- Snowline has discovered the "Ridge" zone, a 1.0 km stretch of anomalous gold in soils, talus fines and rock samples on the northeast shoulder of the Valley intrusion

- Gold-bearing sheeted quartz veins within this new zone similar are to those hosting Snowline's 2021 Valley drill discoveries

- Ridge zone significantly increases bulk-tonnage scale potential and further demonstrates fertility of the Valley intrusion.

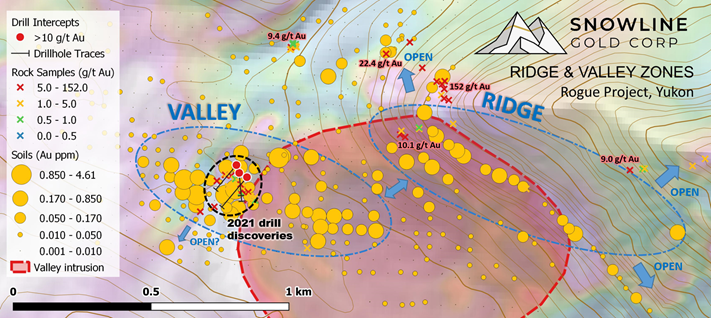

Snowline Gold Corp. (CSE:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce additional surface sampling results from its "Ridge" zone, immediately adjacent to its Valley discoveries on its Rogue gold project in the Yukon Territory, Canada. Contour soil and talus fine samples as well as rock grab samples reveal a 1.0 km zone of anomalous gold concentrations on the northeast edge of the Valley intrusion associated with sheeted quartz veins arrays. A continuous stretch of 18 contour soil and talus fine samples spanning 750 m within the zone averaged 0.21 ppm Au, with values up to 0.758 ppm Au. The zone is open in all directions

Figure 1 - Soil, talus fines, rock and magnetic results around the Valley intrusion delineates an open, 1.0 km zone of anomalous gold concentrations to 0.758 g/t Au in soils near sheeted quartz vein arrays. Background colours show detailed total magnetic field data, with pinks and purples denoting high field values and blues low.

"These reconnaissance sampling results significantly expand the scale of the mineralized system at Valley," said Scott Berdahl, CEO and director of Snowline Gold. "The tenor of our September 2021 drill discoveries, with drilled intersections of up to 1.25 g/t Au over 168.7 m from surface, provide context for the inherent potential of this sibling zone, located on an adjacent shoulder of the Valley intrusion and exhibiting a similar style of mineralization. Overall, the broader Valley area is looking more and more like the type of large, robust gold system that we founded Snowline Gold Corp to find. With a drill parked on site, permits in place and a strong treasury, we are looking forward to an exciting and discovery-filled exploration season in 2022."

Figure 2 - Discovery outcrop at Snowline Gold's Ridge target. A dense array of sheeted quartz veins cut weathered quartz diorite, striking roughly parallel to similar vein arrays drilled at the nearby Valley zone in 2021. Grab samples of quartz vein and intrusive material in this vicinity assay up to 10.1 g/t Au.

In addition to locating additional sheeted vein arrays, prospecting by Snowline's field team confirmed historical discoveries of arsenopyrite vein material sourced from the Ridge zone, just outside of the Valley intrusion. Historical grab sample assays of this material run as high as 152 g/t Au, and check assays by Snowline and an independent qualified person hired by the Company returned up to 58.4 g/t Au. While this occurrence was known to the Company, the extent of high gold values in soils, talus fines and rock samples and the extent of sheeted veining demonstrate the presence of a significant new zone for targeted future exploration.

Higher on the ridge and farther east of the intrusion, prospecting by Snowline personnel encountered mineralized dikes, additional gold bearing sulphide veins and skarn-like alteration, demonstrating the extent and fertility of the Valley reduced-intrusion related gold system (RIRGS). These observations suggest that the intrusion itself may laterally beneath sedimentary units to the east, in the direction of Snowline's adjacent "Gracie" RIRGS prospect.

