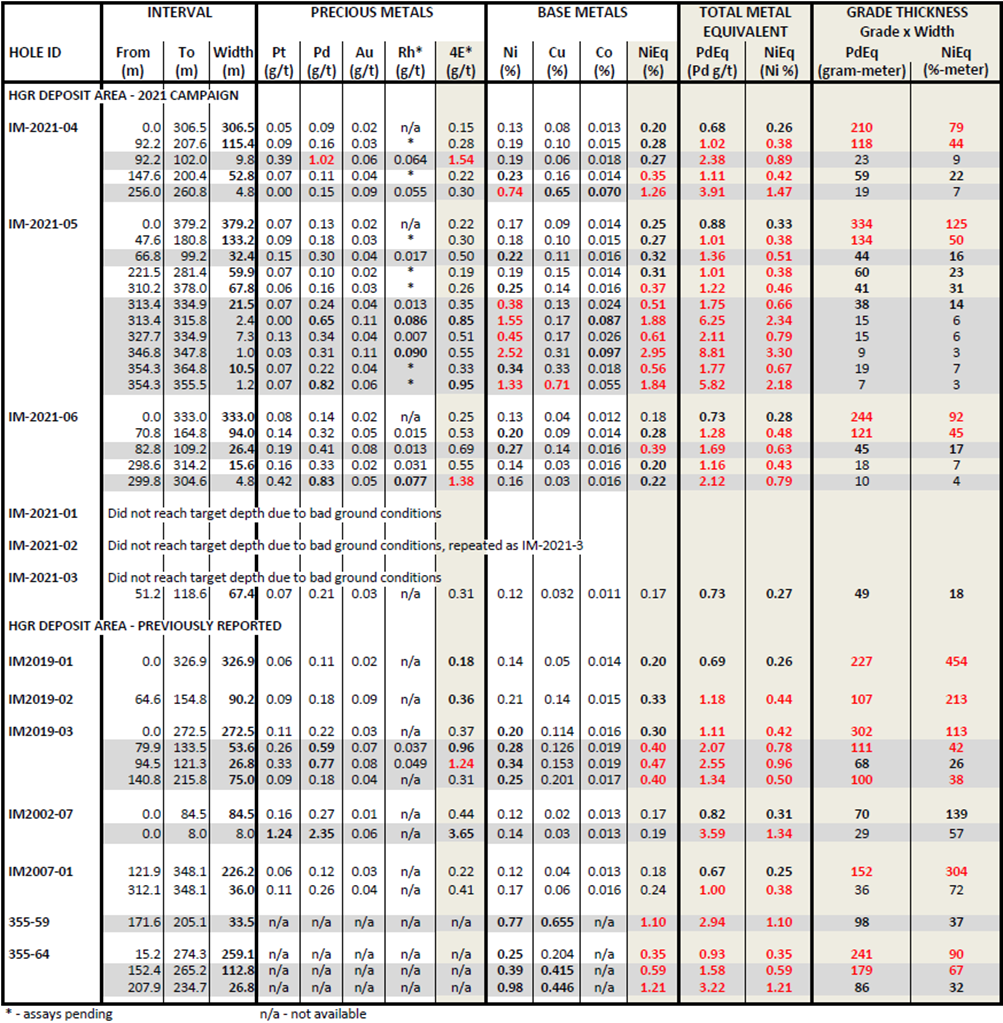

Table 1 - Highlight Results from the 2021 Expansion Drill Campaign at the HGR Deposit Area

Highlighted significant mineralized intercepts are presented above. Grade-thickness values cover significant mineralized intervals with total palladium and nickel equivalent grade-thickness determined by multiplying the thickness of continuous mineralization (in meters) by the palladium equivalent grade (in grams/tonne) to provide gram-meter values (g-m) or by multiplying the nickel equivalent grade (in percent) to provide percent-meter values as shown. Total nickel and palladium equivalent calculations reflect total gross metal content using long term metal prices (all USD): $7.00/lb nickel (Ni), $3.50/lb copper (Cu), $20.00/lb cobalt (Co), $1,000/oz platinum (Pt), $1,800/oz palladium (Pd), and $1,600/oz gold (Au). Equivalent values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals. Intervals are reported as drilled widths and are believed to be representative of the actual width of mineralization.

About Stillwater West

Stillwater Critical Minerals is rapidly advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as key catalytic metals including platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen. Stillwater West positions SWCM as the second-largest landholder in the Stillwater Complex, with a 100%-owned position adjoining and adjacent to Sibanye-Stillwater's PGE mines in south-central Montana, USA 1 . The Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu-Co mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. SWCM's work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex 2 . Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 12-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

About Stillwater Critical Minerals Corp.

Stillwater Critical Minerals (TSX.V: PGE | OTCQB: PGEZF) is a mineral exploration company focused on its flagship Stillwater West PGE-Ni-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the recent addition of two renowned Bushveld and Platreef geologists to the team, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group and other metals by neighbouring Sibanye-Stillwater. The Platreef-style nickel and copper sulphide deposits at Stillwater West contain a compelling suite of critical minerals and are open for expansion along trend and at depth, with an updated NI 43-101 mineral resource update expected in 2022.

Stillwater Critical Minerals also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals' development-stage Goliath Gold Complex in northwest Ontario, which is currently under an earn-in agreement with an option to joint venture whereby Heritage Mining may earn up to a 90% interest in the project by completing payments and work on the project. The Company also holds the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfield assets in established mining districts adjacent to some of the industry's highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon's high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Granite Creek Copper in the Yukon's Minto copper district, and Stillwater Critical Minerals in the Stillwater PGM-nickel-copper district of Montana. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry's leading explorers/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

Note 1: References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company's projects.

Note 2: Magmatic Ore Deposits in Layered Intrusions-Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012-1010.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Phone: (604) 357 4790

Toll Free: (888) 432 0075

Email: info@criticalminerals.com

Web: https://criticalminerals.com

Quality Control and Quality Assurance

2021 drill core samples were analyzed by ACT Labs in Vancouver, B.C. Sample preparation: crush (

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Stillwater Critical Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Stillwater Critical Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Stillwater Critical Minerals

View source version on accesswire.com:

https://www.accesswire.com/707898/Stillwater-Critical-Minerals-Reports-Wide-and-High-Grade-Intervals-of-Platreef-Style-Mineralization-in-Resource-Expansion-Drilling-in-the-HGR-Deposit-Area-at-Stillwater-West-Project-in-Montana-USA