TSX: SIL | NYSE American: SILV

SilverCrest Metals Inc. ("SilverCrest" or the "Company") is pleased to provide an update on commissioning activities at the Company's Las Chispas Mine ("Las Chispas" or the "Mine") located in Sonora, Mexico . All currency amounts herein are presented in United States Dollars, unless otherwise stated.

Highlights

- Processing plant metallurgical recovery and daily throughput are trending ahead of Feasibility Study* ramp-up projections; For August 2022 , actual average recovery of 96.2% gold ("Au") and 85.6% silver ("Ag"), or 90.7% silver equivalent ("AgEq")** and average tonnage throughput of 784 tonnes per day ("tpd") were achieved

- Project fully energized by grid power; reliability not at steady state but expected to improve in Q4, 2022

- Underground in-vein and waste development continue to track Feasibility Study projections, production stoping underway and ramping up

- Underground mine ramping up to 600 to 700 tpd by end of 2022 compared to 750 tpd in the Feasibility Study; continued focus on dilution and ore recovery

- First metal sale expected in Q3, 2022, commercial production on schedule for Q4, 2022

- Community efforts advanced with key 2022 projects approaching completion

- Well-funded ahead of first full year of production in 2023

- Updated Technical Report remains on schedule for H1, 2023

| * NI 43-101 Technical Report & Feasibility Study on The Las Chispas Project dated January 4, 2021 ("Feasibility Study") |

| ** AgEq is based on the 2021 Feasibility Study Mineral Resource and Reserve gold to silver ratio of 86.9:1 calculated using US$1,410/oz Au and US$16.60/oz Ag |

Pierre Beaudoin , COO, remarked, "Starting up a new mining operation is a dynamic period, and our team and contractors continue to navigate and address mostly typical ramp-up issues. Overall, we are pleased with the performance of the processing plant to date. Metal recoveries, plant throughput and the availability of the plant itself have generally tracked favorably when compared to the expectations outlined in the Feasibility Study. The project continues to benefit from the sizable surface stockpiles which have allowed the underground operation to be ramped up at a measured pace."

N. Eric Fier , CPG, P.Eng, and CEO, stated, "We are extremely proud of how our team and contractors having navigated the construction process and transition to commissioning, which remains on track at Las Chispas. We remain focused on managing risk and are happy to have the financial flexibility to address the challenges and opportunities that will come our way".

Processing Plant and Stockpile

During the first three months of commissioning, the Las Chispas processing plant has performed in-line or ahead of the design curve on all metrics. Throughput, recoveries, and plant availability have all shown month over month improvements.

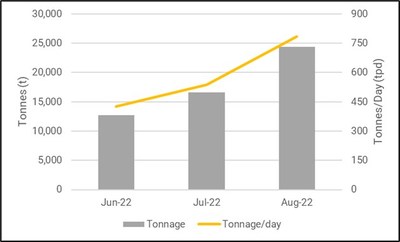

A total of 53,600 tonnes of material have been processed since start-up with August 2022 average throughput of 784 tpd, up 46% from July 2022 as shown in Figure 1 . It is still expected that the design plant throughput of 1,250 tpd will be reached in Q4, 2022. Grades to the plant have remained low during the initial months of processing as most ore continues to be intentionally sourced from historic low-grade stockpiles.

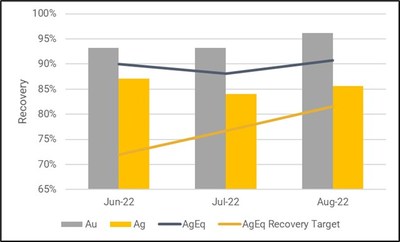

Recoveries are tracking ahead of the planned ramp-up projections as shown in Figure 2 with August 2022 recoveries averaging 96.2% Au and 85.6% Ag or 90.7% AgEq as compared to the August 2022 ramp-up projection of 81.5% AgEq.