Figure 3 - Composite, panoramic view of the Ridge zone. Extensive gossans occur within and above the edge of the Valley intrusion, which runs along the lower half of the mountainside in this photo. Eighteen contour soil and talus fine samples across 750 m at the break in slope midway up the mountainside averaged 0.21 ppm Au, with values up to 0.758 ppm Au. Additional soil and rock samples suggest an overall extent to the zone exceeding 1.0 km. View looks northeast from the eastern end of the Valley geochemical anomaly shown in Figure 1.

UPCOMING EXPLORATION

With over $8.5M CAD in the treasury, Snowline is actively preparing for a busy 2022 exploration season. The upcoming program will see at least two drills turning on an 8,000+ m program focused on the Company's Valley and Jupiter discoveries along with nearby targets. This work continues to build toward establishing North America's newest gold district in the Yukon's Selwyn Basin.

The Company currently has a diamond drill under contract and on site at Valley, overwintering for a quick and cost-effective resumption of drilling in Spring 2022. Given the scale of the associated geochemical anomaly, the extent of sheeted veins observed on surface and the potential for high vein densities within the intrusion, a 3000+ m drill program is planned at Valley to better understand the scale and continuity of the mineralized zone.

QA/QC AND QUALIFIED PERSON

Soil, talus fine and rock samples were collected by Snowline staff and contractors. Soils and talus fines were air dried in camp. Rock samples were photographed during sampling. Standard reference materials, blanks and duplicate samples were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor and by Snowline personnel to ALS Laboratories' preparatory facility in Whitehorse, Yukon, with analysis completed in Vancouver.

ALS is accredited to ISO 17025:2005 UKAS ref 4028 for its laboratory analysis. Rock samples were crushed by ALS to >70% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. An aqua regia digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 51-element analysis on 50 g samples (ALS code: Au-ME-TL44). Any rock sample returning >50 ppb Au was re-analysed for gold content by fire assay with an inductively coupled plasma atomic emission spectroscopy (ICP-AES) finish on 30 g samples (ALS code: Au-ICP21). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 50 g sample (ALS code: Au-GRA22).

Soil and talus fine samples were further dried on receipt at the laboratory at temperatures

While talus fine and soil samples are collected and processed in the same fashion, they are slightly different sample mediums, as talus fines represent a more primary material as derived from bedrock.

Information in this release has been prepared and approved by Scott Berdahl, P. Geo., Chief Executive Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101.

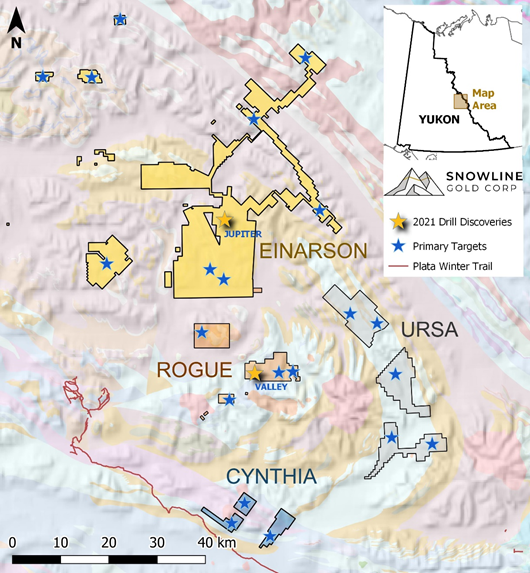

Figure 4 - Valley zone location map in relation to surrounding Snowline Gold Corp. projects. Valley is the westernmost in an east-west line of 3 small intrusive bodies, each of which appears to have potential to host an intrusion-related gold deposit or deposits.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering >100,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. Snowline's first-mover land position provides a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/692432/Snowline-Gold-Expands-Valley-Gold-Mineralization-to-2-km-with-Discovery-of-Ridge-Zone-on-Its-Rogue-Project-Yukon