August 30, 2023

Step-out drilling intersects additional extensive near-surface nickel at Hotinvaara, highlighting near term growth in the current Mineral Resource

Nordic Nickel Limited’s (“Nordic Nickel” or “the Company”) (ASX: NNL) is pleased to report further assay results from drilling completed at its flagship Pulju Nickel Project (the Project) in the Central Lapland Greenstone Belt (CLGB) of northern Finland.

HIGHLIGHTS

- Assays received for an additional three diamond drillholes with multiple wide mineralised intercepts returned in: HOT004, HOT005 and HOT010.

- Latest assay highlights include1:

- 25.7m @ 0.20% Ni from 179m; and

- 86m @ 0.18% Ni from 286m in HOT004

- 54m @ 0.19% Ni from 81.5m; and

- 40m @ 0.19% Ni from 204m in HOT005

- 37.4m @ 0.21% Ni from 231.6m;

- 51m @ 0.17% Ni from 398m; and

- 70m @ 0.18% Ni from 491m in HOT010

- Pervasive disseminated nickel sulphide mineralisation confirmed and supported via partial leach assay results.

- Peak assayed nickel grade from drilling to date of 4.66% Ni obtained in HOT006.

- Results support the potential to significantly expand the current Mineral Resource Estimate (MRE) at the Hotinvaara Prospect, with an updated MRE scheduled for later this year.

- The Hotinvaara Prospect represents just 2% of the total prospective mineralised belt within the Pulju Project.

- Twenty (24) diamond drillholes now completed for a total of 13,836.6m.