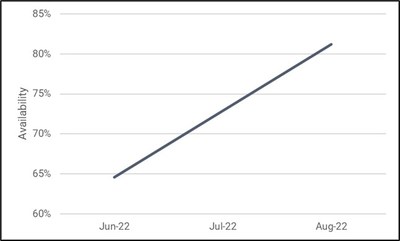

Plant availability has continued to increase since the start of commissioning ( Figure 3 ), with availability in August 2022 of 81%, up from 65% in June 2022 .

While the processing plant ramp-up has generally been trending favorably when compared to the Feasibility Study ramp-up projections, minor modifications have been required to the circuit to address lower dissolved oxygen than planned. Temporary modifications were implemented in late August 2022 and have addressed the initial challenges encountered. The permanent modifications, while minor, are more intrusive, and will be implemented during planned down-time before the end of 2022.

Ore feed continues to be sourced primarily from the historic lower grade stockpiles as the processing plant and underground production continue to ramp-up. The stockpile at the end of August 2022 is estimated at 300,000 tonnes and is comprised of the historic low-grade stockpile and pre-production stockpiles which have been generated from mining, since 2019. The stockpiles will continue to represent the bulk of the processing plant feed in 2022, but underground ore will also be used to start focused batch grade reconciliation with the process plant.

As underground ore begins to be a source of processing plant feed, the focus will be on determining the reconciliation of the reserve mined grades to the processing plant. It is expected that when the processing plant feed is sourced more consistently from the underground, the results from these reconciliation efforts, including grades, will be available in greater detail.

Plant grades and produced ounces will be announced with quarterly production results in Q4, 2022.

Power

The construction of the 55 kilometre ("km") powerline managed by SilverCrest was completed in Q2, 2022 and as of August 2022 was 100% operational inclusive of all required supporting equipment (Harmonic Filters and Power Factor Correctors). The Las Chispas operation is connected to the Comision Federal de Electricidad ("CFE") grid but at a capacity limited to 6.4 MW via a temporary CFE bypass. This limited grid power connection is adequate to support all major elements of the operation, however, the stability has been below target which has resulted in some minor production delays and disruptions. The final connection (7.6 MW) to the refurbished CFE Power line (now at 80% completion) is scheduled for Q4, 2022 and is expected to improve the stability of the connection.

The temporary diesel deneration system has now been disconnected and demobilized from Las Chispas. The processing plant and the Mine are equipped with Emergency Diesel Power generation systems.

Underground Mining

In 2022, an additional 5.1 km of underground development has been completed at the Mine, bringing the total to 22.6 km. In-vein drifting represents 5.5 km of this total. A total of 109,000 tonnes of ore have been mined from development and stoping activities in 2022 up to the end of August 2022 , approximately 9% below the Feasibility Study target.

The ramp up of underground stoping continues to progress. As stated in the Feasibility Study, the focus during production ramp-up is the refinement of mining methods and implementation of grade control procedures. These procedures involve the collection and use of detailed geological, geotechnical and operational data to adjust mine plans and stope designs to minimize dilution and maximize ore recovery.

The Company now anticipates ramping-up the underground mine to between 600 and 700 tpd by the end of Q4, 2022, lower than the 750 tpd stated in the Feasibility Study.

Safety, COVID-19, and Community

Safety has remained a top priority at Las Chispas. With the commencement of production, our team has focused its attention on the changing nature of the risks encountered in the stoping processes and interaction with our main underground contractor. COVID-19 prevention measures remain in place and there have been no outbreaks that have impacted production efforts.

The Company is progressing work related to the potential impacts of climate change for both Las Chispas and the local community. The initial results for the physical risk assessment portion of the work related to the Task Force for Climate Related Financial Disclosures ("TCFD") are expected in Q4, 2022 along with a water stewardship plan that will include and consider the findings of the TCFD data. Work to address the risks and opportunities from our findings has already begun.

Our community efforts have continued in earnest in 2022, with the focus being execution of a multi-year major water infrastructure project that is focused on improving the sewage system and the water infrastructure for the local community and ranching, and farming industries. This investment includes upgrades to three main infrastructure areas which were considered priorities in discussion with the local community. Further details will be provided in the inaugural TCFD and water stewardship report. These initiatives were in addition to the completion of an assay lab built by SIlverCrest in Arizpe , a nearby community, to create a long-term employment opportunity for the region.

