June 16, 2024

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX- V:SWA) is pleased to present its investor presentation.

INVESTMENT HIGHLIGHTS

50KM UNEXPLORED GREENSTONE BELT IN WA + 0.5M OZ OF GOLD IN WEST AFRICA

Sarama has signed a Non-Binding MOU1 to acquire the Cosmo Newbery Project, highlights include:

- Project situated on one of the last unexplored greenstone belts in Western Australia

- Tenure is contiguous over 583km2 and covers the entire +50 km of greenstone belt

- The belt has seen virtually no modern exploration and no drilling of merit

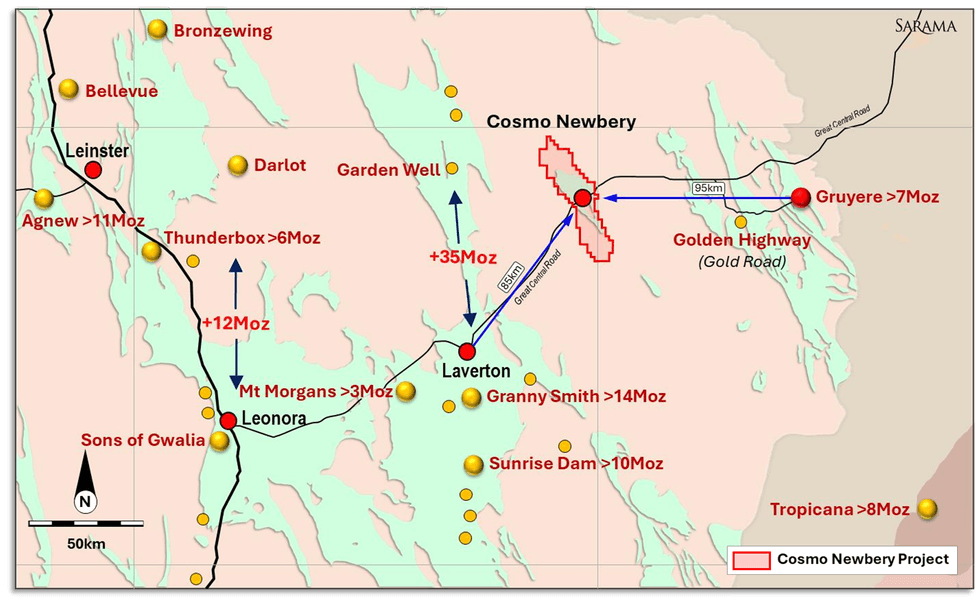

- Located 95km west of +7Moz Gruyere (Gold Road) and 85km northeast of Laverton

- Documented historical gold workings (discovered in 1890’s)

- Reserve since 1980 but Land access now obtained, easy access via Great Central Road

Material additional value includes:

- Burkina Faso gold assets including 100% owned, 0.5Moz (Inf) Bondi Gold Deposit2

- Significant arbitration claim3

COSMO NEWBERY PROJECT LOCATION

LOOKING FOR GOLD IN AN AREA SURROUNDED BY GOLD

EXPLORATION OPPORTUNITY

LARGE AND PROSPECTIVE SYSTEM WITH MULTIPLE TARGETS TO BE TESTED

- Cosmo Newbery greenstone belt has clear gold showings and strong geological and structural similarities to the adjacent Dorothy Hills greenstone belt which hosts the +7Moz Gruyere gold deposit

- Project is underlain by prospective volcanic and volcano-sediment rocks with localised intrusives, however is mostly under shallow cover and has seen little to no significant exploration

- A major regional fault/shear system extends for over 50km through the Project

- The fault/shear system combined with granite-greenstone rocks has the potential to provide requisite fluid pathways and favorable host rocks that are amenable to gold mineralization

- Historic, small-scale mining east of this regional system indicates gold deposition in the immediate area

- Soil geochemical and geophysical surveys identified numerous exploration targets for gold and nickel-cobalt

- Currently 8 areas of interest & 17 specific interpreted targets for follow up

This article includes content from Sarama Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

6h

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

8h

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

19h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

22h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00