October 24, 2024

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to announce that it has applied for an exploration permit over the historic Endeavour Antimony mine, located in Marlborough, 120kms east of Sams Creek.

Highlights

- The Endeavour mine was historically New Zealand’s largest antimony producer.

- Around 3,000t of stibnite ore (antimony) was recovered from the Endeavour mine and direct shipped to England in the late 19th Century.

- Stibnite ore was mined along strike for 1,200m and a vertical extent of 400m.

- The antimony mineralisation mined contained approximately 2g/t Au but the gold was not recovered.

- The Endeavour antimony mine is part of a larger shear zone that extends for at least 5-6kms and includes at least two other antimony occurrences.

- The mineralisation and structure at the Endeavour mine look very similar to the Auld Creek mineralisation in Reefton.

- Siren is particularly encouraged by the 400m vertical extent exposed in the old mine workings at Endeavour.

- By comparison, only a 150m vertical extent has been tested by drilling at Auld Creek, which contains an inferred mineral resource estimate of 105koz at 3.9g/t Au and 14,500t at 1.7% antimony.

- Metallurgical testwork was completed on Endeavour antimony samples (average 18.7% antimony) in 1977. A stibnite concentrate grading 63% antimony and an overall recovery of 90% was obtainable in a two-stage flotation process.

Siren Managing Director and CEO, Victor Rajasooriar commented:

“We are quite thrilled to have applied for the exploration permit over the historic Endeavour Antimony mine. Our geological team has been scouting for Antimony projects to build scale to our existing Antimony / Gold projects and a successful application would be a welcome addition to the portfolio. Antimony is one of the few elements classified as a 'critical' or 'strategic' mineral by countries including the United States, China, Australia, Russia, the European Union, and more recently New Zealand, underscoring its special geopolitical value. The price of Antimony currently trading at US$25,000/t, supply forecast to drop due to lower grade / old mines coming to an end and the recent decision by China to stop exporting Antimony to other countries, all point to a very positive environment for Siren to explore and grow the Antimony and Gold business in New Zealand”.