Well-Funded Ahead of First Full Year of Production in 2023

As of August 31, 2022 , SilverCrest had cash and cash equivalents of $101.6 million . Given the strong financial position, the Company will not draw the remaining $30.0 million under its $120.0 million Credit Facility, and the availability of this amount has now expired.

While production of silver and gold has been ongoing since first pour on June 30, 2022 , the first sale and resulting revenue from the Mine is expected in Q3, 2022. As projected in the Feasibility Study, it is expected that revenue will be limited and operating costs elevated through the end of 2022 as the mine and processing plant are ramped up and the processing plant is commissioned using lower grade material.

Updated Technical Report

SilverCrest continues to advance the work required to complete the Updated Technical Report in H1, 2023. This report will include additional infill and delineation drilling, further in-vein drifting, initial months of stoping, processing data, and reconciliation completed since the Feasibility Study. This report will incorporate updated resources and reserves, updated metallurgical results, reconciliation (mine, stockpile and plant) including comparison to the 2021 Feasibility Study resource estimate, a revised mine plan, and updated operating and sustaining costs arising from any potential changes to the mine plan, the new outsourcing regulations and the impact of inflation from the Q3, 2020 cost base used in the Feasibility Study.

2022 Exploration Update

Las Chispas exploration in 2022 has mainly continued to support the transition to production through further infill and delineation drilling of planned mining stopes and updated resource modelling. Results of drilling completed to the end of July 2022 will be included in the planned Updated Technical Report.

Picacho exploration in 2022 has continued with focus on expansion and infill drilling of current areas for potential resources. As of August 2022 , one surface drill rig was operating.

Exploration has also focused on mapping and sampling unexplored areas around Las Chispas and Picacho to generate new drill targets. Limited drilling has been completed outside of the known mineralized zones, as SilverCrest remains focused on prudent capital allocation during ramp-up.

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is N. Eric Fier , CPG, P.Eng, and CEO for SilverCrest, who has reviewed and approved its contents.

ABOUT SILVERCREST METALS INC.

SilverCrest is a Canadian precious metals exploration and development company headquartered in Vancouver, BC , that is focused on new discoveries, value-added acquisitions and near-term production in Mexico's historic precious metal districts. The Company's top priority is on the high-grade, historic Las Chispas mining district in Sonora, Mexico , where it has completed construction of its Las Chispas Mine and is proceeding with commissioning. SilverCrest is the first company to successfully drill-test the historic Las Chispas Property resulting in numerous high-grade precious metal discoveries. The Company is led by a proven management team in all aspects of the precious metal mining sector, including taking projects through discovery, finance, on time and on budget construction, and production.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" and "forward-looking information" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation. These include, without limitation, statements with respect to: the strategic plans, timing and expectations for the Company receiving revenue in Q3, 2022, completing commissioning and ramp up and achieving commercial production of the processing plant in Q4, 2022, reaching 1,250 tpd throughput at the plant by end of Q4, 2022, results of TCFD in Q4, 2022, ramp-up of u/g mine at a rate of 600 tpd – 700 tpd by the end of Q4, 2022, final connection of the power line in Q4, 2022, and completing a technical report update by the end of H1, 2023 . Such forward looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: gold and silver prices, impact of the COVID-19 pandemic; the reliability of mineralization estimates, mining and development costs, the conditions in general economic and financial markets; availability of skilled labour; timing and amount of expenditures related to rehabilitation and drilling programs; and effects of regulation by governmental agencies. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors including: uncertainty as to the impact and duration of the COVID-19 pandemic; the timing and content of work programs; results of exploration activities; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project cost overruns or unanticipated costs and expenses; fluctuations in gold and silver prices and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

N. Eric Fier, CPG, P.Eng

Chief Executive Officer

SilverCrest Metals Inc.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercrests-las-chispas-commissioning-on-track-nearing-first-metal-sale-301623928.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercrests-las-chispas-commissioning-on-track-nearing-first-metal-sale-301623928.html

SOURCE SilverCrest Metals Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/14/c5903.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/September2022/14/c5903.html