- WORLD EDITIONAustraliaNorth AmericaWorld

June 03, 2024

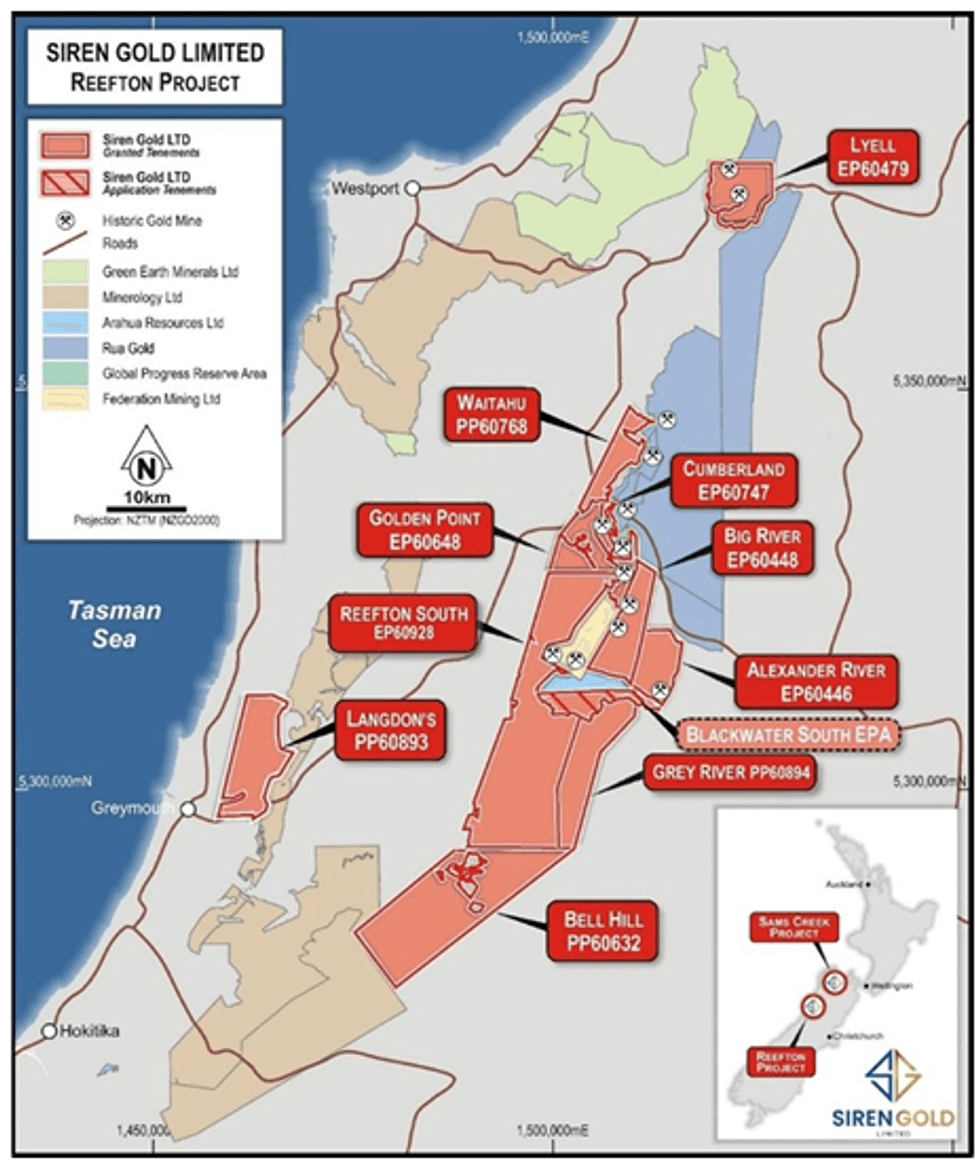

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide an update on the Lyell tenement located within the Reefton Project.

Highlights

- The Company’s application to extend the Lyell exploration permit for an additional 5 years has been granted by New Zealand Petroleum and Minerals (NZPaM).

- Previous results at Lyell from trenching and surface sampling include:

- 7m @ 13.8g/t Au (LYTR001) (ASX release 14 October 2022);

- 8m @ 6.3g/t Au (LYTR002) (ASX release 14 October 2022);

- 3.0m @ 19.1g/t Au (LYTR009) (ASX release 8 March 2023); and

- 1.1m @ 36g/t Au (LYTR008) (ASX release 8 March 2023).

- The Lyell Goldfield extends 5kms along a mineralised structural trend and includes the Alpine United, Break of Day, Mt Lyell North and United Victory prospects.

- Lyell’s access agreement with the Department of Conservation is expected to be concluded during Q3 CY24.

- Drilling targeting the high-grade shoots will commence soon after an access agreement is executed.

Siren Managing Director and CEO, Victor Rajasooriar commented:

“Lyell has the potential to be the jewel in Siren’s crown, based on the recent discovery by the Company around Mt Lyell North of high-grade gold mineralisation, which extends over a 1km strike. Our geological team are looking forward to drilling once all approvals are in place and replicating the surface rock chips and trenching data gathered last year”.

Background

The Lyell Goldfield is located 40kms north of Reefton (Figure 2), where gold bearing quartz lodes were historically worked over a continuous strike length of 5kms. The Lyell Goldfield is the northern extension of the Reefton Goldfield that produced 2Moz of gold at an average recovered grade of 16g/t. The project overlays the historic Alpine United mine, which produced ~80koz of gold at an average recovered grade of ~17g/t between 1874 and closing in 1912. Several other small mines, such as the Break of Day, Tyrconnell, United Italy, Titchborne, Victor Emanual and United Victory also operated historically north of the Alpine United mine.

Soil sampling has confirmed a NNW trending 4km long anomalous gold zone between the Alpine United and United Victory mines (Figure 3). The Break of Day mine is also located along this anomaly. The soil samples have identified several anomalous areas which may represent mineralised shoots similar to those seen at Alexander River. The Alpine United mine shoot plunged ~45o to the north and was mined down to 500m below the surface and 750m down plunge and is open at depth. A total of 80koz @ 17g/t Au was recovered from the mine.

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

12h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

13h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

13h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

14h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

14h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

09 February

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00