February 11, 2025

With a portfolio of past-producing gold assets with a resource potential of 1 to 4 million ounces, Providence Gold Mines (TSXV:PHD,OTCQB:PRRVF,GR-FRANKFURT:7RH1) is a compelling investment opportunity for those seeking exposure to high-potential gold assets amid a current gold bull market.

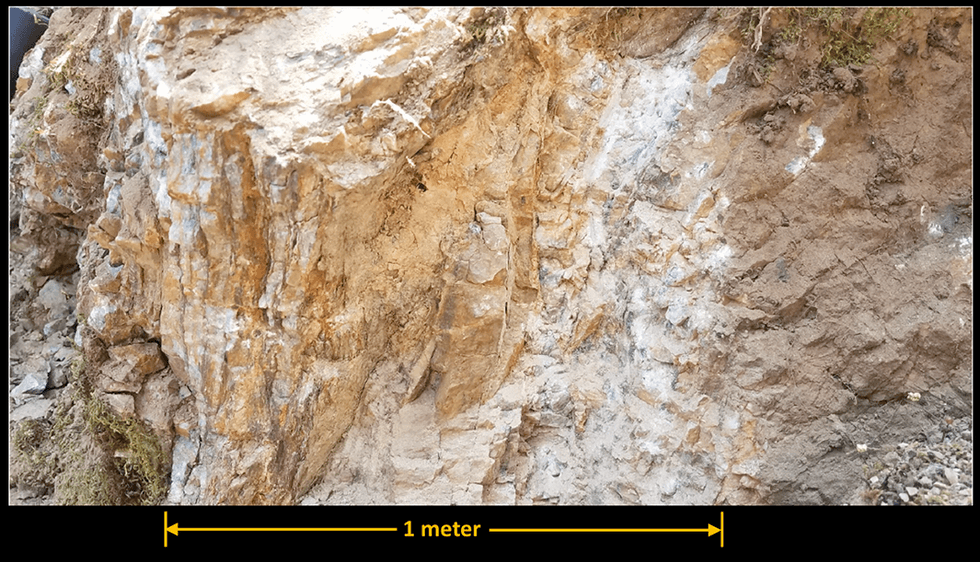

Providence Gold Mines focuses on revitalizing the historic Providence Group of Mines. The company aims to unlock the potential of its high-grade gold deposits within the Mother Lode Gold Belt in Sonora, California. This prolific gold district has historically reportedly produced over 128 million ounces of gold, making it one of North America's most significant gold-producing regions.

The Providence Group of Mines consists of seven patented mineral claims: Bonita, Consuelo, Fair Play, Good Enough, McCarthy, Mexican and Providence. With a portfolio of past-producing gold mines, high-grade drill targets, and a near-term pathway to production through stockpile processing, the company is poised to generate significant value for shareholders.

Company Highlights

- Providence Gold controls a portfolio of gold mines in Tuolumne County, California, situated in the heart of the historic Mother Lode district, a region that has produced over 128 million ounces of gold to date.

- The Providence Group of Gold Mines, consisting of seven patented staked mineral claims, was historically a high-grade producer, with reported grades grossly exceeding 1.0 oz/ton.

- The company has identified gold-bearing stockpiles from historical operations that could provide an immediate cash-flow opportunity through simple gravity-based processing.

- Utilizing 3D terrestrial LIDAR laser scanning technology and traditional exploration methods, Providence Gold has identified new high-grade drill targets beneath and between historical stopes, supporting a resource potential estimate of 1 to 4 million ounces.

- The company has outlined a 4,000-meter core drilling program, targeting high-grade zones identified through 3D modeling, trenching and soil geo chemistry and traditional mapping.

This Providence Gold MInes profile is part of a paid investor education campaign.*

Click here to connect with Providence Gold Mines (TSXV:PHD) to receive an Investor Presentation

PHD:CC

Sign up to get your FREE

Providence Gold Mines Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 October 2025

Providence Gold Mines

Unlocking untapped, high-grade gold deposits in the historic Mother Lode Gold Belt in California

Unlocking untapped, high-grade gold deposits in the historic Mother Lode Gold Belt in California Keep Reading...

8h

Top 10 Central Bank Gold Reserves

Global central banks own about 17 percent of all the gold ever mined, with reserves topping 36,520.7 metric tons (MT) at the end of November 2025. They acquired the vast majority after becoming net buyers of the metal in 2010.Central banks purchase gold for a number of reasons: to mitigate risk,... Keep Reading...

8h

Why Québec’s La Grande and Opinaca Subprovinces are Gaining Attention from Gold Explorers

The James Bay region of Northern Québec sits within the Superior Province, one of the world’s oldest and most metal-endowed Archean crustal blocks. While iconic gold districts like the Abitibi have seen generations of exploration and mine development, other Archean terrains in Québec — notably... Keep Reading...

16 February

Metallurgical Testwork Commences at Oaky Creek High Grade Antimony Prospect

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”), a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce the commencement of metallurgical testing work for the... Keep Reading...

15 February

Boundiali extends strike and depth at BDT3 and BST1

Aurum Resources (AUE:AU) has announced Boundiali extends strike and depth at BDT3 and BST1Download the PDF here. Keep Reading...

13 February

Editor's Picks: Gold, Silver Prices Dip and Bounce Back, Plus Top Takeover Candidate

Gold and silver were having a fairly quiet week until Thursday (February 12), when both precious metals experienced steep drops early in the day.The gold price, which had been steady above US$5,000 per ounce, and even briefly breached US$5,100, tumbled by over US$100, bottoming out around... Keep Reading...

Latest News

Sign up to get your FREE

Providence Gold Mines Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00