Rua Gold Inc. (CSE: RUA) (OTCQB: NZAUF) (WKN: A3DB6A) ("Rua Gold" or the "Company") is pleased to provide an exploration update for the Reefton Project on the South Island of New Zealand .

Permit and Land Access Agreements for drilling have been extended for a further 5 years

The Company's application to extend the permit and Access Agreement at the Reefton Project on New Zealand's South Island for an additional 5 years has been granted by both the New Zealand Petroleum and Minerals (NZP&M) and the Department of Conservation (DoC), following Iwi (local indigenous) and archaeology consultation.

This provides the Company full access to carry out an extensive drill campaign on 37 drill sites and includes the establishment of the associated infrastructure, including camps and pumping stations. The Company now has the rights to drill all the targets identified following our extensive surface exploration program which was focused on numerous near mine prospects over the four mine camps within the Company's permits at the Reefton Project.

Rua Gold's near-mine drilling program

The Company has commenced its near mine drill program with five targets in the Murray Creek area as the first step in a comprehensive drilling campaign that will test targets in the Murray Creek, Crushington, Capleston and Caledonian historic districts. These historic mines collectively produced ~700koz of gold at 25.2g/t within a radius of ~20 kilometers.

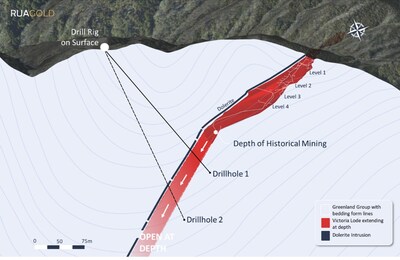

The Company has commenced with its first target in Murray Creek, which is a down-dip extension of the historic mine shoot. This is a compelling, relatively shallow target as records show mining ceased at 200 meters, yet this was the largest lode. The lode contained gold grades ranging between 18.0g/t to 67.5g/t Au (Barry, 1993).

Two diamond holes are planned to test the down dip extensions of the lode at depth. Accurate mapping of the dyke (UAV magnetics) and 3D structural mapping show significant potential for continuation at depth. Surface rock chips show grades up to 33 g/t Au (from No 3 Victoria Adit).

Drilling will target below the mined extent of the Victoria Lode at ~200 meters depth.

The Company finds the first target at Murray Creek compelling as it is relatively shallow in comparison to the historical mining in the nearby Crushington and Ajax areas which demonstrated mining was economic to depths of greater than 600 meters, and at Federation Mining's Blackwater gold deposit, there is continuity of high grade mineralization to a depth of 1500 meters.

More information can be found at the Company's website: www.ruagold.com .

Historic Mine Evaluation, Proposed Drilling

The Company has completed a comprehensive evaluation of the historic mines in the Reefton Goldfield. This includes 3D modelling of the geology, structure, and historical mine lodes in a precursor to drill testing of priority targets, testing down-dip and potential duplicate structures in the vicinity of the historic mines.

Rua Gold has commenced drilling the first of five targets in the Murray Creek area as the first step in a comprehensive drilling campaign that will test near-mine targets in Murray Creek, Crushington, Capleston and Caledonian historic districts. A table of historic production in these districts is included in Appendix 1.

Grant of Deferred Share Units

The Company also announces that it has granted an aggregate of 326,327 deferred share units ("DSUs") to non-executive directors of the Company at a deemed price of $0.193 per DSU. The DSUs were granted in consideration for services provided by the non-executive directors for the period from April 1, 2024 to June 30 , 2024. The DSUs were granted under the Company's Deferred Share Unit Plan adopted on April 17, 2024 and are subject to a one year vesting period. Each DSU entitles the holder to receive one share of the Company at the time the holder ceases to be a director of the Company.

About Rua Gold

Rua Gold (RUA.CSE) is a new entrant to the mining industry, specializing in gold exploration and discovery in New Zealand . With permits that have a rich history dating back to the gold rush in the late 1800's, Rua Gold combines traditional prospecting practices with modern technologies to uncover and capitalize on valuable gold deposits.

The Company is committed to responsible and sustainable exploration, which is evident in its professional planning and execution. The Company aims to minimize its environmental impact and to execute on its projects with key stakeholders in mind. Rua Gold has a highly skilled team of New Zealand professionals who possess extensive knowledge and experience in geology, geochemistry, and geophysical exploration technology.

For further information, please refer to the Company's disclosure record on SEDAR+ at www.sedarplus.ca .

Technical Information

Simon Henderson CP, AUSIMM, a qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects , has reviewed and approved the technical disclosure contained herein.

Website: www.RUAGOLD.com

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and specifically include statements regarding: the Company's strategies, expectations, planned operations or future actions, including but not limited to its drill programs at its Reefton project; and the Company's expected receipt of permits or other regulatory approvals. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to the effects of the Russia - Ukraine war; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavourable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's CSE Form 2A – Listing Statement filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Appendix 1: Historic production from mining in the Murray Creek mine group, Reefton Goldfields.

| Lode | Easting | Northing | Quartz | Au (kg) | Total | Recovered | Recovered |

| Inglewood- | 1510233 | 5336224 | 52,945.9 | 1,053.7 | 33,877.2 | 0.6 | 19.9 |

| Perseverance | 1509653 | 5335145 | 57.9 | 0.6 | 19.3 | 0.3 | 10.4 |

| Golden Fleece | 1509544 | 5335654 | 136,642 | 2,787.8 | 89,629.9 | 0.7 | 20.4 |

| Venus | 1509084 | 5335145 | 11,046 | 219 | 7,041.0 | 0.6 | 19.8 |

| Source: Barry, J.M., 1993. The History and Mineral Resources of the Reefton Goldfield. Ministry of Commerce Resource Information Report No. 15. |

SOURCE Rua Gold Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/05/c1293.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/05/c1293.html