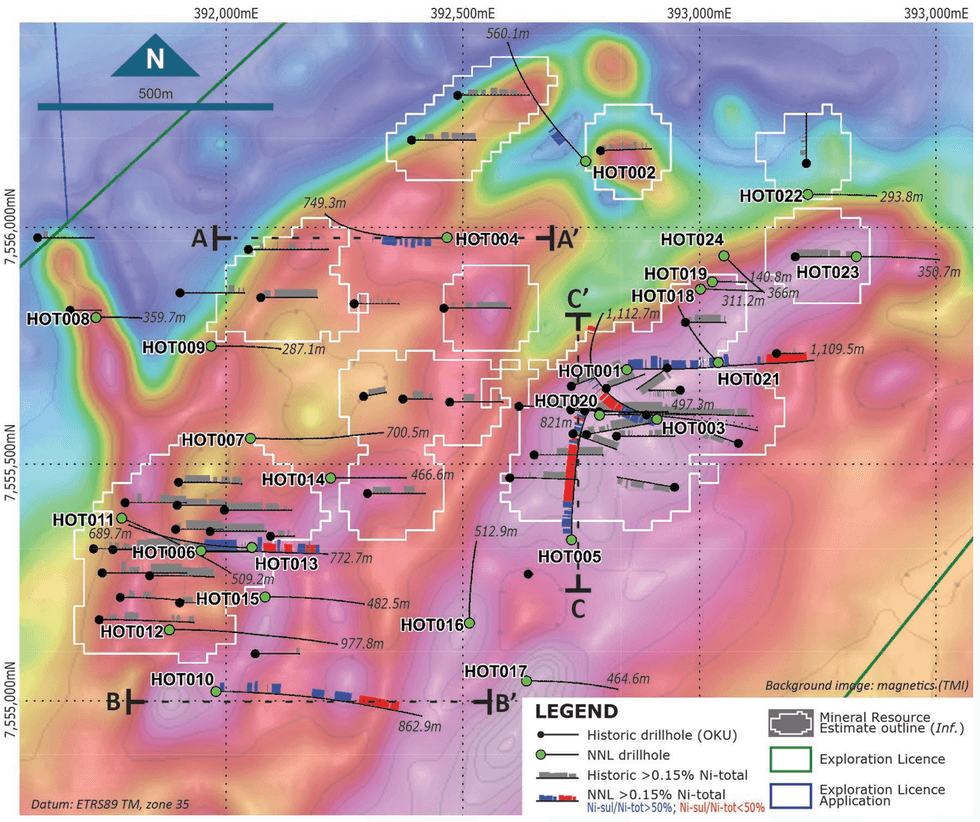

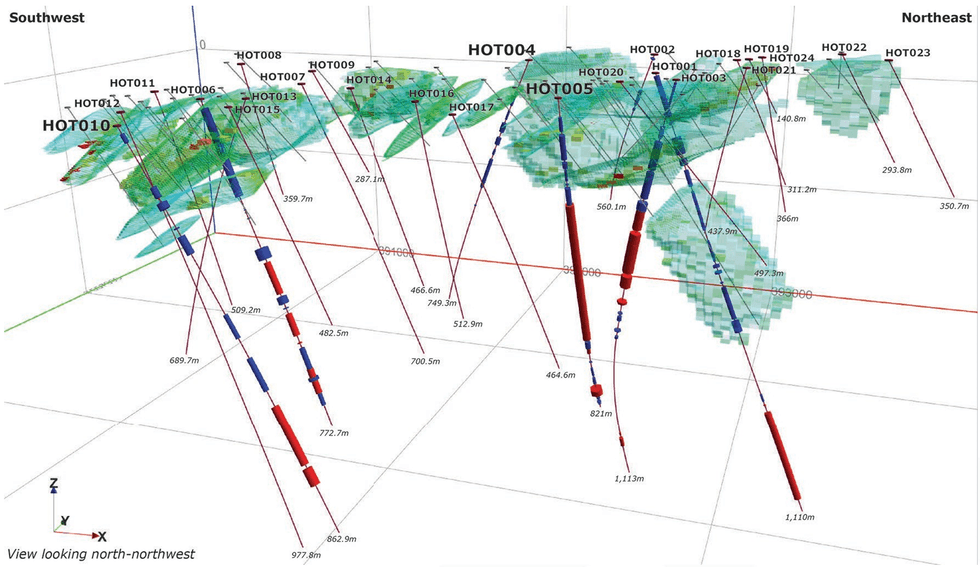

Assays from diamond drillholes HOT004, HOT005 and HOT010, which form part of the Company’s maiden diamond drilling program at the Hotinvaara Prospect (Hotinvaara), have confirmed and extended the footprint of nickel mineralisation intersected by historical drilling (Figure 1 & Appendix 1).

HOT004, HOT005 and HOT010 all encountered multiple near-surface disseminated sulphide zones that complement and extend disseminated sulphide zones and discrete zones of semi-massive and net-textured massive sulphides intersected in previous drilling2. The grade of the mineralisation intersected is consistent with the current Mineral Resource Estimate (MRE) for Hotinvaara of 133.8Mt @ 0.21% Ni and 0.01% Co3.

The Phase 1, 22,000m drilling program at Hotinvaara is focused on a dual exploration strategy of targeting high-grade massive nickel-copper sulphides of a similar style to the nearby world-class Sakatti Deposit and bulk tonnage-style disseminated nickel sulphide mineralisation with the potential to host long-life Mineral Resources.

Management Comment

Nordic Nickel Managing Director, Todd Ross, said: “Our maiden drilling campaign at Pulju continues to deliver, with consistently wide zones of disseminated nickel sulphide mineralisation returned in the latest batch of assays from three diamond drillholes, HOT004, HOT005 and HOT010. These latest results continue to confirm historical drill results within the current 133.8Mt MRE, while importantly also stepping out significantly beyond the current MRE boundary.

“Pulju is continuing to emerge as a very large nickel sulphide project, with all drilling completed to date pointing to a significant increase in the MRE, due for an update later this year.

“In addition, we are pleased to see indications of higher grade zones beginning to show through in the drilling, with a peak assay of 4.66% returned in HOT006. This shows that the system is capable of hosting higher grade zones, and finding larger accumulations of these zones remains a core objective of our exploration program. It is also worth noting that the current drill program and MRE covers just 2% of the total area of the Pulju Nickel Project, highlighting the enormous scale of the opportunity in front of us.”

Drillhole summaries

The assay results from the 2023 diamond drilling campaign have confirmed those from the historical drilling at the Hotinvaara Prospect, while also increasing the mineralised footprint of the deposit and geological confidence levels in the current Mineral Resource Estimate (MRE) (Figure 2).

Significantly, near-surface disseminated nickel mineralisation has been intersected consistently along with narrow high-grade intersections. Following is a brief description of the three new drillholes, HOT004, HOT005 and HOT010. Full details of the assay results are provided in Appendix 1.

Drillhole HOT004

HOT004 was positioned toward the northern portion of the mineralised zone to extend the continuity of the mineralised ultramafic packages. More specifically, HOT004 was designed to intersect mineralised serpentinised ultramafic packages by targeting a distinct gravity low (often associated with serpentinised ultramafics), between two known in-situ MRE shells, to facilitate resource expansion (Figure 1).

Discrete, geological and geophysical targets controlled the hole design, whereby deep westerly drilling was required not only to constrain the geometry of the ultramafic and extent of mineralisation in the area; but also, to develop an understanding of the host stratigraphic package. Additionally, the hole tested the basal footwall contact together with a series of EM conductor plates derived from surface geophysical surveys (FLEM) and down-hole EM from prior holes (BHEM).

Drillhole HOT004, intersected a lithostratigraphic package representative of, and analogous to, other drill holes within the system, portraying robust geological continuity. The upper portions of the hole displayed this typical volcanic to sub-volcanic depositional setting, interleaved and intercalated with; serpentinised, mineralised and metasomatised meta-peridotites (ultramafics) (Figure 3; Table 1).

Click here for the full ASX Release

This article includes content from Nordic Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NNL:AU

The Conversation (0)

03 July 2024

Nordic Resources

Exploring district-scale nickel asset in Finland to support growing demand

Exploring district-scale nickel asset in Finland to support growing demand Keep Reading...

28 May 2025

Total Finland Gold Resources Increase to 961,800oz AuEq

Nordic Resources (NNL:AU) has announced Total Finland Gold Resources Increase to 961,800oz AuEqDownload the PDF here. Keep Reading...

25 May 2025

A$3.5M Institutional Placement and New Chairman Appointed

Nordic Resources (NNL:AU) has announced A$3.5M Institutional Placement and New Chairman AppointedDownload the PDF here. Keep Reading...

21 May 2025

Trading Halt

Nordic Resources (NNL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

11 May 2025

Excellent Gold Intersections Verified at Kiimala Project

Nordic Resources (NNL:AU) has announced Excellent Gold Intersections Verified at Kiimala ProjectDownload the PDF here. Keep Reading...

23 April 2025

Quarterly Activities Report & Appendix 5B

Nordic Resources (NNL:AU) has announced Quarterly Activities Report & Appendix 5BDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

7h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00