Queen Charlotte Exploration Permit Application

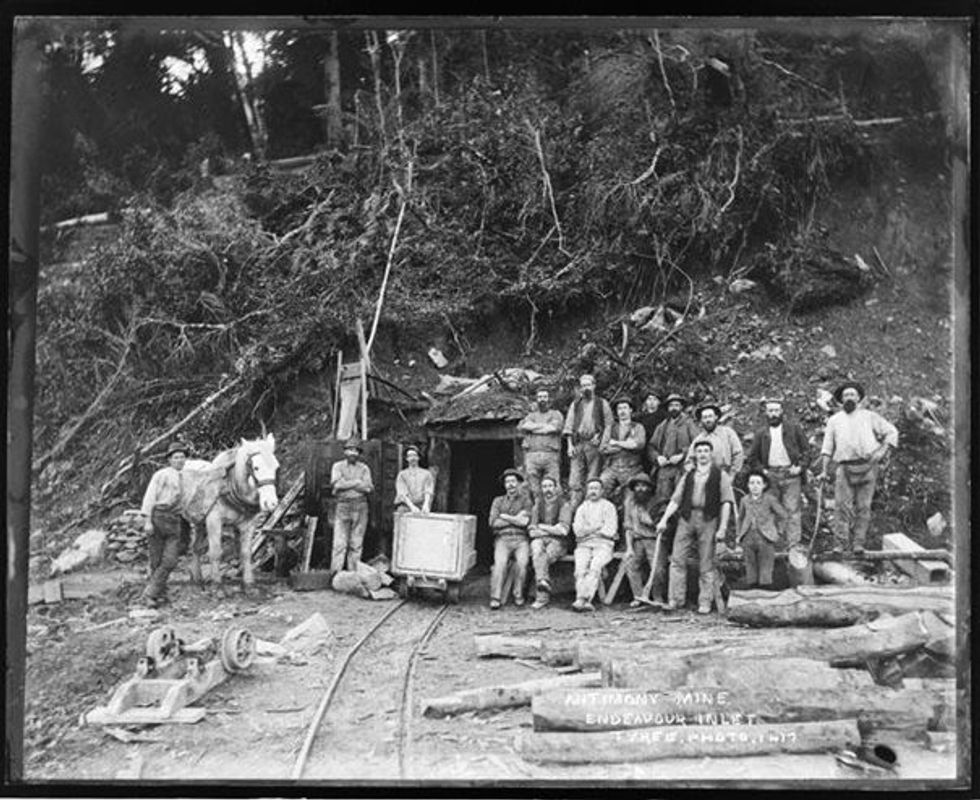

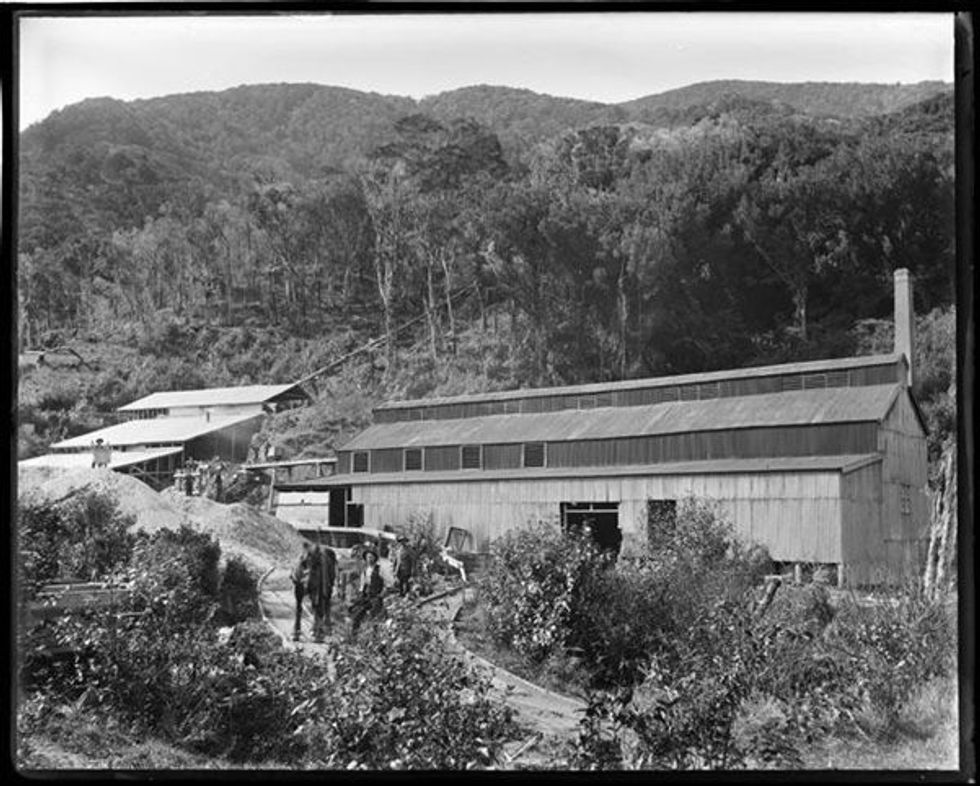

Sams Creek Gold Limited, a wholly owned subsidiary of Siren, has applied for the Queen Charlotte exploration permit that contains the historic Endeavour antimony mine (Figure 1). In 1873 mineralisation containing 60% antimony was discovered in a landslide near the saddle between Endeavour Inlet and Port Gore within a line of mineralisation running from Titirangi Bay through the Endeavour Inlet to Resolution Bay. This mine was the largest antimony mine in New Zealand, producing over 3,000t of stibnite (antimony) ore that was direct shipped to England between 1870 and 1890 (Figures 1 and 2). The high-grade ore was sorted by hand and exported untreated, while the lower grade ore was for a period treated at a smelter adjacent to the mine (MacDonnell 1993).

The historic workings penetrated less than 100m deep into a mineralised system that is 1-2kms long and has a surface exposure extending more than 400m vertically. In addition to the antimony, this mineralised system contains significant gold, but it was not recovered.

Detailed records and mapping of the Endeavour Inlet mineralised system are very sparse and fragmented. A comprehensive overview of this mineralised system was largely developed by geologist Franco Pirajno (Pirajno 1979) and is the basis for the current understanding of the system. He proposed that there may be three parallel major shear zones that strike NNW-SSE, one of which passes through the Endeavour Inlet mineralised zone (Figure 3).

The known part of the Endeavour mineralised zone is about 1,200m long (Figure 4). The Endeavor mineralisation may connect with the East Endeavour Inlet and the Resolution Bay mineralisation along strike to the SE which would increase the strike length to 5-6kms (Figure 3). The known vertical extent of the Endeavour mine exceeds 400m, but the total vertical extent could be significantly greater (Figure 5).

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

4h

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

23h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

02 March

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00